In August, digital assets experienced a 2-year low in trading volume, historic lows in volatility, and a slowdown in VC fund deployment into blockchain projects.

Please note that VanEck may have a position(s) in the digital asset(s) described below.

Digital assets’ trading volumes & volatility made 2-year and all-time lows, respectively, in August as investor interest dwindled amidst the lure of the beach and the US 10-year treasury bond, the yield on which reached its highest levels in 15 years. Venture capital funds deployed into blockchain projects totaled just $500M in August 2023, compared to $1.9B in August 2022 and $2.7B in August 2021, respectively, while crypto ETPs saw large redemptions.

For the month, Bitcoin (BTC-USD) & Ethereum (ETH-USD) fell 9% and 10%, respectively, underperforming the Nasdaq Composite’s 2% decline for the 2nd straight month.

| August | YTD | |

| S&P 500 Index | -2% | 18% |

| Nasdaq 100 Index | -2% | 34% |

| Bitcoin | -9% | 60% |

| Ethereum | -10% | 39% |

| MarketVectorTM Smart Contract Leaders Index | -14% | 12% |

| MarketVectorTM Decentralized Finance Leaders Index | -17% | 5% |

| MarketVectorTM Infrastructure Application Leaders Index | -18% | 10% |

| Coinbase | -18% | 128% |

| MarketVectorTM Media & Entertainment Leaders Index | -21% | -34% |

Source: Bloomberg, as of 8/31/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Layer 1s

August was a typical month in the tempestuous snow globe of digital assets as a blizzard of volatility and uncertainty swirled around crypto markets. Regulatory decisions, smart contract exploits, solvency rumors, and potential liquidation fears all contributed to a substantial decline in prices. The 30-day performance of Smart Contract Platforms (SCPs) was (-10.7%).

The sector was ripe with hope at the end of July after Ripple’s partial victory against the U.S. Securities and Exchange Commission (SEC) when a federal judge ruled that Ripple’s programmatic sales to retail investors through exchanges were not securities. It was expected that further regulatory catalysts would materialize in August, including Grayscale winning the right to convert its Bitcoin investment trust into a spot BTC ETF, the potential of other spot BTC ETFs winning approval, and the SEC signaling a potential green light for the launch of Ethereum Futures ETFs. However, prices soured with no approval for any of the ETFs and the SEC announcing its intention to appeal the Ripple ruling.

Additional issues that contributed to negative price action were:

- Questions about the solvency of Binance.

- The liquidation of a $200M position by a BNB exploiter on BNB DEX Venus.

- Exploits of staple Ethereum DeFi applications Balance and Curve.

- Concerns that the hacking of Curve might lead to the liquidation of Michael Egorov’s $168M CRV position, representing 34% of all CRV supply.

- Rumors about the arrests of Huobi’s executives in China and the potential insolvency of the Huobi exchange.

- Bitstamp’s decision to suspend trading of altcoins for US users.

- Outflows totaling $260M from crypto ETPs in August.

While none of the SCPs had a token whose price increased in August, the top performers were ETH (-11.3%) and Tron (TRX-USD) (-1.6%). Meanwhile, the worst monthly laggers were ATOM (ATOM-USD) (-21.9%), MATIC (MATIC-USD) (-19.3%), and AVAX (AVAX-USD) (-22.1%).

The Neon Glow Coming from Solana

Despite the cascade of negative headlines, the value proposition of blockchain technology to non-crypto native users made some large strides. On August 23, Shopify (SHOP, SHOP:CA) integrated Solana Pay into Shopify’s online retailer platform – this new addition will allow Shopify’s 1+ million retailers to accept payments in the USDC (USDC-USD) stablecoins. Solana’s (SOL-USD) blockchain will be used to execute these transactions, and each payment will cost only $0.00025 per transaction while settling in under one second. This allows online businesses to avoid credit card fees, which range from 1-3%, and international currency interchange fees, which can be higher. Instant access to USDC also improves the working capital position of small businesses by allowing them to forgo revolving credit options and even earn interest on their funds. This new development follows the path of Solana’s drive to smooth consumer adoption by focusing on user experience improvements like cheap NFT minting technology, the Solana Phone, the Solana Mobile Stack, and Solana Pay.

