A Quick Take On TTEC Holdings

TTEC Holdings, Inc. (NASDAQ:TTEC) provides various customer experience and related advisory services to global businesses.

I previously wrote about TTEC with a Hold outlook.

Consulting firm clients are delaying discretionary projects and exerting more scrutiny over existing and new project engagements.

Given reduced revenue growth and the apparent full valuation of the stock, I remain Neutral [Hold] on TTEC Holdings, Inc. in the near term.

TTEC Overview And Market

TTEC Holdings is a customer experience technology and services company that designs, builds, and operates customer experience solutions to enhance customer engagement for its clients.

The company’s main offerings include omni-channel customer experience strategy, technology, and related outsourcing services.

The Chairman and Chief Executive Officer of TTEC is Ken Tuchman, who founded the firm as TeleTech Holdings.

The company has a dedicated sales team that reaches out to potential clients and provides them with tailored solutions.

According to a 2021 market research report by 360 Market Updates, the worldwide market for digital transformation strategy consulting was an estimated $58.2 billion in 2019 and is expected to reach $143 billion by 2025.

This represents a forecast CAGR of 16.2% from 2020 to 2025.

The main driver for this forecasted growth in IT consulting is a transition by organizations from on-premises, legacy systems to cloud-based environments with complex architectures.

There is also growth in the breadth of industries seeking to adopt digital transformation strategies, including manufacturing, finance, and retail, as well as a growing demand for improved customer experience.

Many organizations are engaging with IT consulting firms to help them align their digital transformation strategies with their overall business objectives to improve customer and prospect engagement and conversion.

Also, the COVID-19 pandemic has pulled forward demand to modernize enterprise systems to better serve internal and external customers, partners and stakeholders.

Major competitive or other industry participants include:

-

Globant

-

Thoughtworks

-

EPAM

-

Slalom

-

Accenture

-

Deloitte Digital

-

McKinsey

-

BCG

-

Ideo

-

Cognizant Technology Solutions

-

Capgemini

-

Computer Task Group

-

Company in-house development efforts.

The firm is also active in the customer experience services outsourcing market, which is a $270 billion worldwide market.

