Unity (NYSE:U) has been in the news due to game developer uproar over the latest set of pricing changes. U has sought to counteract headwinds from a tough macro environment with price increases, though the structure of this past pricing change appears to have hit a nerve. After its acquisition of IronSource, U has been left with quite a bit of leverage on its balance sheet, but that is expected to moderate over time, with management continuing to expect $1 billion in EBITDA run-rate by the end of 2024. I continue to see U as being squarely positioned to benefit from digitization trends as well as the long term potential of the metaverse through its partnership with Apple (AAPL). I reiterate my strong buy rating as the valuation remains too cheap for such an attractive growth story.

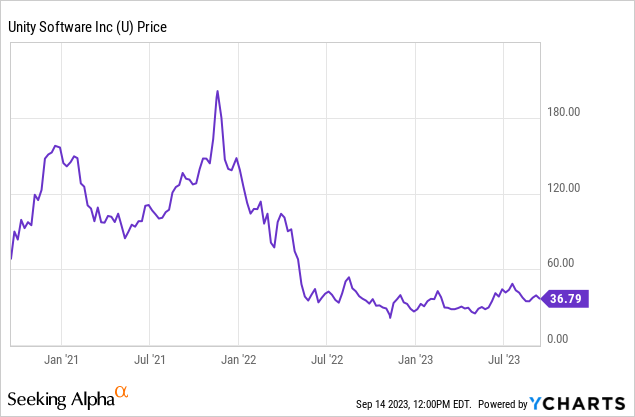

U Stock Price

The metaverse was once a highly hyped idea, one that sent U stock soaring to the stratosphere. Those days are long gone, as the hype faded alongside a valuation reset in the growth sectors.

I last covered U in June where I rated the stock a strong buy on account of its partnership with AAPL for its VisionPro. The stock is roughly flat since then as that partnership is not expected to bear fruit in the near term. Stay patient here.

U Stock Key Metrics

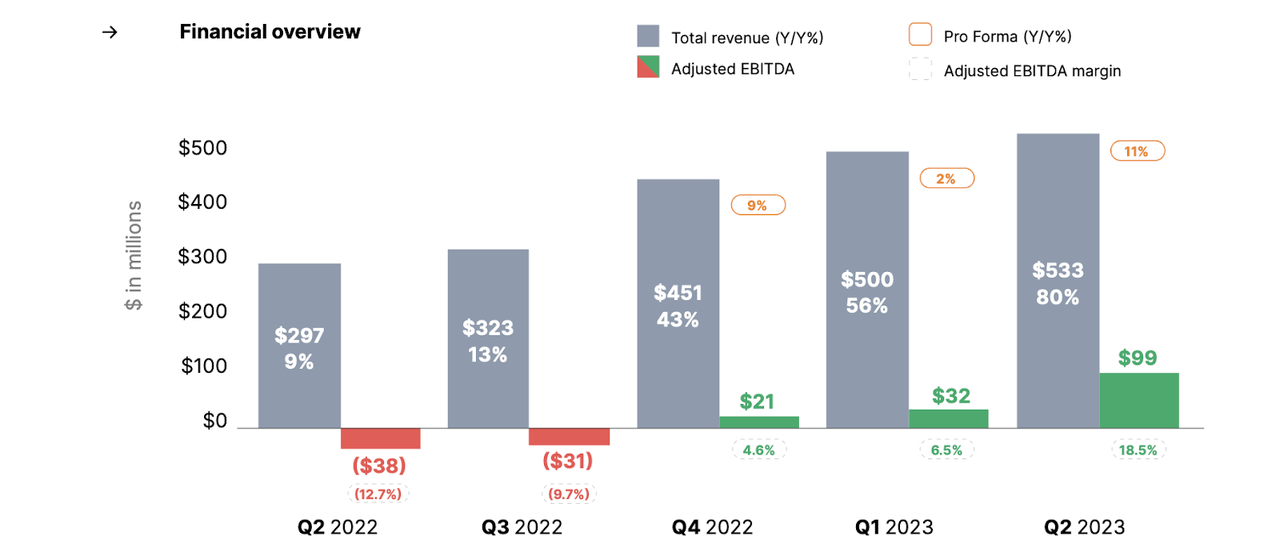

In its most recent quarter, U delivered 11% YoY revenue growth on a pro-forma basis to $533 million, ahead of guidance for $520 million. Adjusted EBITDA came in at $99 million, ahead of guidance for $60 million.