Ethereum’s Layer-2 Performance

Layer-2 Daily Active Users

Source: Artemis.xyz, VanEck Research as of 9/4/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

The long-term roadmap of Ethereum is to alter its business model to become a settlement layer while offboarding the transaction processing to Layer-2 (L2s). This drastic change stems from the technological limitations imposed by Ethereum’s focus on “credible neutrality.” The Ethereum Foundation (EF), the entity that maintains and updates Ethereum’s software, contends that Ethereum’s users must believe Ethereum to be inviolably fair for it to replace the existing financial system. The EF concludes that the best way to achieve this impartiality is through decentralizing the network by enabling millions of people to host Ethereum’s open-source software on inexpensive servers across the globe. However, due to internet bandwidth limitations and computer processing costs, Ethereum’s network is handicapped to process only 14 TPS. By contrast, the Visa network can process tens of thousands of transactions per second.

The technical limitations of the Ethereum network spawned Layer-2 blockchains, which execute transactions in a less technically constrained environment than Ethereum’s. In turn, L2s settle these transactions to Ethereum in large blobs of data representing a batch or “roll-up” of transactions. These data blobs use up Ethereum’s limited blockspace, and Ethereum assesses L2s hosting fees for this data. The effect of this arrangement is that many more transactions can take place in the “modular” ecosystem of Ethereum. The total amount of transactions in Ethereum with L2s is expected to scale to 220 TPS, with EIP 4844 coming in 4Q2023. Over the month of August, Ethereum’s full ecosystem averaged around 26.5 TPS. However, these Layer-2s are each a siloed ecosystem. This means that smart contracts and stored value cannot cross Layer-2s. In essence, each L2 is like a distinct Excel sheet containing the ledger entries and functions for only that L2.

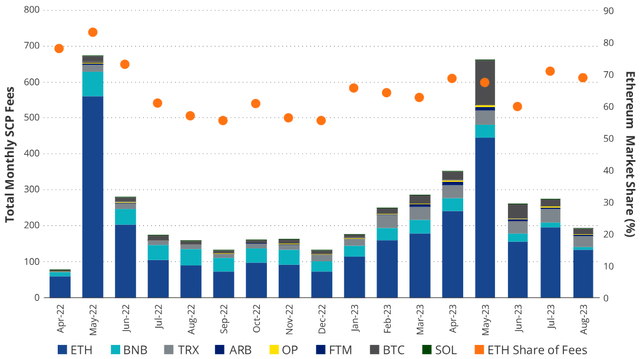

The consequence of this arrangement is that dozens of Layer-2s have been created to compete for the most important smart contracts (blockchain businesses), total value locked, and users. Over the past 12 months, numerous L2s have become consistent cashflow-generating entities, including Arbitrum (ARB-USD), Optimism (OP-USD), Polygon, Starknet, and ZkSync Era. Currently, these blockchains only generate cash for their parent entities and not any of their own tokens. The daily average revenue of all L2s combined for the last 30 days is $680k, which compares to Ethereum’s revenue of $6.4M. L2s also have margins that fluctuate between 20-50% depending upon the L2 and the price of blockspace on Ethereum. The market share of all Ethereum L2 has grown to 9% of all SCP fees generated. From a usership standpoint, the userbase of all L2s has averaged roughly 3-4x that of Ethereum’s, and both the absolute number of users and the ratio of L2/Ethereum users have been growing over time. Consequently, the amount of Ethereum blockspace used by L2s has climbed to between 10-14%.

Total Combined SCP Fees and L2 Market Share of Fees

Source: Artemis.xyz, VanEck Research as of 8/28/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

August was a strong month for L2 adoption amid negative price action. Optimism’s OP token was the best performer of the bunch, which only lost (-14%) of its value over the past 30 days. The price of OP was buoyed by strong usage driven by WorldCoin (WDC-USD) and its registry of new users through its WorldCoin Wallet. Every time WorldCoin registers a new user on Optimism, a Gnosis SAFE (GNO-USD) wallet is created. As a result of the onboarding of 600k new users to Optimism through WorldCoin, WorldCoin generated 26% of all fees on Optimism.

