This Analysis Assigns a Hold Rating to Tredegar Corporation

Tredegar Corporation (NYSE:TG) is a manufacturer of aluminum extrusions, polyethylene (PE), plastic and polyester films in the United States and internationally.

This analysis recommends a Hold rating on Tredegar Corporation as the stock remains under pressure from adverse macroeconomic headwinds that do not bode well for the company’s profitability. In response, shares are likely to remain neutral for now as the market has likely priced in most of the headwinds, while conditions for a recovery in stock prices are not currently in place.

Tredegar Corporation’s Aluminum Extrusions Segment Amid Current and Most Likely Negative Winds in the Near Future

The company’s sales and profitability in the first production area, namely the aluminum extrusion industry, which accounts for at least 70% of sales and more than 85% of gross profit based on the results of the first half of 2023 alone, are severely affected by the winds of the current macroeconomic and geopolitical situation.

Total aluminum extrusion revenue decreased 27% year-over-year to $255.2 million in the first half of 2023, and segment EBITDA decreased 46% year-over-year to $24.9 million in the first half of 2023. The aluminum extrusion segment’s EBITDA margin was 9.8% in the first half of 2023 compared to 13.1% in the first half of 2022, deteriorating by 330 basis points.

The profitability of the aluminum extrusion segment bears the consequences of reduced purchasing power of US households, which affects the demand for products, resulting in lower sales volume of TG’s aluminum products, and the costly procurement of raw materials due to increased core inflation.

These factors of high borrowing costs/increased core inflation are now having a negative impact on demand for TG products as they are weighing on sales volumes for TG customers primarily operating in the construction and automotive sectors. The outlook for the construction sector is bleak due to declining numbers of mortgage applications and home purchase loan refinancing. Due to higher borrowing costs, not only first-time buyers but also those looking to move to a larger and more expensive home are putting off their plans as the move would force them to replace existing low-interest loans with more expensive ones. This creates a shortage of homes that are actually for sale, which has no positive effect on sales in the construction sector either. Construction sales continue to be hit by rising mortgage rates, as the Fed appears poised to keep rates higher for an extended period, and its chairman Jerome Powell recently introduced the scenario of further rate hikes as a robust labor market allows inflation to remain resilient.

In addition, the lack of support for aluminum consumption from China also doesn’t help TG’s sales, as demand from China typically eats up a large portion of the world’s supply of aluminum products under normal conditions. The economy of the Asian country and the world’s largest aluminum consumer by volume is paying for the financial problems of China Evergrande Group (OTC:EGRNQ) and Country Garden Holdings Company Limited (OTCPK:CTRYF) (OTCPK:CTRYY) as these major real estate companies cannot meet their offshore commitments, leading to uncertainty about the creditworthiness of an entire sector. As if by design, the real estate sector is a mainstay of China’s domestic economy.

The other major end market for TG products in the automotive sector also has weak growth prospects as companies postpone their main project.

For example, while General Motors (GM) must postpone its electric car production plan to convert its Orion assembly plant to electric truck production until the end of 2025, Tesla’s (TSLA) planned construction of an electric car factory in Mexico slows down, as its owner Elon Musk fears Tesla’s return margins will decline as higher interest rates continue to depress demand for Tesla electric cars.

Instead, the Western European car market (EU+EFTA+UK) is growing unsatisfactorily, with one in five car registrations missing compared to pre-pandemic levels. According to the Centro Studi Promotor, the industry’s growth is hampered by reduced incentives to buy electric cars, especially in Germany, the most important market in the region, and by the high prices of electric cars, not only in countries with the lowest per capita income.

Tredegar Corporation’s PE Films and Flexible Packaging Films Segments Amid Current and Likely Negative Winds in the Near Future

But TG’s other two business areas are not immune either to the aggressive interest rate policy of the US Federal Reserve (Fed), high core inflation, and the effects of the war in Ukraine and now also the crisis in Israel’s Gaza Strip.

