At a Glance

In a follow-up to my previous analysis where I recommended a “Hold” stance on MannKind Corporation (NASDAQ:MNKD), the latest financial quarter reveals some pivotal developments. Revenues have seen a notable increase, primarily fueled by strategic partnerships and an expanded product line featuring Tyvaso DPI. The FDA’s approval of Tyvaso DPI not only legitimizes MannKind’s unique Technosphere technology but also indicates a potentially robust revenue stream through royalties. Operational sustainability seems to be on an upward trend, marked by a positive net cash flow from operating activities. Nevertheless, investors must navigate around an enduring net loss and a significant debt burden of $383.16M. These financial constraints cannot be ignored, especially in light of possible future financing that could result in share dilution or other less favorable forms of capital. As MannKind focuses on boosting Afrezza’s market presence, the core issue remains: Can these new strategies achieve sustained market acceptance and profitability? While the short-term financial indicators appear promising, the long-term outlook still largely depends on MannKind’s ability to transform its clinical achievements into monetary success, all while managing a sizeable debt.

Financial Highlights

To begin my analysis, looking at MannKind’s most recent earnings report for the quarter ended June 30, 2023, total revenues surged to $48.6M from $18.9M year-over-year, primarily driven by increased commercial product sales ($18.3M) and a substantial uptick in royalties from collaborations ($19.1M). However, the company still posted a net loss of $5.3M, albeit an improvement from a $29.0M loss in the same quarter of 2022. Expenses marginally increased, led by R&D costs which reached $6.5M. Notably, there’s evidence of share dilution; weighted average shares used to compute net loss per share rose from 253,644 to 265,626 YoY.

Turning to MannKind’s balance sheet, the company shows $86.2M in cash and cash equivalents and $58.2M in short-term investments as of June 30, 2023, aggregating to a total of $144.4M in liquid assets. The company’s total current assets stand at $230.2M. Meanwhile, the total current liabilities amount to $97.0M, rendering a current ratio of 2.37. Total liabilities significantly outweigh total assets, $573.9M versus $313.4M.

In terms of cash burn, the net cash provided by operating activities over the last six months is positive at $3.8M, or approximately $0.63M per month. While the positive operating net cash and the high current ratio provide a cushion, the looming total debt of $383.16M cannot be ignored. The odds of MannKind requiring additional financing within the next twelve months appear to be medium to high.

Market Sentiment

According to Seeking Alpha data, MannKind’s market cap of $1.07B relative to its revenue suggests moderate market confidence, not exuberant but cautiously optimistic. Analysts project substantial growth in revenue to $347.44M by 2025, buttressed by diversification into products like Tyvaso DPI. Options expiring in November indicate more open interest in calls than puts, subtly hinting at bullish sentiment while showcasing moderate implied volatility. Short interest is high at 14.60%, which indicates skepticism but also sets the stage for a possible short squeeze. Stock performance lags SPY over 3M, 6M, and 9M (-5.45%, -4.32%, -17.39% vs -4.04%, +4.38%, +8.22%) but slightly outperforms over 1Y (+27.88% vs +17.93%).

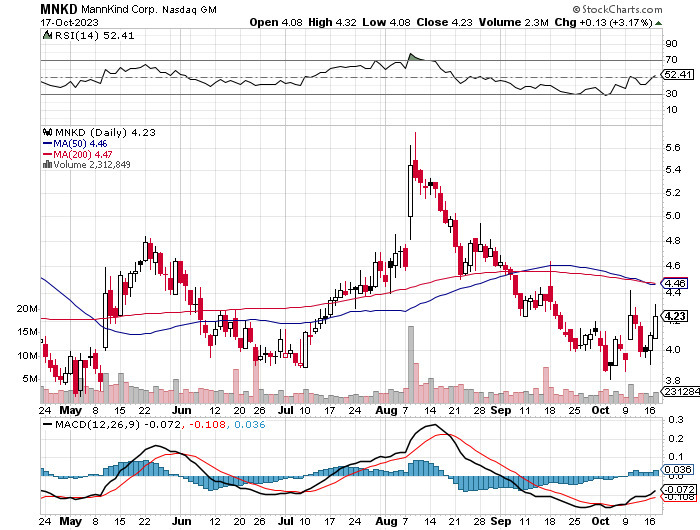

StockCharts.com

With the price sitting below its 50 and 200MAs, MNKD trades in bearish territory. However, if the stock breaches the key MAs, this could serve as a “Buy” signal. To mitigate downside risk thereafter, traders may be interested in placing a stop loss at a MA.

Institutional ownership is primarily dominated by entities like Vanguard Group and BlackRock, with new positions totaling 6.6M shares and sold-out positions relatively minimal. Insider trades have not shown alarming sell-offs, signaling internal confidence.

MannKind’s Afrezza Remains a Focus Despite Market Underperformance

In the recent earnings call, management conveyed a buoyant outlook owing to the FDA approval of Tyvaso DPI, which they believe paved the way for profitability. They underscored the growth in the diabetes and orphan lung disease segments, with notable mentions of Afrezza and V-Go contributing to their success. They highlighted a 63% growth in royalty revenue and a 250% increase in manufacturing capacity. With regards to challenges, they hinted at a shift in GMP manufacturing to Connecticut following a fire incident, and regulatory feedback on their inhaled nintedanib program. They also shared plans for upcoming clinical trials, expressing optimism about expanding Afrezza’s eligible population and ongoing partnerships.

Afrezza, marketed by MannKind, is an inhaled insulin product targeting type 1 and type 2 diabetes. Its market spans the US, EU4 (Germany, France, Italy, Spain), the UK, and Japan. However, Afrezza has faced sales underperformance, with issues like pricing and reimbursement cited as ongoing hurdles. MannKind has made efforts to surmount these challenges by introducing programs like the Afrezza Patient Savings Card and Reimbursement Program to ease product accessibility.

