The US dollar index updated

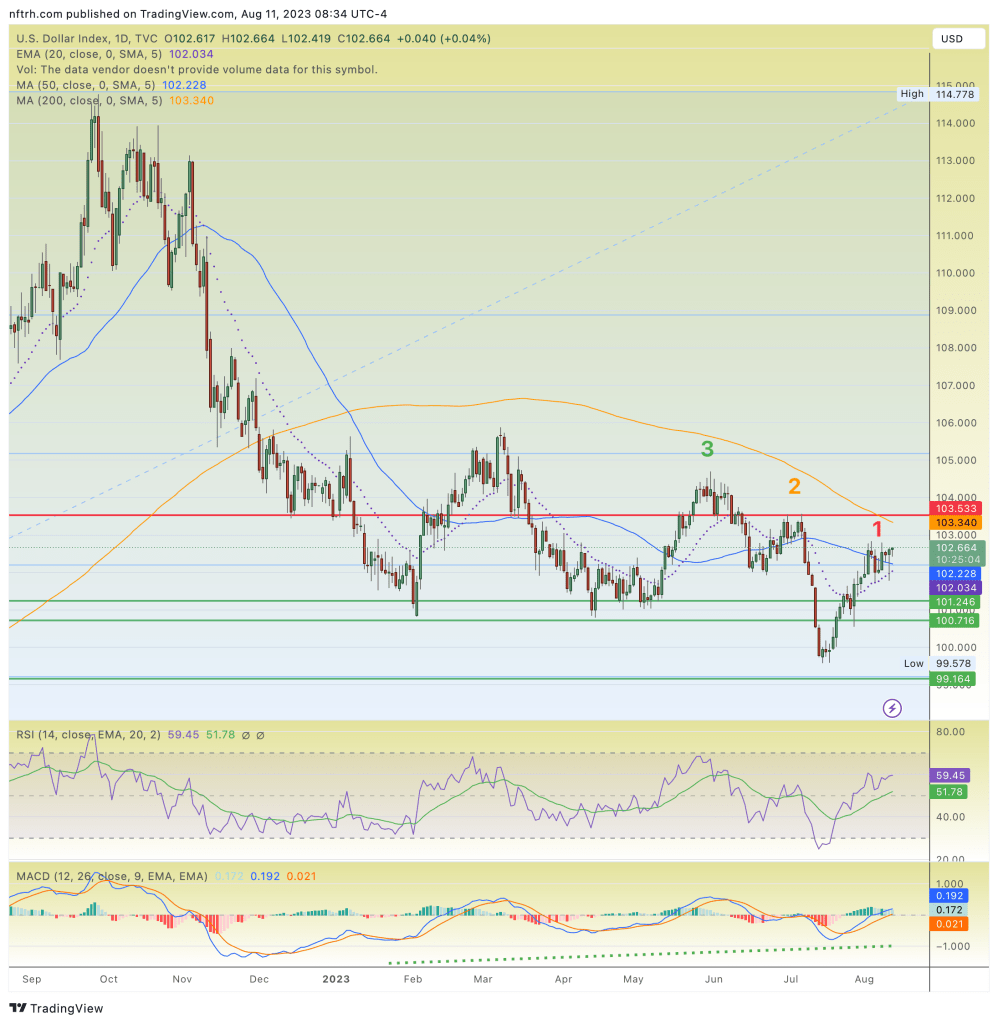

We have been keeping well aware of the implications of a) USD following its daily chart downtrend, or b) painting the July plunge as a bear trap and going bullish again. We’ll leave the detailed implications aside in this post and simply note that the process is still evolving.

From a separate update I projected the up move on July 19:

USD can break through it [clear resistance at the time, now support] and test the SMA 50 and still remain in a downtrend.

A downtrend it still is, to this day. But we have since assigned 1-2-3 levels as objectives/resistance:

- 1) 50 day moving average, which USD currently sits atop.

- 2) Clear resistance and the downtrending SMA 200, which USD is eyeballing now for an important test.

- 3) Likely a big time trap of USD bears and asset market liquidity issues if this is taken out and other indicators (hello Gold/Silver ratio) corroborate, which I expect they would.