The other two segments contribute to TG’s very first lines of earnings according to the following percentages: PE films accounted for about 10% of the company’s total sales and EBITDA, while the third segment, Flexible Packaging Films, accounted for about 6% of company’s total sales and 17, 5% of EBITDA.

Total PE films revenue decreased more than 42% year-over-year to $36.1 million in the first half of 2023, and PE films EBITDA decreased 81% year-over-year to $2.7 million in the first half of 2023. The PE films segment’s EBITDA margin was 7.5% in the first half of 2023 compared to 22.5% in the first half of 2022, deteriorating by 1,500 basis points.

Total Flexible Packaging Films revenue decreased nearly 20% year-over-year to $64.8 million in the first half of 2023, and Flexible Packaging Films EBITDA decreased more than 87% year-over-year to $1.6 million in the first half of 2023. The Flexible Packaging Films segment’s EBITDA margin was 2.5% in the first half of 2023 compared to 15.7% in the first half of 2022, deteriorating by 1,322 basis points.

Costlier credit since consumers grapple with stunning interest rates on record $1 trillion in outstanding credit card debt, along with tougher access to credit following the US regional banking crisis in March and May 2023, are both weighing on the consumer outlook. And as if that weren’t enough, stubbornly elevated core inflation is adding to the factors that have sent US consumer confidence below the recession threshold.

With consumer spending at a pace typical of a recession and the trend set to continue or even worsen amid continued high inflation/borrowing costs, while personal savings are at an all-time low in 2023, TG’s PE films segment is currently not well positioned. While, the third segment of the flexible packaging films is set to be significantly scaled down as soon as the sale of the Terphane-branded advanced polyester films segment is finalized for a total net consideration of about $85 million.

TG’s customers in electronics and home appliances (-0.8%) and apparel retail (-0.8%) appear to be the first to bear the cost of lower-than-normal consumer spending, but it is clear that other sectors will join the list of shrinking retail sectors.

The sectors that continue to grow are supported by robust labor market conditions, but these have long been in the crosshairs of the Fed’s hawkish stance, and with the Federal Reserve not letting up until some unemployment or uncertainty kicks in, cooling retail sales are well on their way to expanding into more and more industries.

The Stock Valuation

These macroeconomic factors will continue to depress consumer demand, leaving no sector unscathed and even reducing the growth prospects of the industries served by Tredegar Corporation.

Due to the pessimistic expectations that weigh on the future profitability of each segment of TG, this stock currently does not receive a rating higher than “Hold”.

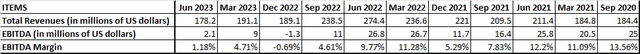

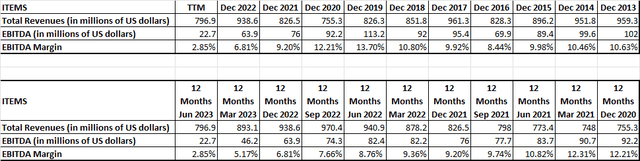

Declining 3-month sales and declining 3-month EBITDA and 3-month EBITDA margins, which have fallen significantly over the past 12 months as shown in the table below, have resulted in a share price drop of more than 50% compared to last year’s levels and demonstrate the great importance of sales and profits as drivers of share prices.

Source of Data: https://seekingalpha.com/symbol/TG/income-statement

Source: Seeking Alpha

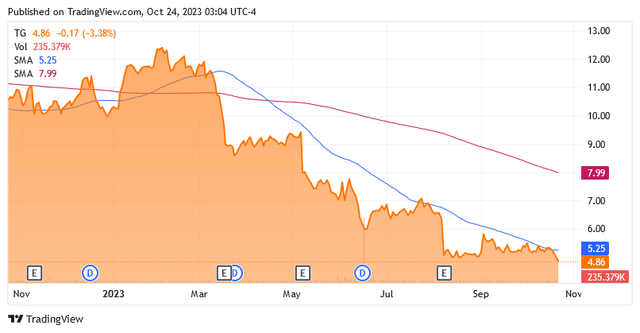

As long as the resulting profitability remains under pressure, this will be reflected in a share price that has little chance of recovering from current levels. Following the past year’s tumble shares are now trading significantly below the 200-day simple moving average of $7.99 and close by the 50-day simple moving average of $5.25.

