Investment Thesis

V.F. Corporation (NYSE:VFC) is an apparel conglomerate operating 13 premium active brands. Globally VFC has an estimated total addressable market of $600 billion, with significant international exposure.

The price has collapsed by 55% year over year and 81% since its 2020 high. The dividend was cut by $1.20 per share annualized in order to strengthen the balance sheet and maintain financial flexibility. Post cut, VFC’s dividend yield is 6.2%, easily covered by our estimate of $2.00 in current year earnings. With new leadership, cost-cutting, brand innovation and strong globally recognized brands, VFC has significant potential for a turnaround in our opinion; moreover, it has a secure 6% dividend yield while we wait.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $2.60 X 13 = $33.80 VFC is a March Fiscal Year

|

E2024 |

E2025 |

E2026 |

|

|

Price-to-Sales |

0.7 |

0.6 |

0.6 |

|

Price-to-Earnings |

9.7 |

8.3 |

7.0 |

2027 Targets

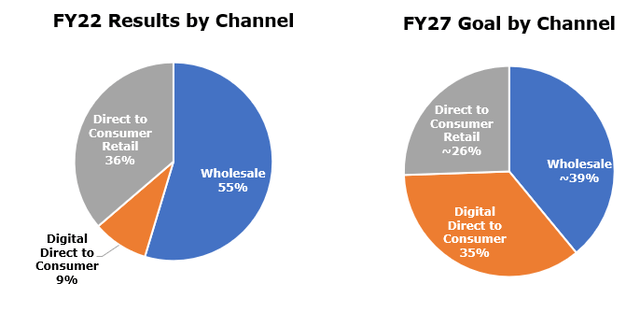

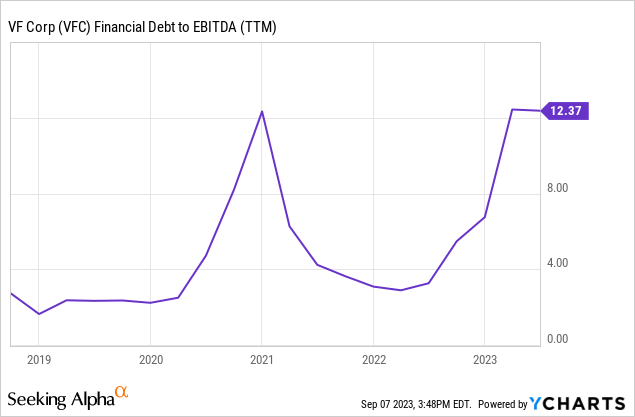

VFC has set some aggressive goals for FY 2027 that September 2022. The FY27 targets include mid to high single-digit revenue CAGR, $5.5 billion in FCF (Free Cash Flow), and operating margin of 15%. More digital DTC, better mix and the pricing power potential of their premium brands combined with improving macro conditions could allow VFC to reach its aggressive goals. We should point out that these goals do not need to be fully met for VFC to be a good stock. A 12 times FCF multiple of FVC’s target of $5.5 Billion would imply a $66 Billion market cap compared to only $7.5 Billion today. Operating margins currently sit at 2.8%, a destructive contraction from 13.8% in FY22. The contraction was attributed to increased product manufacturing costs, elevated promotional activity, and adjusting inventory levels.

Bracken Darrell has recently taken over as CEO in July. Darrell had previously led a successful 10-year stint at Logitech, which underwent a similar strategic transformation. The CEO said, “We are well positioned to advance our key priorities this year with an emphasis on increasing operating earnings through improved gross margins, generating healthy cash flow, and reducing debt, all of which lead to a strengthened financial position.” We expect that this new CEO Darrel will modify the 2027 goals down as they appear to us to be overly aggressive. Taking only half the FCF goal and its resulting 2027 reasonable market cap of $33 Billion would still make this a great stock.