But as yet the major daily chart trend is down and a test of the SMA 200 will be very important. Despite the weakening inflation signals in the wider macro and slowly decelerating economy, which would indicate a weakening Fed from its hawkish stance, the US dollar is improbably still buoyant. Except that it was not improbable. It was right there in the July 19 update linked above.

Let there be no ghost stories about manipulation, please. “They” are not controlling the dollar, or stocks or gold for that matter, to any large degree. The market is doing what it will do.

US dollar index, daily (TradingView.com)

While our operating plan has been for a resumed bear phase within USD’s long-term bull market, there is a perfectly viable scenario where USD could break the daily chart bear trend. That scenario is an asset market liquidity crisis that would, despite the “dedollarization” touts, drive the herds to the perceived safety and liquidity of the US dollar. A monetarily Utopian concept like the BRICS forming a hard asset backed currency block may happen one day, but it will very likely not apply in the next liquidity crisis.

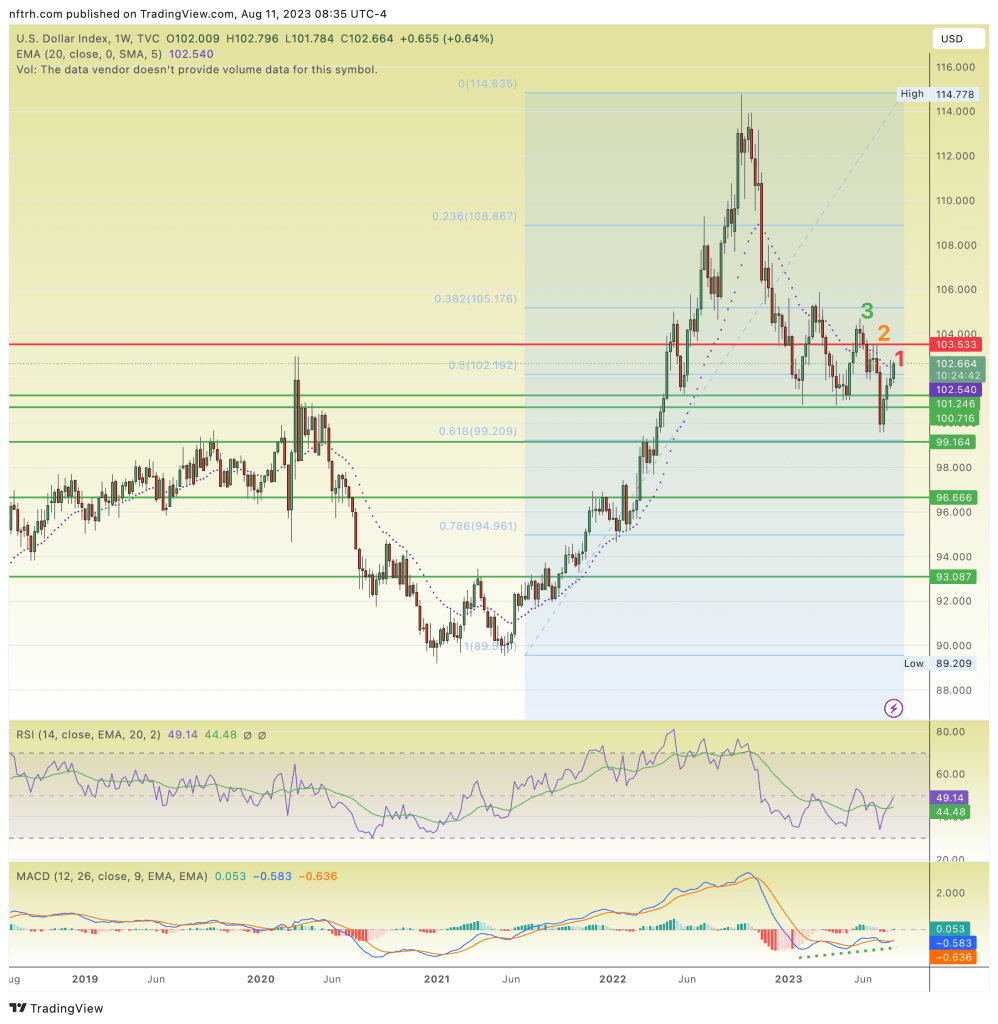

Moving on to the weekly chart, we have a nice view of a bull market correction that did not quite touch the 62% Fibonacci retrace level. That may or may not be unfinished business and indeed, if the daily chart above does hold its bear trend and assert itself on the longer-term view we have targets for USD that are significantly lower.