2023 Q2 Shareholder Letter

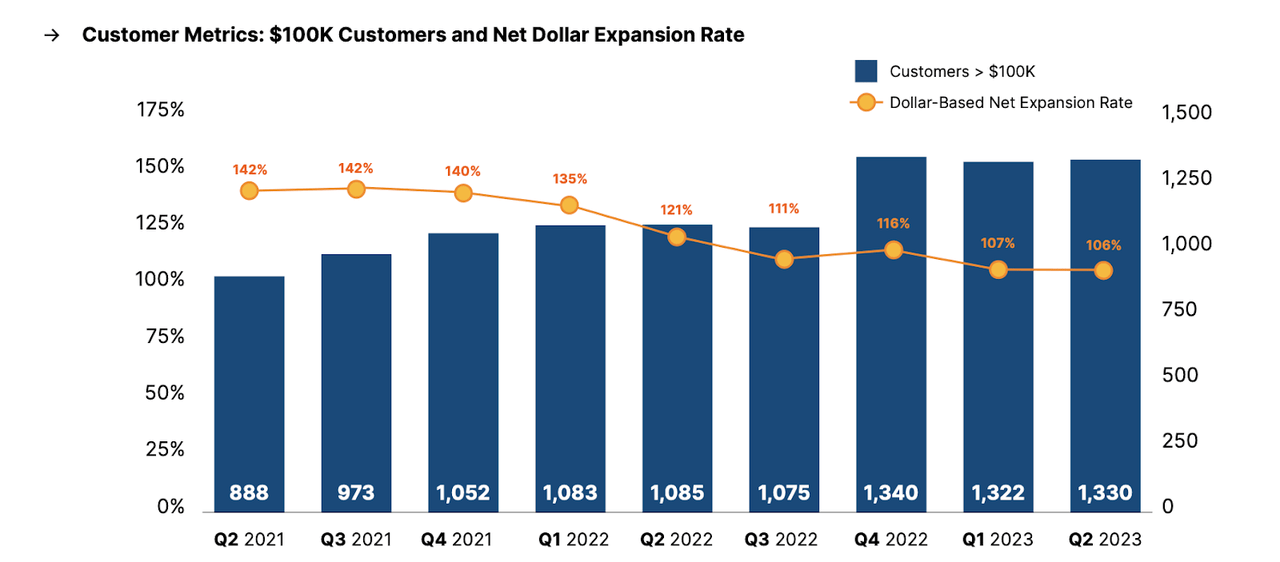

U saw its net dollar expansion rate appear to stabilize at around 106%, after several quarters of rapid deceleration. U is particularly exposed to the macro environment due to online advertising being one of its core growth drivers. It is notable that large customer growth grew after declining sequentially in the first quarter.

2023 Q2 Shareholder Letter

On the conference call, management noted that Create subscription growth would have been 22% excluding weakness in China. Create refers to the company’s 3-D design software product. Management noted that the company’s prior price increases were being adequately received and the company managed to grow faster than the general advertising market, implying market share gains.

U ended the quarter with $1.6 billion of cash versus $2.7 billion of debt, representing around $1.1 billion in net debt. That reflects a roughly 2.5x to 3x debt to EBITDA ratio, a steep ratio but management continues to expect $1 billion in EBITDA run-rate exiting 2024. While that implies a more than doubling of adjusted EBITDA over the next year, I find such a target to be realistic given management’s increased commitment in operational efficiencies. For the full year, management increased the low end of their revenue guidance, now expecting between $2.12 billion and $2.2 billion in revenue, implying up to 9% YoY growth on a pro-forma basis. Management expects full-year adjusted EBITDA to end up at around $340 million, up from prior guidance of $300 million.

Is U Stock A Buy, Sell, or Hold?

U stock is an investment on the growth of the 3-D digital world, which includes applications such as augmented reality and virtual reality. These applications go beyond just mobile gaming as many industries such as the automotive industry have embraced their software to help improve their design processes.

Unity

U makes its money primarily in two ways: first through selling subscriptions to use its software (“Create”) and second through enabling its customers to show advertisements (“Grow”). Advertising was expected to be the biggest driver of long term growth and thus its disappointing performance amidst a tough macro environment can be blamed for management having to walk back its former guidance for over 30% long term overall growth.