Additionally, Optimism’s ecosystem and the OP token have been aided by the launch of BASE. BASE is a Layer-2 built using the Optimism software development stack by Coinbase. While BASE is its own L2, separate from Optimism’s L2, Coinbase has promised to remit a portion of its profits to Optimism. BASE, launched on August 9, has averaged an impressive $143k in fees per day or around $4.6M since launch. This amounts to a market share of L2 fees of approximately 20-30%, and BASE’s fees have only been second to ZKSync over the past 30 days.

L2 Share of Ethereum Activity 30-Day MA

Source: Dune, Etherscan, VanEck Research as of 8/27/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Friend.Tech Overview

One of the most interesting applications on BASE is Friend.Tech. Friend.Tech is a social media application that allows users to access private chat rooms with gated content from famous social media personalities. This access is sold on the open market as “keys,” and users can trade the keys. The content creators get some secondary market key trading fees as revenue. The result has been a flurry of activity that has generated $4.2M in fees and 183k unique users since its launch on August 9. Friend.Tech has also catalyzed interest in a new type of application design that allows applications to navigate around the 30% fees imposed by Android and Apple’s app stores. With Friend.Tech, users install the application by adding a website to their phone’s home screen rather than downloading an application through a web store. The smooth, simple onboarding process will likely spawn similar application distribution approaches that will be fascinating to see unfold.

Friend.Tech’s long-term success will ultimately hinge on whether or not they can attract non-crypto influencers who then return value to their key holders in the form of exclusive content, giveaways, etc. However, based on the “pump & dump” price action of most Friend.Tech keys: it appears that early platform usage has mainly been driven by speculation rather than users acquiring keys for the content they unlock.

Another juggernaut of the L2 space is ZkSync Era, which is a zero-knowledge (Zk) roll-up. ZkSync has been earning around $200k in fees per day since July and has earned $6.5M in fees over the past 30 days. ZkSync is the most profitable, widely used Zk roll-up with over $411M in bridged value. Unlike Arbitrum and Optimism, which are optimistic roll-ups that post transactions that cannot settle for 7 days until the passing of a challenge period, Zk roll-up transactions are finalized once they are posted to Ethereum. This is because the rolled-up batch of transactions posted to Ethereum includes a zero-knowledge cryptographic proof of their authenticity. As a result, Zk roll-ups provide a much better user experience that allows users to withdraw funds faster. The downside is that Zk roll-ups have higher settlement costs on Ethereum because they include the data-expensive proof of authenticity.

Ethereum Update

Monthly Blockchain Fees vs. Ethereum Market Share

Source: Artemis.xyz, VanEck Research as of 8/31/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Ethereum maintained its key position as one of the safest digital assets during periods of volatility and saw a slight uptick in users (+3.44%) while seeing its fees drop (-23%) compared to the previous 30 days. Indicative of this decline is Ethereum’s daily transaction fees falling on Sunday, August 27, to their lowest level since December 2022. However, Ethereum retains a greater than 70% market share of all smart contract platform fees, and its dominance persisted in the month of August. Ethereum staking continues to grow with 26M ETH staked, around 22% of the total ETH supply, with 815k validators. Part of Ethereum’s success, despite its fee decline, is that it is no longer simply an execution layer. Ethereum has begun to reap the benefits of also being a settlement layer that generates revenue from hosting L2 transaction data. This business arrangement results in Ethereum benefiting from the success of projects like Coinbase’s BASE.

