The TSN Investment Thesis Appears To Be Less Than Promising Here

Tyson Foods (NYSE:TSN) is a company that requires no introductions, with many American families likely enjoying some of their meats from time to time, while picking up their offerings at multiple retailers, such as Walmart (WMT) or Target (TGT).

TSN has also went into the food service segment, offering their products to hotel chains, schools, healthcare facilities, and restaurants, with the most famous partner likely being McDonald’s (MCD).

One of its most commonly seen offerings may be the chicken nuggets made for MCD, through a previous acquisition from Marfrig Global Foods in 2018.

These suggest TSN’s well diversified sales approach, with FQ3’23 bringing forth retail revenues of $5.92B (-0.3% QoQ/ +0.4% YoY) and Foodservice revenues of $3.91B (+1.3% QoQ/ -0.5% YoY) within the US.

It is apparent that the company’s domestic segment is the top-line driver at 74.9% (+0.3 points QoQ/ +2.1 YoY) of its overall sales at $13.14B (inline QoQ/ -2.6% YoY) in the latest quarter.

TSN 1Y Stock Price

Trading View

However, sentiments surrounding TSN have drastically reversed since the April 2022 top, with the stock continuously charting new lows since then.

It appears that much of the pessimism is attributed to its growing inventory levels of $5.39B (-2% QoQ/ +1.1% YoY) in FQ3’23, compared to FY2019 levels of $3.92B (+11.6% YoY), worsened by its perishable aspects.

The same has been reported by early September 2023, with it “wrestling with excess stock as demand for poultry is flat,” explaining the management’s decision to “close four additional chicken facilities bringing the total announced closures to six this year.”

Perhaps this is why TSN has had to drastically cut prices over the past five quarters, with FQ3’23 bringing forth impacted gross margins of 5.2% (+0.5 points QoQ/ -6.5 YoY), compared to the pre-pandemic averages of ~12.7%.

While the management has attempted to maintain stable operating expenses over the past few years, it is apparent that the impacted ASPs have translated to lower operating margins of 1.1% (+0.6 points QoQ/ -6.3 YoY) in the latest quarter, compared to the pre-pandemic averages of ~7.6%.

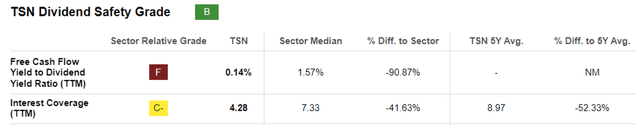

TSN’s Dividend May Be At Risk As Well

The TSN management’s aggressive price actions have also directly impacted its Free Cash Flow generation to $98M over the last twelve months (-93% sequentially), implying FCF margins of ~0.2%.

This is compared to FY2019 levels of $1.25B (-28.9% YoY) and 3% (-1.4 points YoY), respectively.

While the TSN management has reiterated its cash flow priorities of returning cash to shareholders, we believe that its dividends may temporarily be at risk.

For example, the management has sustained shareholder returns of $1.01B over the LTM (-25.7% sequentially), comprising $665M in dividends (+2.3% sequentially) and $352M in share repurchases (-50.4% sequentially).

However, due to its impacted FCF, it is unsurprising that TSN’s balance sheet has also deteriorated in the latest quarter, with its reliance on long-term debts increasing to $8.86B (+12.7% QoQ/ +7.2% YoY) and its cash/ short-term investments declining to $706M (+28.3% QoQ/ -33.1% YoY).

TSN’s Dividend Safety

Seeking Alpha

Therefore, while TSN’s dividend safety may receive an overall B grade from the Seeking Alpha Quant, we are not convinced for now, since its FCF Yield to Dividend Yield Ratio seems rather risky at F grade, with the Interest Coverage Ratio similarly at C-.