Unity

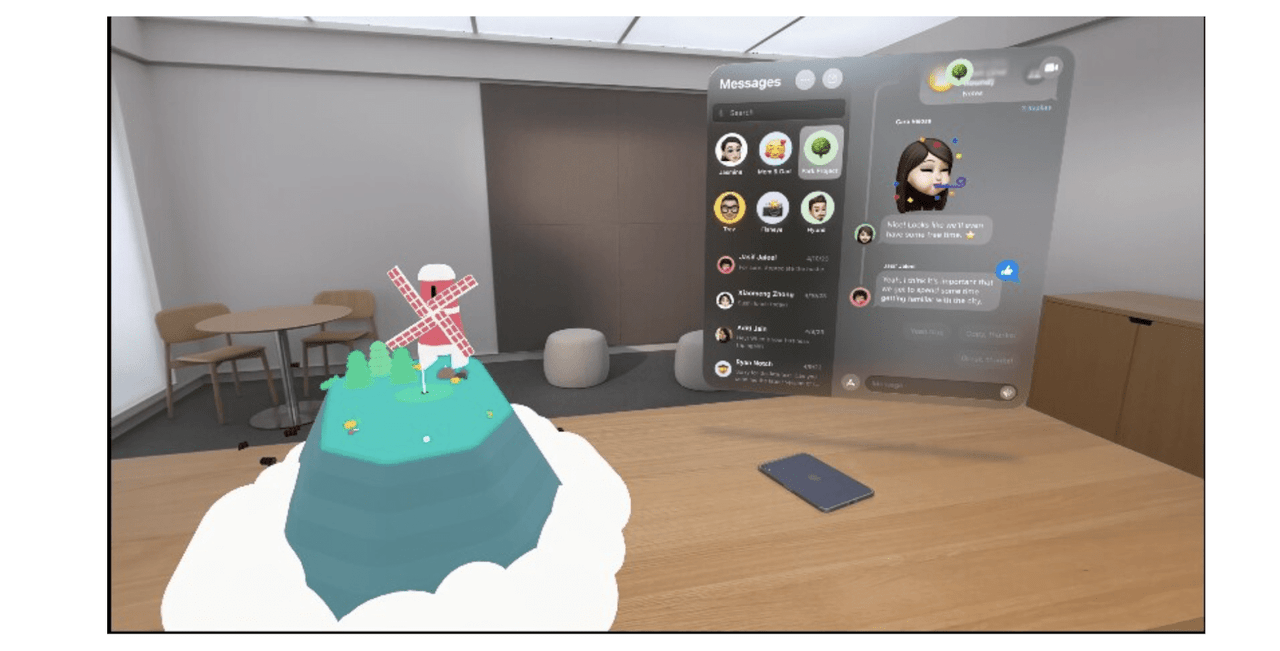

U remains positioned to benefit from the metaverse over the long term, as the company’s PolySpatial technology will be used to help load apps to AAPL’s VisionPro.

Unity

U the company has been in the news as of late, after rolling out its latest set of pricing changes, which were poorly received. U is aiming to charge around 20 cents per new install for customers that have reached scale. This has led to a viral outrage among game developers and it isn’t clear if U will have to roll back these changes. From my view, the 20 cent charge for large applications does not seem too much to ask for, but perhaps this measure is being viewed as predatory and not conducive to a mutually beneficial relationship.

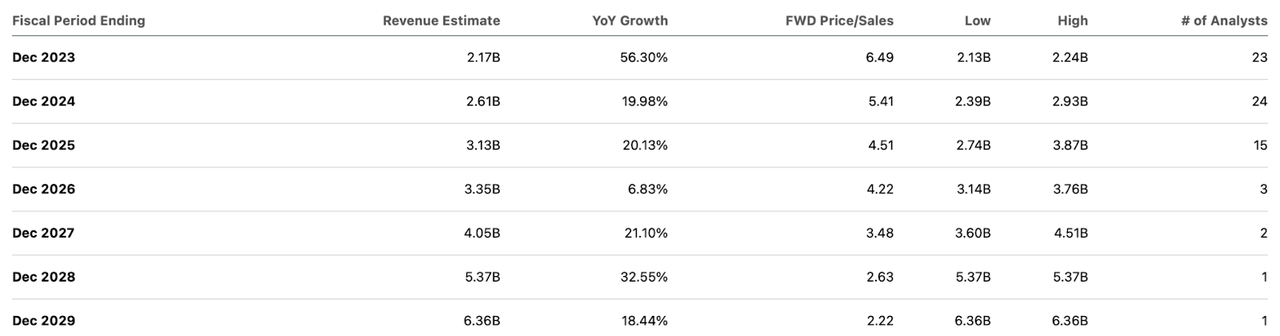

Even after U’s strong bounce from the lows, the stock still trades cheaply. The stock recently traded hands at around 6.5x sales.