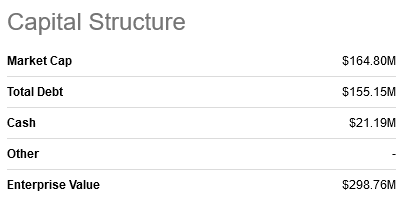

Currently, the stock price trades at $4.86 apiece giving it a market capitalization of $164.80 million. The stock price is hovering at the lower end of the 52-week range of $4.86 to $12.51.

Source: Seeking Alpha

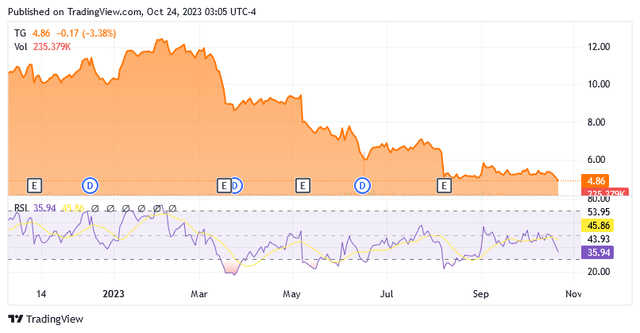

It’s also possible that shares could reach significantly lower levels than the current ones, as today’s Relative Strength Indicator chart suggests that oversold levels still leave room for further decline. The 14-day RSI is at 35.94 against oversold levels of around 30.

The short interest of 1.31% at the time of writing does not currently indicate any additional bearish sentiment toward TG stock, which may mean that these valuations may already include the headwinds that are expected to continue to impact sales, profits, and margins.

Source: Seeking Alpha

This analysis assumes that investors should maintain a neutral stance on TG stock as the stock price is expected to trade around the 50-day simple moving average line, with insignificant changes until something is certain.

The Risk of Economic Recession Is Increasing: A Share Price Target in the Event of a Major Stock Market Sell-Off

The question is whether US-listed stocks, including TG, will suffer an economic downturn due to signals from the Federal Reserve, or whether they will experience a new season of growth and now, in what for many is reminiscent of Goldilocks, they rev their engines before the green light.

As was the case with the resumption of human activities after the lifting of anti-COVID-19 virus restrictions, which boosted TG’s sales and profitability, REMOVE BRACKETS there will be a new upward cycle for demand and prices of TG production and the restoration of bullish mood will bring the company’s profitability to the level of the first half of 2022. The environment will be favorable again in which the share price can then flourish.

But before that happens, there could be a recession and possibly even a crisis. A significant economic downturn may occur, but the situation is highly volatile, and the volatility has a significant impact on the validity of the forecasts.

However, a recession that has gained momentum following comments from Fed Chair Jerome Powell and former U.S. Treasury Secretary Larry Summers is unlikely to arrive before 2024, as two other economists have suggested previously.

Chryssa Halley, chief financial officer of the US Federal National Mortgage Association (Fannie Mae), and David Rosenberg, economist at Rosenberg Research, have assessed the sharp downturn in the business cycle as very likely, but it will still take a few months for it to happen, according to their estimates.

This means investors now have time to better understand where the economy is heading and avoid making hasty decisions on TG stock.

Perhaps imagining more serious consequences for TG’s business following Powell’s and Summer’s predictions, someone might be persuaded to sell TG’s shares and use the money in another way, perhaps taking advantage of interest rates that are still high.

But with the prevailing narrative still assuming it will be a soft landing after all, and with many economic indicators here and there that could warn us well in advance of a looming recession, in the meantime investor sentiment on TG should be in line with a Hold stance.

In the event of a recession, headwinds that will most likely come from panic selling among US-listed stocks may well push shares of TG lower than current levels.

