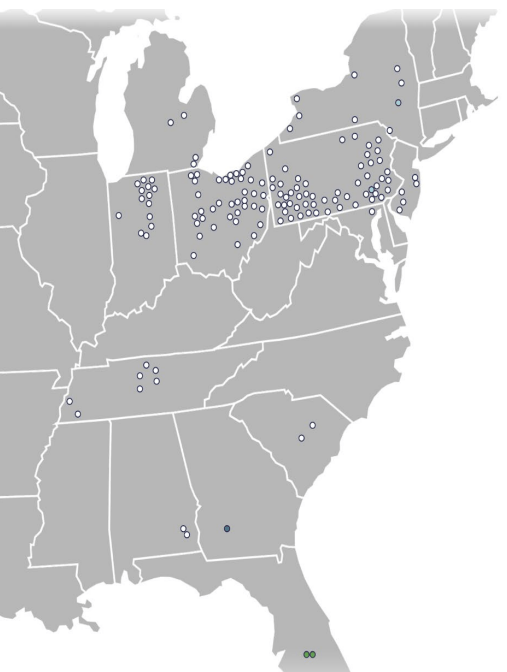

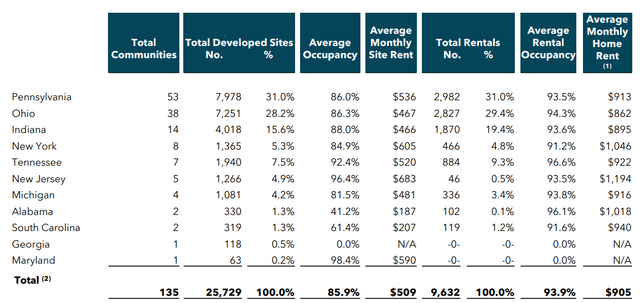

UMH Properties (NYSE:UMH) is a REIT that owns and operates a large number of manufactured home communities in the eastern half of the US. The company owns 135 properties in 11 states with a total number of 25,700 homesites.

UMH Property Locations (UMH)

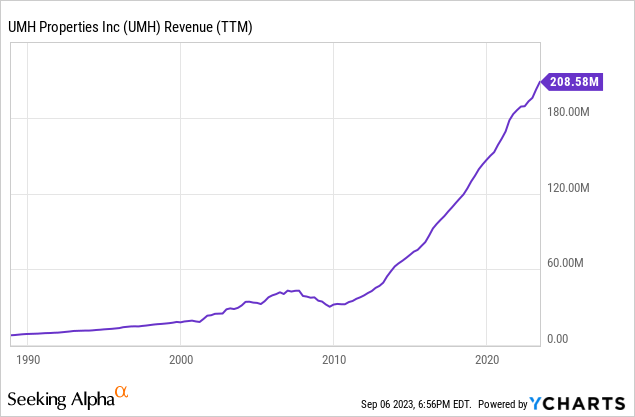

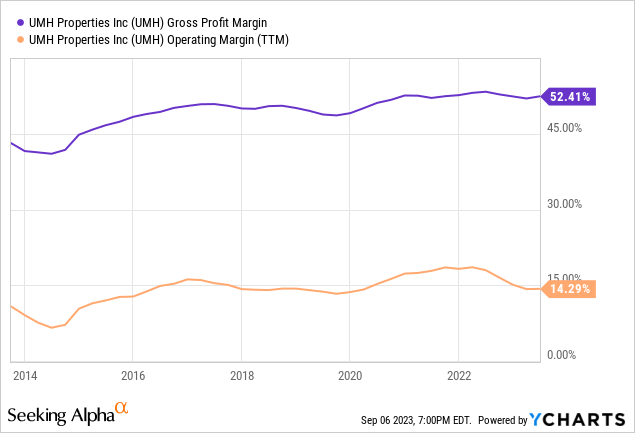

The company buys large empty land and cuts them into lots to prepare them to accommodate manufactured or mobile homes. After getting necessary permits from local governments, it builds up necessary infrastructure so that manufactured home owners can move in and start living in. Since the company doesn’t actually build units, it collects rent on its land lots and its margins tend to be pretty healthy.