Another contributing factor to Ethereum’s success is the slow evolution of ETH as a collateral asset. Launched in June, Eigenlayer enables holders of ETH and ETH LSTs to deposit their funds into Eigenlayer and opt into backing various projects that employ the value of those funds. This value can be used to collateralize new protocols, applications, and financial arrangements. Projects like oracles, bridges, or on-chain insurance businesses could back their projects’ trust models with Eigenlayer-staked assets. This enhances the potential for new projects to leverage the value rented from Eigenlayer stakers to create novel, trust-based businesses. The result is that ETH is molting from its core use case as the base asset for securing and transacting on Ethereum to being an important collateral asset. This will establish new, permanent demand channels for ETH that make it substantially more useful. Eigenlayer recently upped the limit on the total amount of locked ETH it would accept to 141k ETH worth $23.3M, which will grow again as Eigenlayer becomes more mature.

Ethereum Upcoming Catalyst: EIP 4844

EIP 4844 is an upgrade to Ethereum that will improve Ethereum’s scalability and is slated to occur in 4Q2023. Called Proto-Danksharding, the EIP will allow Ethereum to settle L2 transaction batches in a separate memory storage scheme called a “side car.” The result of this upgrade will be the ability of Layer-2s to settle more transactions to Ethereum and do so with less cost. These data side cars will not be permanently stored on Ethereum but will persist for only about a month. Ethereum will also have more blockspace for its native transactions previously occupied by L2 settlements.

As a direct consequence of EIP 4844, L2 settlement costs to Ethereum will drop significantly. Unless more L2 settlements occur or more transactions happen on Ethereum to make up for the cost difference, Ethereum’s revenue may decline. Another potential side-effect is that more users may migrate to transacting on L2s because the cost of doing so should drop significantly. Interestingly, because L2 businesses costs are mainly settlement fees paid to Ethereum, L2 profit margins may increase if they can successfully capture some of the saved costs.

In EIP 4844, the variable cost of settling transactions will be around 90% cheaper for L2s. With current margin estimates of 30% for an L2 like Optimism, if Optimism captures all of the cost savings as profits, it will see margins jump to 93%. However, competition for L2 power users will likely drive transaction prices lower across all L2s, and where margins will end up is uncertain. Unless Ethereum can find new sources of blockspace demand vacated by L2s in the EIP 4844 upgrade, it could see 10-14% of its revenue derived from L2 settlements decline by 90%. We will discuss EIP 4844 in more detail in an upcoming Ethereum piece.

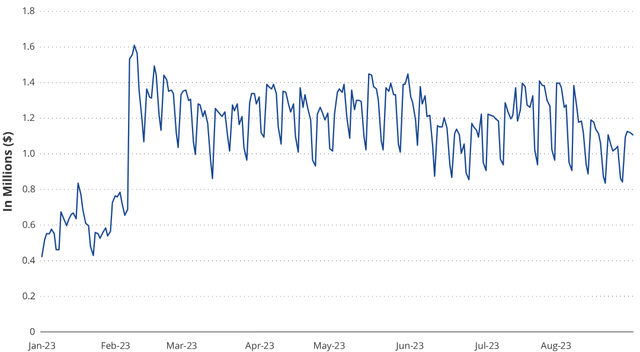

TRON Update

The fundamentals for Tron continue to be relatively strong amid the backdrop of greater crypto weakness. Tron has been averaging around $1M in fees per day in August, with around $5.27B in TVL, 1.35M daily active users (DAUs), and $44B in on-chain stablecoins (almost entirely USDT (USDT-USD)). Despite a dramatic 30% loss in DAUs from July, Tron still boasts the highest amount of DAUs among all smart contract platforms, including Bitcoin. Tron’s main use case is the utilization of USDT for payments among developing countries, and Tron averages around $9B transferred each day. While Tron has a functioning DeFi ecosystem, it is not decentralized, as its top applications are controlled by Justin Sun, who seems compelled to add his name to everything he touches. JustLend, JustStables, SUNswap, and the mysterious stUSDT collectively control 99.7% of all chain TVL. Additionally, TRON’s fees exhibit a peculiar seasonality as the majority of fees, and by proxy on-chain volume, occur during the week while weekends see remarkably consistent lulls in activity.

TRX Fees

Source: Tronscan as of 8/31/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Tron’s activity consistently declines on weekends.