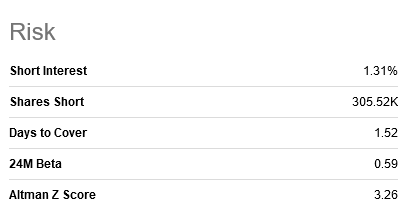

Unless another correlation is established with the US stock market, shares of TG would suffer an impact if strong bearish sentiment were to take place among US-listed stocks, but probably much less than many others, as indicated by the 24M Beta of 0.59.

Source: Seeking Alpha

For this scenario, this analysis also provides a stock price target that could better reflect the company’s profitability under such macroeconomic conditions and that investors may want to use when the time comes to reposition themselves for the subsequent recovery.

First, let’s estimate the forward 12-month EBITDA for TG’s business based on the latest trends for total sales, EBITDA and EBITDA margins illustrated in the chart below.

Source of data: https://seekingalpha.com/symbol/TG/income-statement

Since the company will face the same, if not worse, challenging conditions in the near future, this analysis assumes that EBITDA will not exceed 5% of total sales, which will in turn not exceed $750 million on a twelve-month basis, including the sale of the 3rd business segment. Thus, these assumptions lead to an estimate of 12-month EBITDA of not more than $38 million.

Tredegar Corporation has the following Enterprise Value (EV) equation: The EV of $298.76 million is equal to the market cap of $164.80 million plus total debt of $155.15 million minus cash of $21.19 million.

Source: https://seekingalpha.com/symbol/TG

Tredegar Corporation’s EV/ forward EBITDA is then 7.9 times, which is a little bit higher than the sector median of 7.2x.

But as a benchmark for valuing aluminum producers’ U.S.-listed stocks, Aswath Damodaran, a professor of corporate finance and equity valuation at New York University’s Stern School of Business, has calculated that 5.30x is generally a fair value for the EV/EBITDA ratio of these companies.

Therefore, assuming all other components remain roughly at current levels, the market capitalization of TG stock must decrease by about $97.4 million to $67.44 million, implying a share price of about $2 given that there are 34.38 million outstanding shares in circulation.

$2 per share is well below the current $4.86 per share.

This target has a chance if the economy enters a recessionary period, but until that negative event for the business cycle, shares are unlikely to fall that much, even given continued downward pressure from the Fed’s “longer-term higher” interest rates.

The upcoming quarters promise to be very challenging for the company, but TG doesn’t want to be caught off guard and despite the Altman Z-Score of 3.26 (scroll down to the “Risk” section on this page of Seeking Alpha) implies a very low risk of financial insolvency within the next few years, management is taking action.

As of June 30, 2023, total debt was $155.15 million, against total cash of $21.2 million. Tredegar’s revolving secured credit facility expires in the first half of 2027 at the earliest. The company plans to strengthen its financial position further with the suspension of the dividends, by refraining from repurchasing its own shares and reducing allocations to the 3 segments as follows: from $37.5 million allocated in 2022 to $28 million to allocate in 2023.

In addition, it is renegotiating with credit institutions about corporate financing options in order to be able to better respond to the challenges of the current economic situation and its possible deterioration. TG is also looking for forms of financing that are no longer based on EBITDA and are therefore exposed to the price and demand volatility of the aluminum market but are guaranteed by balance sheet assets such as receivables, inventories, or fixed assets.

The financial position will be further strengthened by the sale of Terphane-branded advanced polyester films for a total net purchase price of approximately $85 million.

Conclusion

Tredegar Corporation’s profitability continues to be exposed to macroeconomic factors that bode poorly for current and likely near-future demand for aluminum and the other two smaller segments of the company.

Most of the headwinds are likely already factored into this stock’s market value, as they have been impacting the financial markets for months now. So, the stock price is not expected to deviate from a neutral stance, meaning shares are foreseen to fluctuate with meaningless changes from a 50-day simple moving average.

If the economy enters a recession, there could be a share price decline that brings EV/EBITDA in line with the target of 5.30x. Such a deterioration in the business cycle, which forecasters do not expect to occur before 2024, has little chance of occurring, according to the prevailing narrative, but appears to gain momentum as time passes.

Read the full article here