These goals are to be achieved with the key strategy of transforming revenue streams on both a geographic and origination basis. Direct-to-consumer digital is targeted to grow by low double digits, to account for 35% of all sales, which should aid the shift to the goal of 50% of sales being international. The international shift will help broaden the addressable market, while the digital DTC shift will allow higher margin realization and better inventory. This combination should dramatically improve profitability and cash generation.

Estimated revenue by stream (VFC, BuildingBenjamins)

Operations

VFC

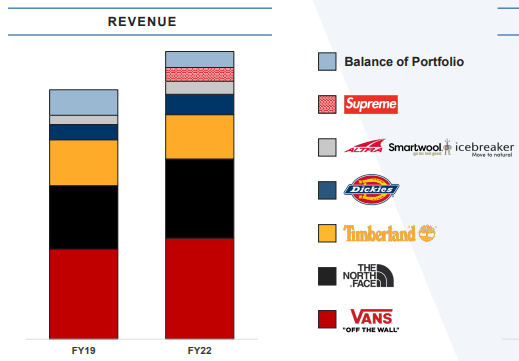

The total addressable market for VFC is estimated to be over $600 billion. VFC maintains a large portfolio of brands, the most successful being Vans and The North Face.

VFC

Asia Pacific is the lead driver to Outdoor brands growth, with 12% year-over-year growth. In China alone, The North Face has grown to be the largest outdoor brand, with 31% year-over-year growth in revenue. However, the Outdoor brand has been running at a loss, with an operating margin of -5.3% attributable to being particularly sensitive to wholesale trends and the cyclicality of its product portfolio.

Activewear is dominated by Vans, the largest of the brands by revenue. Vans has realized a 22% decline in revenue – mostly in wholesale, with a 40% drop year over year. The Vans segment has been slipping in domestic market share, with management attributing it to a culture of low innovation and a heavy reliance on mature product lines. Vans will shift to a more digital DTC strategy and improve international footing as part of a broader repositioning effort for the brand. Vans will reduce the number of products offered by around 20-30% in DTC channels while pushing for more innovation within the brand. The first results will likely be realized for this change in 2Q24 with acceleration toward 2H24.

The Work segment has also experienced difficulty, with higher material costs and wholesale downturns as primary drivers of the decrease. While Europe saw 17% year-over-year growth, it was not enough to offset the 23% dip year over year for the Americas.

VFC derives revenue from wholesale, retail DTC, and digital DTC. Direct-to-consumer contains VFC-operated retail and e-commerce sites, representing 46% of revenue during 1Q24. DTC allows VF to realize its products’ retail and manufacturing margins. VFC claims their operated stores realize much higher total margins than other channels, though VFC does not publish specific numbers. In 1Q24, direct-to-consumer channels were up by 7% year over year despite declines in wholesale.

Risk

VFC expects a recovery in wholesale in the 2H24 as retail destocking has largely run its course. The strength of the recovery will be determined by a combination of consumer demand and retailers’ willingness to take on inventory for a consumer with shifting preferences. VFC’s DTC expansion lessens exposure to the wholesale channel but does not fully mitigate the risks and also creates a potential backlash by retailers who don’t like competing directly with the VFC’s DTC offerings.

Executing a turnaround is always difficult. Branded fashion success is at the whim of the consumer. The strength of VFC’s brands help mitigate these risks, but VFC is a deep value play with the associated high risk and potentially high reward profile.

McKinsey

Outlook

Global results were far weaker in 1Q24, with VFC realizing a 15% drop in revenue in the Americas and a 3% dip in Europe. However, the Asia-Pacific region saw accelerating revenue growth of 18% year-over-year. All channels in this region grew by double digits, with DTC being dominated by brick-and-mortar growth.

VFC expects better results in 2H24 on the top line, with sequential improvements from 1Q24 as the holiday season cycle starts. But there is a long road ahead for the company. Shareholder returns are still a priority, with management targeting a 50% FCF payout ratio and a $2.5 billion repurchase authorization remaining. However, it is unlikely that the repurchase agreement will be deployed in the near-medium term as most free capital will go toward optimization, deleveraging, and dividend payouts.

YCHARTS

Read the full article here