Seeking Alpha

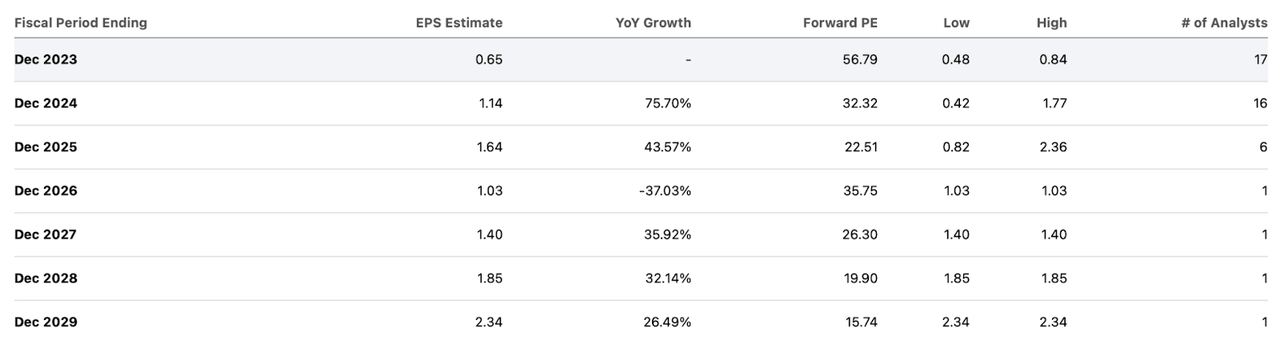

Consensus estimates see operating leverage taking hold, with the stock trading at around 16x 2029 earnings estimates.

Seeking Alpha

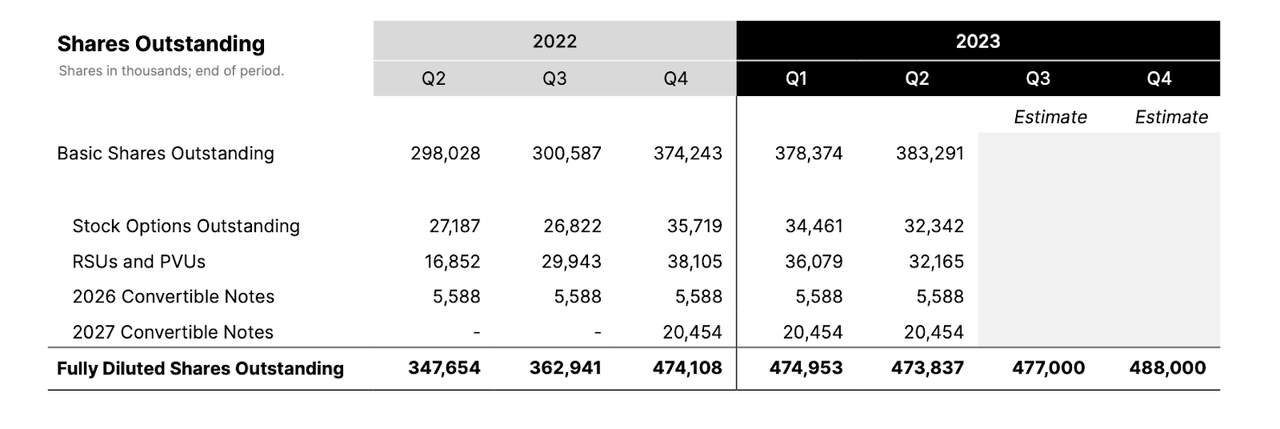

I should note that the multiples shown above are using around 387 million shares outstanding. Fully diluted shares outstanding likely stands more around 470 million, as the 2027 convertible notes have a conversion price of $48.89 (the 2026 notes have a conversion price of $308.72)

2023 Q2 Shareholder Letter

That places the stock at just under 8x sales. I see the company sustaining a 30% net margins over the long term. If the company can return to a 30% top line growth rate, then at a 1.5x price to earnings growth ratio (‘PEG ratio’) I could see the stock trading at around 13.5x sales, implying around triple digit upside over the next 12 months. The company needs to generate around 18% revenue growth to justify the current valuation, which would imply some acceleration from current levels. I expect the growth rate to recover to that level and more as the macro environment improves and the company sees increasing adoption of metaverse products.

What are the key risks? Due to the leverage on the balance sheet, the downside risk is greater here. U needs growth to accelerate not just from a valuation perspective, but also from a financial risk perspective, as in my experience debt tends to be the most obvious downside catalyst. U faces competition, including from the likes of the Unreal Engine and it isn’t clear if U is significantly better, if at all than the competition. I am of the view that the VisionPro will take many years before seeing significant adoption, making it more of a tail-end catalyst for the stock. I should note that U offers software support for products created for the Meta Quest headsets (META), but the metaverse has thus far arguably been more conceptual than popular. The stock is not cheap if growth rates never accelerate to a higher level on a sustainable basis. I can see the stock trading down around 30% just to trade more in-line with peers of a similar growth cohort.

I rate U a strong buy given my optimistic long term view of the company’s growth prospects as well as the expanding profitability and potential for accelerating growth rates.

Read the full article here