TTEC’s Recent Financial Trends

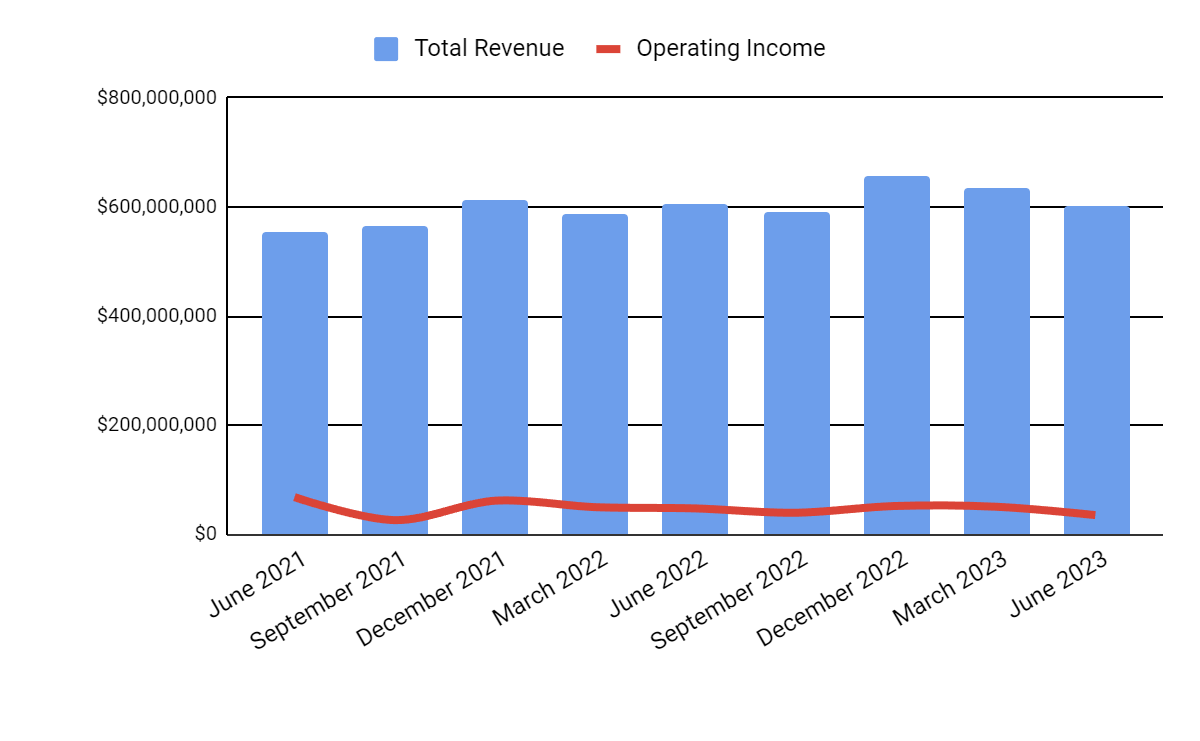

- Total revenue by quarter has largely plateaued in its most recent quarter; Operating income by quarter has dropped recently.

Seeking Alpha

-

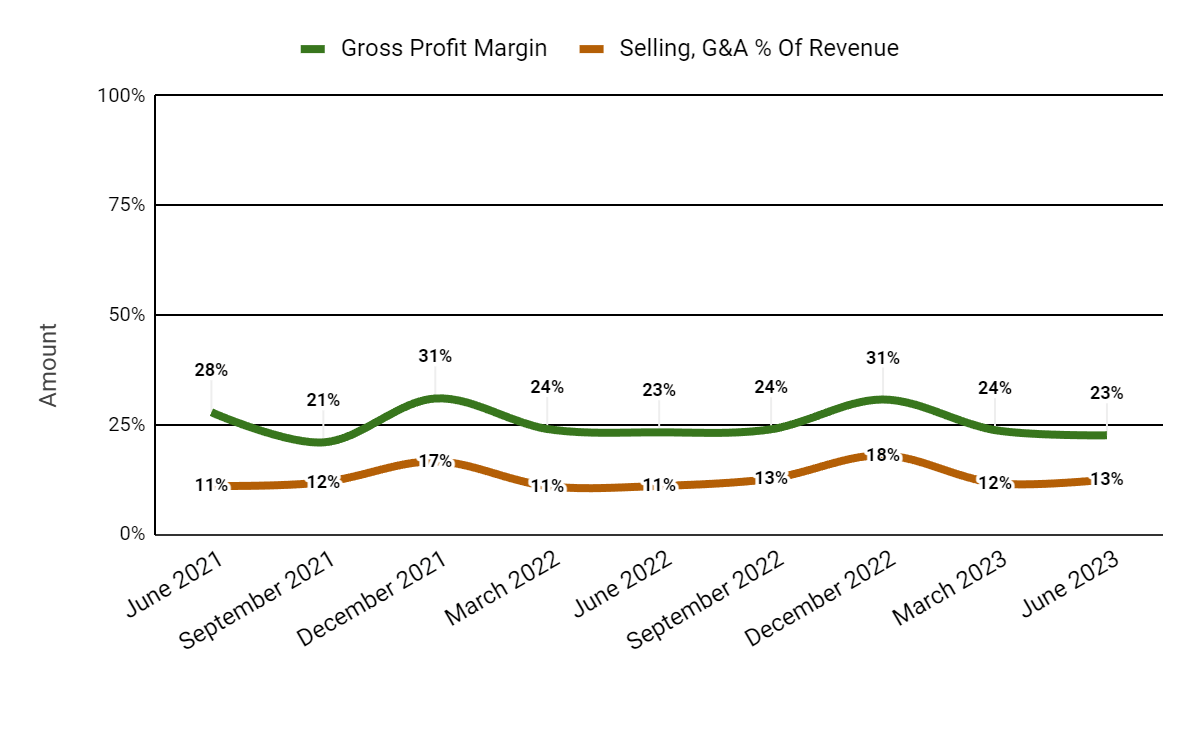

Gross profit margin by quarter has fluctuated within a predictable range; Selling and G&A expenses as a percentage of total revenue by quarter have trended higher in recent quarterly activity:

Seeking Alpha

-

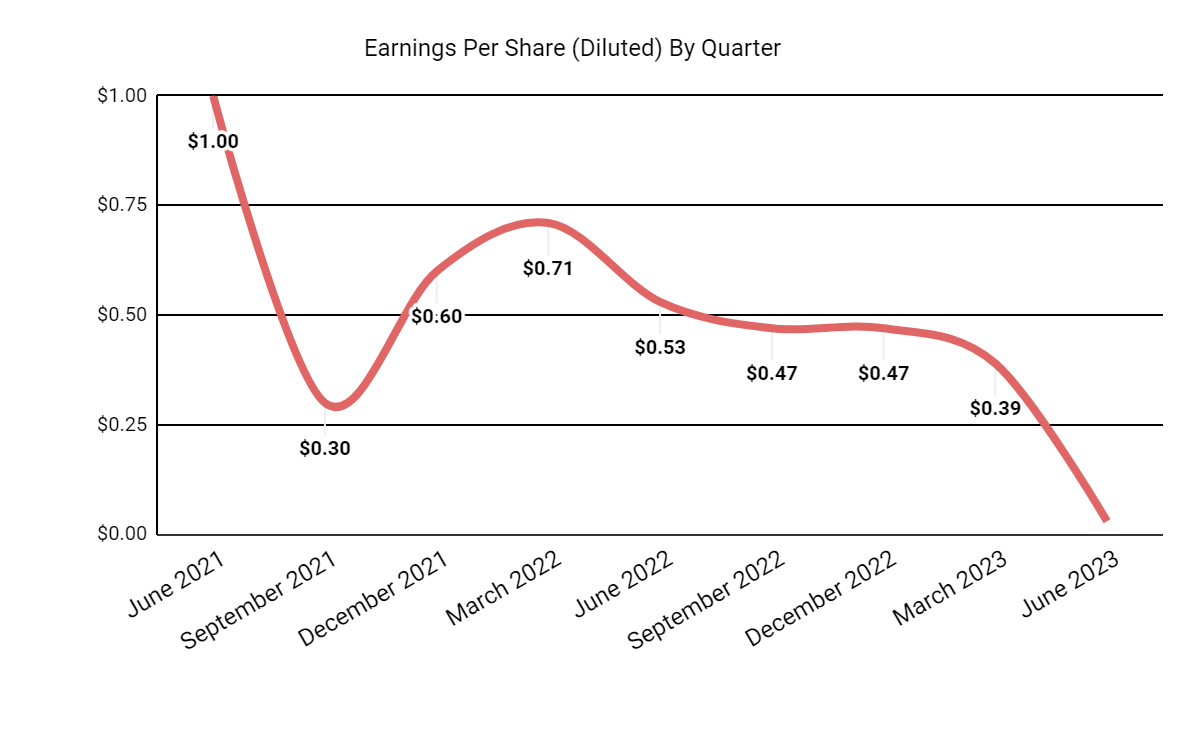

Earnings per share (Diluted) have dropped sharply in recent quarters:

Seeking Alpha

(All data in the above charts is GAAP.)