Once a manufactured home is installed on a lot, it is incredibly difficult and expensive to move it to another lot, so most people who own these types of homes don’t move around much unless they sell their home and buy another one. This allows the company to generate stable and predictable levels of income each year with very few fluctuations. In addition to collecting rent from its land lots, UMH Properties also has a subsidiary that sells manufactured homes to interested people which could add fuel to the company’s future growth.

Some of UMH’s communities have extra amenities that you might expect to see in apartments such as a community pool and community gym. These communities are also part of an HOA managed by the company. Apart from these amenities and basic maintenance of the infrastructure (such as water pipes and electric lines), managing land lots is a lot cheaper than managing whole properties and if done correctly, this kind of business can generally enjoy higher margins than managing apartment units. Over the years, UMH’s margins have been pretty stable with gross margins being around 50% and operating margins being around 15%.

When it comes to manufactured home communities, investors can be worried about stability because people who live in these communities tend to have lower income on average. People also have the perception that crime rates are higher in these communities even though this is not necessarily true since many manufactured home communities are 55+ communities which tend to be quiet and clean. As UMH manages its own properties the company has a lot of control over who it lets to live in its properties. The company typically conducts sufficient background checks to ensure that people who live in its properties aren’t going to cause any trouble and most likely take care of their property and pay their rent on time. It really takes a special kind of experience and skillset to manage manufactured home communities and the company seems to have the right skillset since it’s been around since 1968 and surviving and thriving since then.

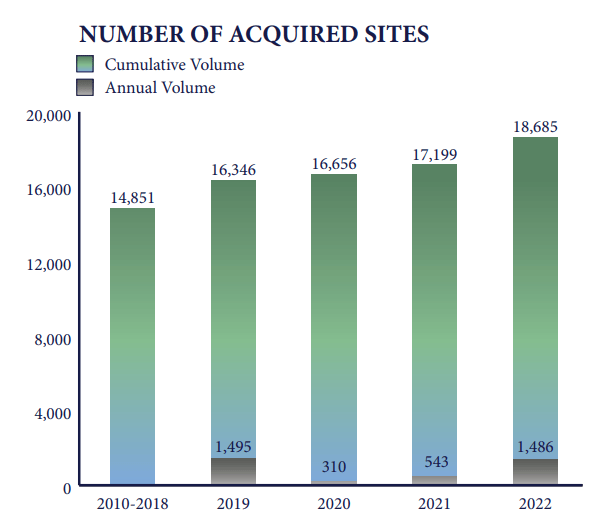

The company seems to be able to achieve growth through both acquisition of new property as well as rent price hikes in its existing properties. Since the collapse of the real estate market in 2009, the company has been aggressively buying up properties as fast as its cash flow and liquidity would allow it to do so. Over the years, the company has acquired a good mix of developed properties as well as unbuilt land and it was able to triple the amount of sites it owns and manages since 2010 through these acquisitions. There is little reason to expect this trend to change anytime soon since the company’s cash flow levels remain healthy and its liquidity levels are strong. Perhaps its acquisitions might be a bit slower for the next couple years due to high inflation rates but they should go back to accelerating after rates are back to normal levels especially if it can come across some discounted deals.

UMH Site Acquisitions (UMH)

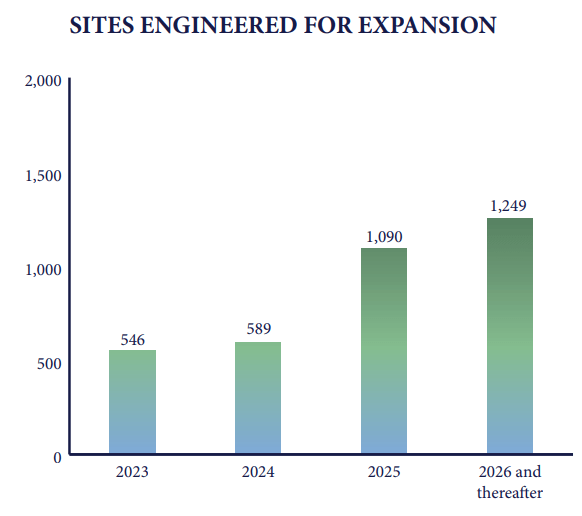

The company owns plenty of empty land suitable to build new properties so this is where a good portion of its near-term growth could come from at a relatively low cost as compared to acquiring developed properties. The company has engineered 546 sites for development this year, another 589 in 2024 and more than a thousand per year starting in 2025. As long as demand for housing stays strong, these sites should fill up soon after development.