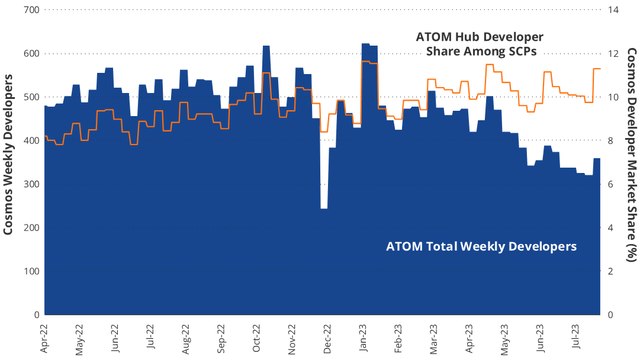

Cosmos Update

Cosmos Developer Market Share

Source: Artemis.xyz, VanEck Research As of 8/14/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

The month of August was not kind to ATOM as its price fell (-21.9%) and was one of the worst performers among smart contract platforms. ATOM, which we wrote a deep-dive on in August 2022, was grabbing the market share of the crypto developer base. Cosmos’ app-chain thesis was attracting adherents amongst important financial players in crypto. After last September’s Cosmos conference, many were excited to see Cosmos’ core contributors finally unveil a value accrual business model for the ATOM token.

This business was termed Interchain Security (ICS), and its economics centered around utilizing the value of the ATOM tokens to back a blockchain called the Cosmos Hub that would lend security to nascent blockchains. This would be accomplished by having each Cosmos Hub validator, all 175 of them, run each security consumer blockchain’s software. If the Cosmos Hub validators reported transactions honestly and provided server uptime, they would receive payments from the consumer chain for running consumer chain software. Effectively, this would allow each consumer chain to piggyback off the security of the staked ATOM because if the Cosmos Hub validators tried to cheat or steal funds, the staked ATOM behind those validators would be seized. In turn, to attract ATOM stakers, the Cosmos Hub validators would reward the stakers with some portion of the revenue from consumer chains.

However, progression towards building this vision has been incredibly slow. At the time of writing, only three chains had been onboarded to the Cosmos Hub, and many of the most important chains by TVL, such as Kava (KAVA-USD), Osmosis (OSMO-USD), and Axelar, have opted away from joining the Cosmos Hub. Likewise, the Cosmos ecosystem has been marred by negative sentiment generated by the glacial launch pace of native USDC launch, dwindling user interest in anticipated novel Cosmos DeFi chains such as Sei, Injective (INJ-USD), and Bera, and community disagreement on the Cosmos Hub business model. At this point, there are currently several ATOM-funded proposals to change the economics of the Cosmos Hub. While Cosmos has been gaining the market share of developers, it is uncertain if that will contribute to ATOM’s value. Until the economics of ATOM change and more chains opt into the ATOM security model, ATOM would appear to be a token without an economic purpose to justify its $2.1B market capitalization.

Polygon Update

Polygon’s MATIC token continued its underperformance for the month of August, losing (-19.3%) of its value. While MATIC did not see a significant decline in usership (-4.7%) amid a greater crypto drawdown of (-10.3%), it did see the third largest month-to-month fee decline (-29%) among SCPs. Part of the decline in Polygon’s token price can be attributed to the continued underperformance of Polygon’s business development initiatives. Over the past 18 months, Polygon has spent hundreds of millions of MATIC tokens securing partnerships with NIKE (NKE), adidas (OTCQX:ADDYY, OTCQX:ADDDF), Starbucks (SBUX), and Reddit (REDDIT). Despite these initiatives, the spent funds’ contribution to Polygon’s bottom line has dwindled immensely. While usership has increased over 6-, 12-, and 18-month intervals on Polygon, fees are down (-2%) over the past year and (-18%) lower than 18 months ago. Polygon’s chief applications, Planet IX, ChainLink (LINK-USD), and Uniswap (UNI-USD), have seen their usage, as measured by gas fees, decline (-37.1%), (-28.8%), and (-50.2%) month to month. Part of this decline is strong competition by L2s, attracting new and interesting projects. Another significant portion is due to useability issues with Polygon’s blockchain, including chain re-organizations, network outages, and security concerns. Though there is a substantial upgrade in the works that will address these issues, the timing of the releases is slower than needed. For example, the first upgrade of Polygon’s Mainnet to Validiums is not expected until late 1Q2024. Additionally, there is concern that the SEC may deem Polygon’s MATIC token a security. An indicator of this fear is the Bitstamp exchange delisting Polygon’s MATIC in early August.