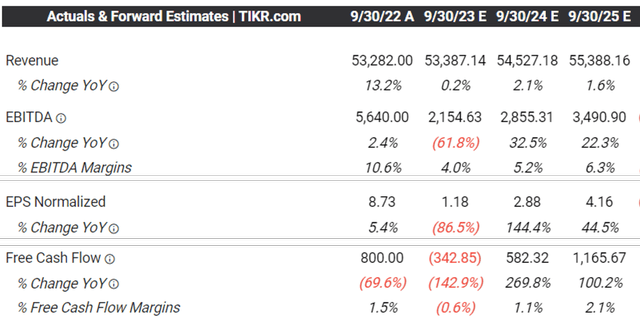

TSN’s Consensus Forward Estimates

Tikr Terminal

These factors have likely contributed to TSN’s underwhelming FY2023 sales guidance at $53.5B at the midpoint, implying minimal growth on a YoY basis.

The consensus forward estimates appears to be pessimistic as well, with the company not expected to regain its pre-pandemic EBITDA margins of ~9.6% over the next few years, naturally implying to its impacted EPS and FCF generation through FY2025, if not longer.

On the other hand, the TSN management has competently managed its debt and interest rate risks, with 93.6% of its debts fixed at a stable weighted average interest rate of 4.5% (inline QoQ/ YoY) in the latest quarter, near to its FY2019 levels of 4.42%.

These prudent strategies have directly contributed to its stable annualized interest expenses of $332M (+1.2% QoQ/ +2.4% YoY), reducing the impact of the elevated interest rate environment on its profitability.

However, TSN investors may want to brace for more pessimism indeed, with the stock likely to remain volatile for a little longer.

So, Is TSN Stock A Buy, Sell, or Hold?

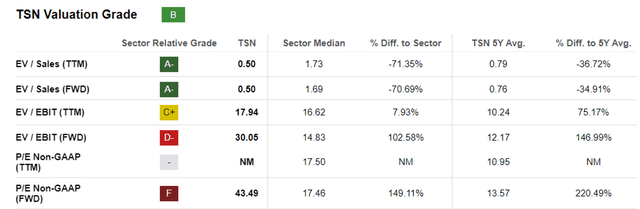

TSN Valuations

Seeking Alpha

As a result of the factors discussed above, TSN’s valuations appear to be overly elevated compared to its 1Y/ 5Y means and Packaged Food/ Meat sector medians.

In addition, there appears to be a minimal upside potential of +13% to our long-term price target of $56.45, based on its normalized P/E valuation of 13.57x and the consensus FY2025 adj EPS estimates of $4.16.

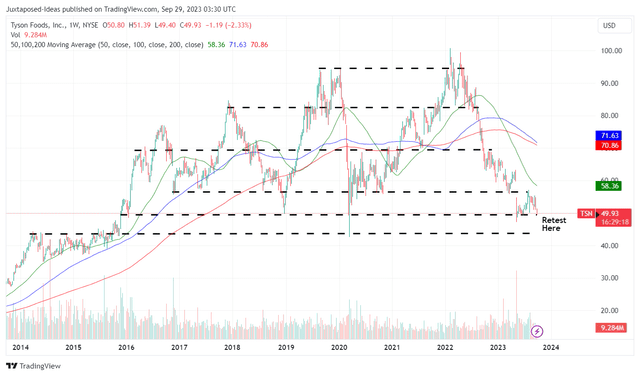

TSN 10Y Stock Price

Trading View

For now, TSN has returned much of its gains over the past seven years. Based on the lower highs and lower lows, we may also see the stock further retrace, likely to retest its 2015 support levels of $43 in the near term, implying a potential downside of -13% from current levels.

While the stock may appear to be attractive at this dip, we do not recommend anyone to add here, due to the potentially prolonged reversal.

As a result, we prefer to rate the TSN stock as a Hold (Neutral) here.

Investors looking to add may want to wait for a little longer, until a floor to this decline is observed, bullish support occurs, and the company’s prospects improve.

Read the full article here