The juxtaposition reveals management’s optimistic stance, driven by recent successes and strategic advancements, against the backdrop of market realities for Afrezza, which has had a turbulent journey marked by underperformance and challenges related to pricing and reimbursement. Nonetheless, MannKind’s efforts to revamp its marketing strategy and bolster patient access to Afrezza depict a proactive approach to navigating these challenges and capitalizing on market opportunities.

A Powdered Punch: MannKind and United Rewrite PAH Therapy

Tyvaso DPI, approved for both pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD), is a product of a collaborative venture between MannKind and United Therapeutics (UTHR), encompassing technological, manufacturing, and financial facets:

Technological Contribution

-

MannKind’s proprietary Technosphere technology is pivotal to Tyvaso DPI, aiding the conversion of the compound into a dry powder format amenable to inhalation. This technology also underlies the Dreamboat inhalation device technology used in Tyvaso DPI, akin to MannKind’s Afrezza (insulin human) Inhalation Powder product.

Manufacturing

-

The production reins for Tyvaso DPI are held by MannKind’s manufacturing facility situated in Connecticut.

Licensing and Collaboration

-

A worldwide exclusive licensing and collaboration accord was struck between MannKind and United in September 2018, earmarking the development and commercialization pathway for Tyvaso DPI.

Financial Engagement

-

MannKind was initially paid $45 million, with the potential to receive an additional sum of up to $50 million upon achieving specified developmental targets. Moreover, MannKind is entitled to a low double-digit percentage of the net sales from Tyvaso DPI as royalties. The agreement further outlines an opportunity for United to expand the license to encompass other active compounds for treating PAH. Each new product developed under this broader license could funnel up to $40 million to MannKind, contingent upon option exercise and the attainment of developmental benchmarks, along with a low double-digit royalty on the net sales of these products.

Revenue Projections

-

In 2022, equity analyst Hazlett projected over 3 billion in peak sales for Tyvaso DPI in PAH and PH-ILD, signifying a substantial revenue potential, which would invariably reflect positively on MannKind’s financial portfolio given the agreed royalty terms.

Future Collaborative Avenues

-

The alliance with United not only augments MannKind’s product diaspora but also sets a precedent for potential future collaborations in crafting inhaled therapeutic solutions for other medical indications, leveraging the Technosphere technology.

This collaboration represents a strategic asset for MannKind, diversifying its product lineup, and exploiting its unique technology to penetrate the PH market via Tyvaso DPI. It also underscores MannKind’s expansive vision of creating and commercializing inhaled therapeutic options for patients afflicted with endocrine and orphan lung disorders, all while potentially boosting its revenue landscape.

My Analysis & Recommendation

MannKind’s march toward breakeven gains traction from Tyvaso’s buoyant market showing, as disclosed by United, which witnessed a robust ascent to $318.9M in Q2 ’23, reflecting a 59% surge YoY; notably, Tyvaso DPI was a significant driver, contributing $96.9 million. The concurrent elevation in total revenues to $48.6M for the quarter underscores a trajectory of improving financial vitality and market receptivity. The joint endeavor with United on Tyvaso DPI not only embodies a staunch clinical orientation but also broadens MannKind’s revenue avenues, fortifying its financial robustness.

Despite the upbeat revenue trajectory, investors should remain circumspect, given the company’s persistent net losses and a concerning debt load of $383.16M. The positive operating cash is a silver lining; however, the looming debt suggests a medium to high likelihood of MannKind seeking additional financing in the near term, which could potentially dilute shareholder value.

In the coming weeks and months, investors should keenly observe the sales performance of both Tyvaso and Afrezza, alongside the company’s ability to manage its debt profile and operational expenses. The market dynamics surrounding MannKind’s offerings and its competitive positioning within the diabetes and orphan lung disease segments are crucial indicators of its long-term viability.

Investment strategies may include maintaining a diversified portfolio to hedge against unforeseen market volatilities and closely monitoring MannKind’s financial disclosures and management commentary for insights on debt management and operational sustainability.

Given the promising sales figures of Tyvaso and a cautiously optimistic market sentiment, upgrading MannKind to “Buy” appears justified. However, a prudent risk assessment and a vigilant eye on the evolving market dynamics are essential to ensure a balanced investment decision with a clear mitigation strategy for potential financial adversities.

Risks to Thesis

Upon meticulous analysis, several elements warrant attention, potentially contrasting my “Buy” recommendation on MannKind.

Firstly, the persistent net losses are concerning despite revenue growth. The company’s reliance on collaborations for revenue, particularly United, exposes it to partnership risks. A change in this relationship or underperformance of collaborative products like Tyvaso DPI could adversely impact revenues.

Secondly, the optimistic sales projection of Tyvaso DPI at >$3 billion may be overly ambitious given the competitive landscape in PH treatment. It’s prudent to question whether MannKind’s Technosphere technology, although innovative, would significantly outperform existing or emerging treatments.

Thirdly, the high short interest of 14.60% reveals a substantive bearish sentiment which could hinder stock price appreciation in the near term. The high debt load of $383.16M, even in the face of positive operating cash, underscores a precarious financial position, necessitating further financing which could lead to share dilution or encumber the balance sheet.

Lastly, Afrezza’s market acceptance remains tentative amidst pricing and reimbursement challenges which may inhibit revenue growth in key markets. While strategic efforts are underway to bolster Afrezza’s market penetration, the historical underperformance and competitive pressures should not be understated.

Read the full article here