US dollar index, weekly (TradingView.com)

That would be party time for market participants who would greedily buy assets, especially those most ‘anti’ to the US dollar index.

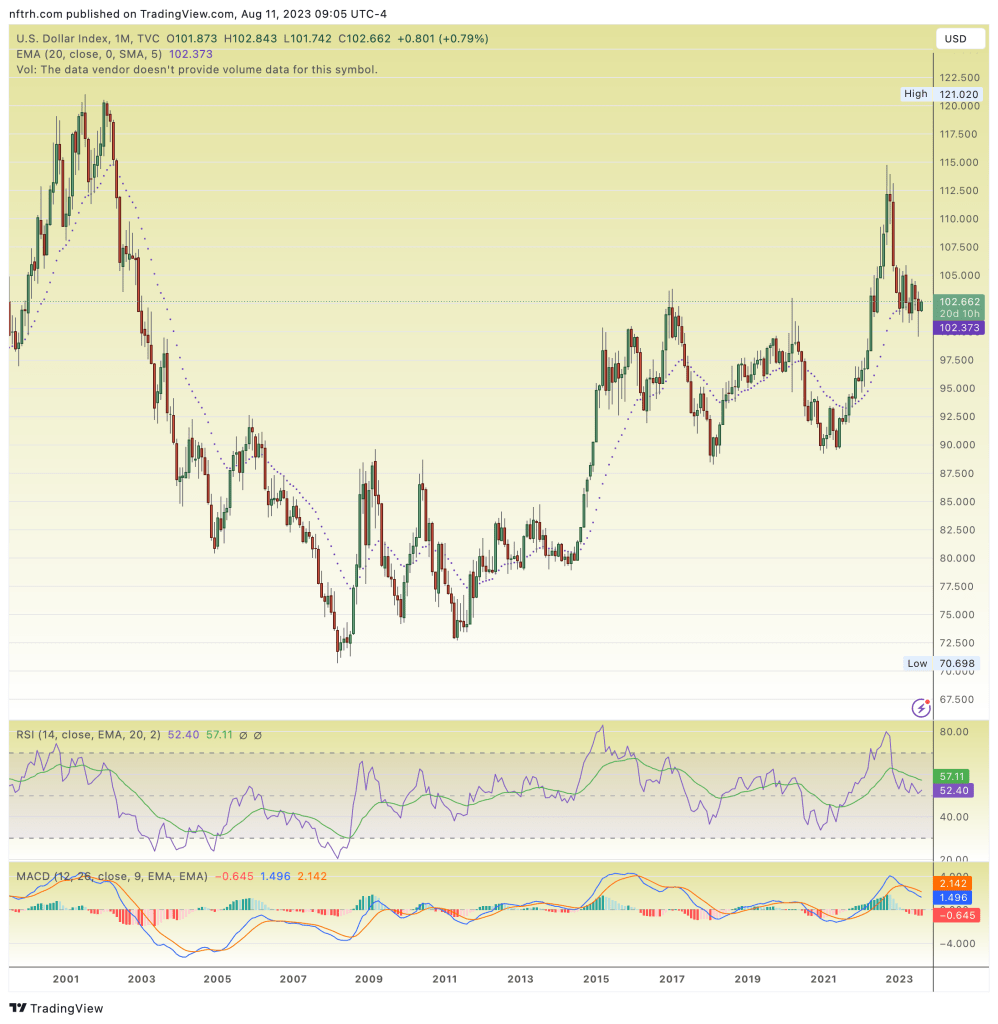

But as the big picture monthly chart shows, the US dollar is not even in danger of losing its big bull market from 2008 unless it takes out the 90 level. And you can sure as shootin’ bet that the next asset market liquidity crisis will come well before that level is approached.

US dollar index, monthly (TradingView.com)

Read the full article here