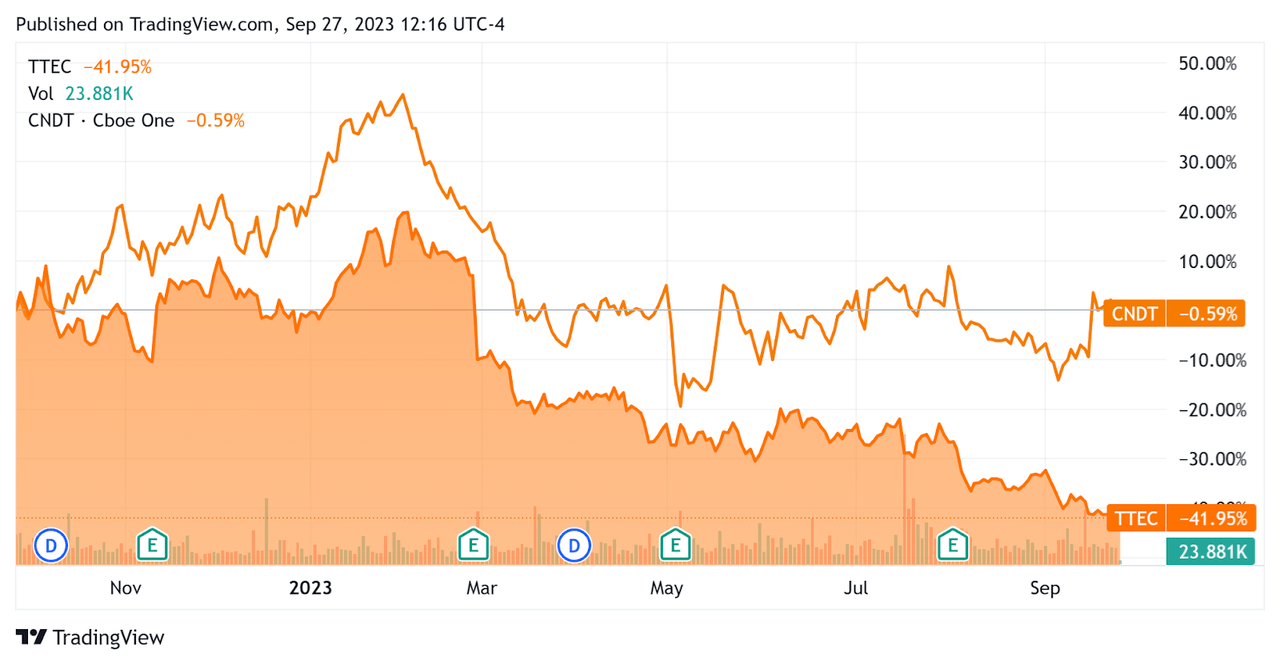

In the past 12 months, TTEC’s stock price has fallen 41.95% vs. that of Conduent Incorporated’s (CNDT) drop of only 0.59%:

Seeking Alpha

For balance sheet results, the firm ended the quarter with $114.8 million in cash and equivalents and $915.0 million in total debt, none of which was categorized as the current portion.

Over the trailing twelve months, free cash flow was $109.5 million, during which capital expenditures were $81.2 million. The company paid $19.5 million in stock-based compensation in the last four quarters, the highest trailing twelve-month figure in the past eleven quarters.

Valuation And Other Metrics For TTEC

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.9 |

|

Enterprise Value / EBITDA |

7.6 |

|

Price / Sales |

0.5 |

|

Revenue Growth Rate |

4.7% |

|

Net Income Margin |

2.6% |

|

EBITDA % |

11.6% |

|

Market Capitalization |

$1,250,000,000 |

|

Enterprise Value |

$2,190,000,000 |

|

Operating Cash Flow |

$190,720,000 |

|

Earnings Per Share (Fully Diluted) |

$1.36 |

(Source – Seeking Alpha.)