UMH Site Expansion Potential (UMH)

Currently the company’s properties enjoy an average occupancy rate of 86% which may not sound like a high number compared to apartment REITs that enjoy occupancy rates in mid 90s but keep in mind that these are long-term rentals. The average apartment dweller might stay in the same apartment for 2-4 years but people with manufactured homes will stay in the same spot for a decade or longer because it is very costly for them to move their property (almost like a “captive audience”). The average monthly site rent across all of UMH’s properties is $509 whereas the average monthly home rent is $905. In the first number, the renters bring their own manufactured home and only pay rent for the land whereas in the second number the rent for the unit itself is included as well.

UMH Rental Characteristics (UMH)

Last year the company raised its rents across the board by anywhere from 6% to 10% and its occupancy rates didn’t drop which means its price hikes were well-received for the most part. Of course we can’t expect the company to be able to hike rates at that rate forever. As inflation rate returns back to long term average of 2%, the company’s rent hikes are likely to stabilize around 3-4% as we see in most residential REITs. There are also cases where the company could acquire a site that is in less than perfect shape, fix up the place, add more amenities and hike rents as a result of improving the property significantly. These actions can drive further revenue growth for the company as long as it’s done strategically.

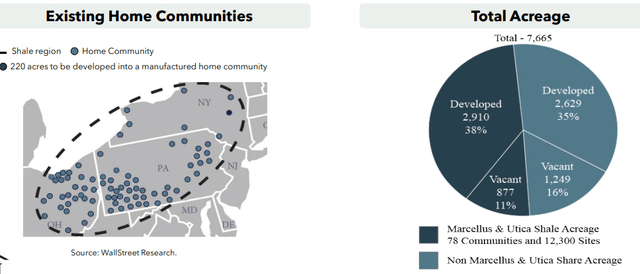

The company owns a lot of sites in Pennsylvania, Ohio and western New York. This area is known as Marcellus & Utica Shale Region which is one of the largest and potentially most productive natural gas fields. There is a lot of development in this area with more to come. The company’s management seems to believe that UMH will benefit greatly from this development since it will provide thousands of high paying jobs where many of its sites are located. This could increase the overall economic activity in the area which could result in higher overall demand for housing and higher rent prices overall but we will have to wait and see if it actually materializes. It’s very difficult to quantify exactly how much it can benefit from this development though so at least some caution is warranted before getting too excited.

UMH Sites near Marcellus & Utica Shale (UMH)

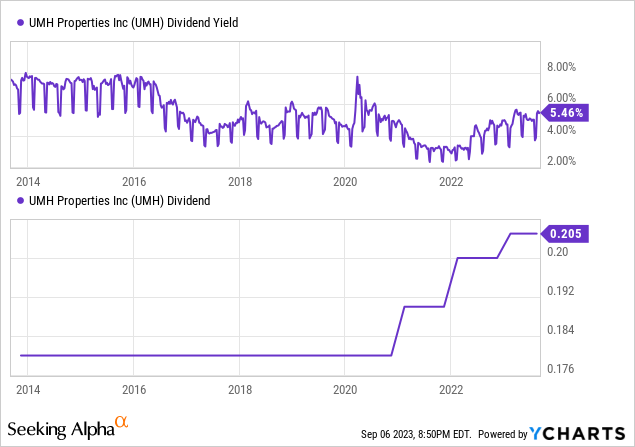

Since this is a REIT, one very important component of this stock is its dividends. After all, REITs are expected to pass virtually all of their earnings to shareholders in shape of dividends and many people invest into REITs for dividends. The stock’s current dividend yield of 5.46% is pretty decent and significantly above what it was just a year ago (about 3%) but it’s still slightly below its long-term average of 6%. Meanwhile, after shying away from raising its dividends for several years, the company finally started to hike its dividends again a couple years ago. UMH’s dividend per share had been flat for 11 years from 2009 to 2020 as the company was spending most of its liquidity on aggressively acquiring new property and growing its business but now there might be more room to hike dividends in the next few years as the company’s earnings grow.