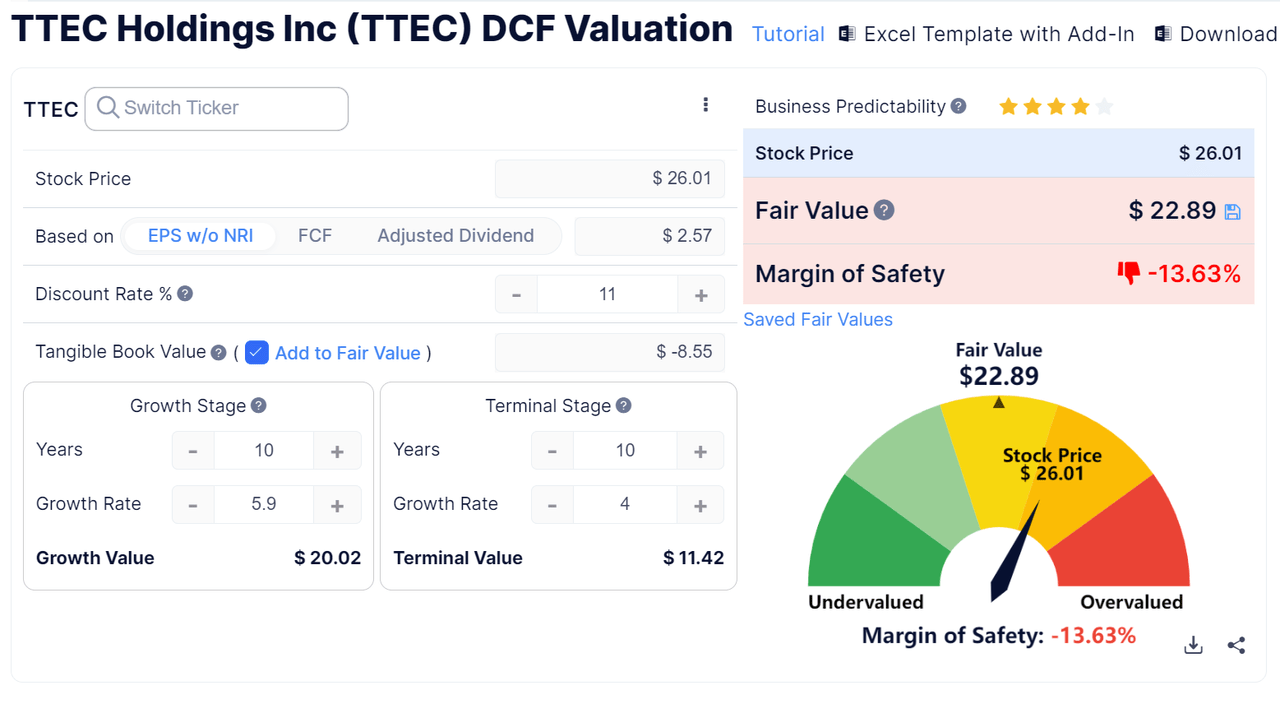

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

GuruFocus

Based on the DCF, the firm’s shares would be valued at approximately $22.89 versus the current price of $26.01, indicating they are potentially currently fully valued.

Sentiment Analysis

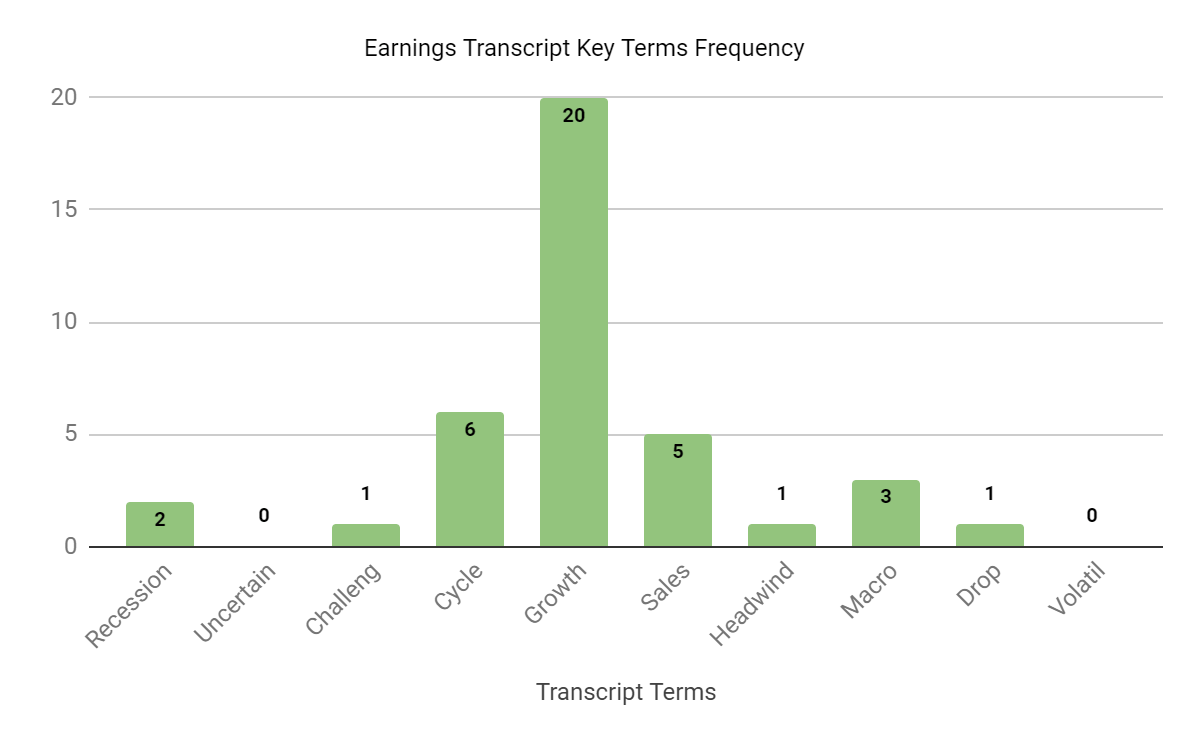

The chart below shows a frequency analysis of certain keywords contained in the most recent management earnings conference call:

Seeking Alpha

The terms and frequency indicate the company and its clients are seeing certain headwinds due to macroeconomic conditions and the potential for a recession ahead.

Analysts asked management about its outlook for its Digital practice and interest in generative AI initiatives.

Leadership responded that Digital’s trajectory is in line with previous guidance, with an 84% backlog coverage, ahead of last year at this time and that it expects more cloud migrations in the second half of 2023.

On the AI front, management said that there are numerous AI pilot projects underway, which are also serving to move conversations with clients about moving their other business operations to the cloud.

Also, clients are seeking private AI models; management is seeing initially high costs, but expects those costs to drop over time.

Commentary On TTEC

In its last earnings call (Source – Seeking Alpha), covering Q2 2023’s results, management’s prepared remarks highlighted the current rapid innovation mode combining customer experience with recent gains in AI technologies.

Notably, management believes that the impact from AI is:

“highly dependent on the industry served, complexity of the customer interactions, mix of voice and digital channels, the state of clients technology platform and the balance of human and automated experience that the brand wants to deliver.”

So, the firm sees a strong and continuing need for customized, vertical-specific applications to help clients achieve their goals.

The 12-month revenue retention rate was 96.5% for its Engage system, indicating moderate sales and marketing efficiency.

Total revenue for Q2 2023 fell by 0.6% year-over-year, while gross profit margin dropped by 0.7%.

Selling and G&A expenses as a percentage of revenue increased by 1.5% YoY and operating income fell a material 25.8%.

The company’s financial position is moderate, with some liquidity, material long-term debt but good free cash flow over the trailing twelve-month period.

Looking ahead, the revenue growth estimate from management suggests 2023 growth of around 2.3%.

If achieved, this would represent a decline in revenue growth rate versus 2022’s growth rate of 7.5% over 2021.

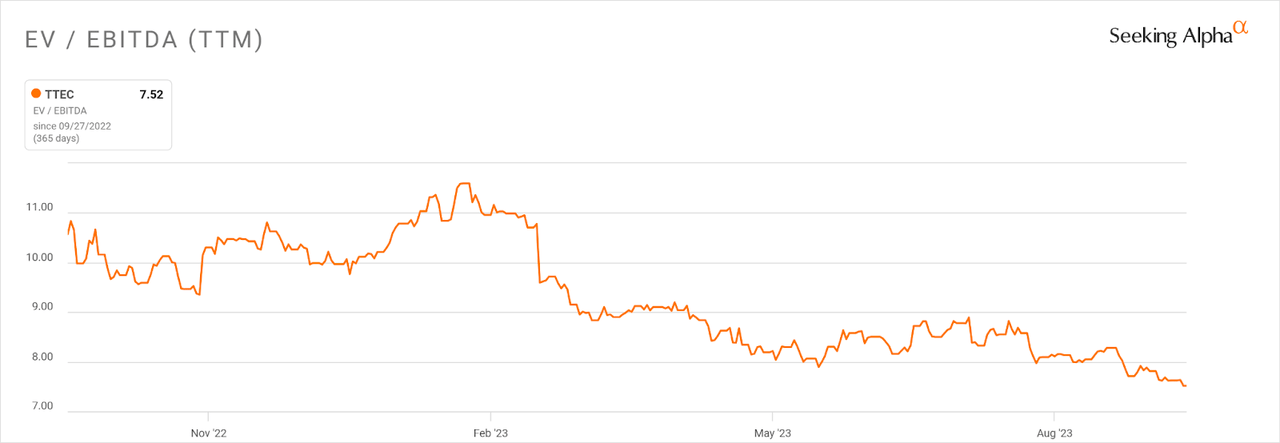

In the past twelve months, the firm’s EV/EBITDA valuation multiple has dropped by 29%, as the chart from Seeking Alpha shows below:

Seeking Alpha

A potential upside catalyst to the stock could include the firm’s ability to monetize its AI investments in its platform elements.

However, other technology consulting companies have stated they view this monetization as taking some time to occur.

Furthermore, consulting clients have been delaying their discretionary projects as well as new project engagements, leading to very soft revenue growth for consulting and outsourcing firms.

Given the prospect for lower revenue growth coupled with ongoing investments in generative AI technologies and the potential the stock is fully valued, my outlook for TTEC Holdings, Inc. remains Neutral [Hold] for now.

Read the full article here