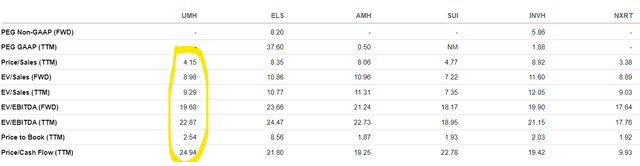

Valuation-wise, we can look at a few metrics to value a REIT. One of them is dividend yield which I mentioned above. When we look at other metrics to compare UMH against its peers such as Equity LifeStyle Properties (ELS), American Homes 4 Rent (AMH) and Sun Communities (SUI) we see that UMH’s valuation is better in some metrics and mixed in others as compared to its peers. For example the company is doing better than most of its peers in Price to Sales metric but it’s higher than its peers in Price to Cash Flow. UMH is also higher than all but one of its peers in Price to Book ratio which is an important metric when valuing a REIT because it tells us how much investors are paying for a company for each $1 it has in assets. The current price to book value of 2.54 isn’t exactly cheap but it’s on the lower end of the company’s 5-year P/B range of 2.5 to 7.5. So I wouldn’t exactly call this stock exceptionally cheap but it’s not excessively expensive either. I would call the company fairly priced.

UMH vs Peers valuation comparisons (Seeking Alpha)

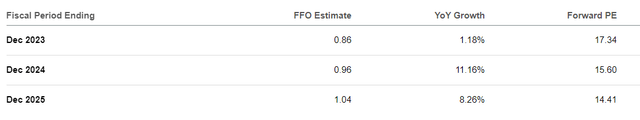

Analysts expect the company to generate $0.86 per share this year, $0.96 in 2024 and $1.04 in 2025 in FFO (funds from operations). This would give the company a forward P/FFO ratio of 17.3 for this year, 15.6 for 2024 and 14.4 for 2025 which makes the company’s valuation even more reasonable if it can meet or beat these estimates. Since the company’s current dividend is around 82 cents per share, this could also mean further dividend hikes if the company is able to meet these estimates.

UMH Analyst forward estimates (Seeking Alpha)

Risk factors

There are a few risk factors with this company since there is no such thing as risk-free investment. First, REITs are capital intensive businesses and they need a lot of liquidity to keep operating. As interest rates rise and liquidity becomes more expensive and difficult to obtain, this will probably put a headwind into the company’s growth at least in the short term. Second, since the company’s customers tend to be people with lower income in general, they are the ones that could suffer the most from a possible recession that could happen in the future. People who live in manufactured home parks tend to have less resources and less financial stability so they might be unable to pay their rent if the economy were to enter a severe recession. This somewhat happened in 2008 and the company had to cut its dividend significantly back then. Third, there could be new regional or local laws and regulations changing how land is being used and what could be built on what kind of land and this could limit what the company could do with vast amounts of empty land it owns. Fourth, there could be shift in people’s preferences and perception where manufactured homes might not be seen as a good option and we might see people making other kinds of living arrangements. Also, since a lot of manufactured home communities are for older citizens, they will have to depend on social security payments to make rent. In the long term this could be a risk factor.

Conclusion

UMH Properties is a decent REIT play with an above average dividend yield and potential for future growth in a niche area of the residential market. UMH’s management seems to be good at what they are doing considering their successes in the last 50 years. This stock has the potential to be a great play if it can continue hiking dividends after that long pause and if the company’s strategically targeted growth continues. The company has multiple tools in its tool box for future growth such as acquisition of new properties, developing existing land, fixing up or upgrading properties to improve their value and hiking its rents. While the stock isn’t exceptionally cheap, it’s not dangerously expensive either. I would call it “fully priced” at the moment.

The company also has a preferred stock (UMH.PR.D) which yields 7.5% and seems to be more stable in terms of share price fluctuations but on the negative side it won’t enjoy potential upside in either the stock price or dividend hikes that you might get from regular shares.

Read the full article here