Polygon Fees vs. DAU 30-Day Moving Average

Source: Artemis.xyz, VanEck Research as of 8/28/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

The Polygon team is currently addressing the issues plaguing its technical architecture and redesigning its MATIC token’s economic model. To prevent Polygon blockchain from having periodic re-org, Polygon will transition its Mainnet, called PoS, to a Validium-based system. A knock-on effect of this move will be that Polygon’s gas fees paid on Ethereum will also decline and make transactions on Polygon. This move is a stop-gap measure before Polygon converts to a true zero-knowledge (zk) ecosystem.

Furthermore, Polygon also introduced a revamped token design that centers around Polygon’s lead in zero-knowledge (zk) scaling technology. In the future set-up of Polygon, the MATIC token will be replaced by the POL token, which will accrue value by backing entities performing “useful work.” The MATIC token will be 1:1 convertible to the new POL token. The new design of Polygon will revolve around a series of bridges connecting various blockchains that will be secured under the aegis of a validator set backed by the POL token. Polygon will provide the tooling and support for entities that want to build their own Polygon blockchains, called “supernets.”

Additionally, a new agent, the zk prover, will play a pivotal role in the system by generating and verifying zk authenticity proofs of Polygon blockchains. The POL token will be used to back these provers as well. The result of Polygon’s design improvements is a host of new token sinks that perform important ecosystem functions for Polygon while providing value for the tokenholders. Finally, to create a sustainable ecosystem fund and security budget for validators, the POL token will implement a 2% inflation, unlike the capped supply MATIC token.

Avalanche Update

Avalanche Gas Usage by Application Category

Source: Artemis.xyz, VanEck Research as of 8/29/2023 Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

The price performance of AVAX in the month of August is poor, around (-22.1%), but is better than expected given Avalanche’s dismal fundamental metrics. According to some important measurements of a blockchain’s health, including fees, daily active users, DEX volume, and TVL, Avalanche is dramatically ailing. Compared to its peers, Avalanche saw the largest month-to-month decline in Daily Active Users (-28.5%) and the second worst decline in fees (-40%), DEX Volume (-46.9%), and TVL (-14.1%). The monthly transaction volume on Avalanche is the lowest since August 2022, while TVL is smaller than it has been at any point since August 2021.

While the decline in activity on Avalanche is dismal on a month-to-month basis, it follows a late spring 2023 surge in usage. However, this bump in activity was not organic but resulted from several large traders gaming an airdrop from the LayerZero project. The evidence to support this contention is that much of the activity on Avalanche has revolved around utilizing the LayerZero products such as the LayerZero bridge, the Stargate DeFi application, and BTC.b (bridged Bitcoin using LayerZero). In fact, since May 2023, bridging applications on Avalanche, almost exclusively the LayerZero-associated products, have accounted for 50-60% of all gas fees on Avalanche, 30-35% of all active wallets, and 25% of all transactions. Before the surge, bridging-related applications ranged around 5% of gas fees on Avalanche. However, the most concerning aspect of this decline in activity is that Layer-Zero airdrop-related activity has remained constant as a percentage of gas fees and usership. This implies that the total figures for Avalanche have been declining as a whole, not just from airdrop farmers’ pairing back activity.

DeFi: Economic Activity Continues to Decline

The MarketVector Decentralized Finance Leaders Index underperformed BTC and ETH, falling 21% in August as on-chain economic activity dwindled. The underperformance was exacerbated by UNI, representing ~30% of the index, declining 33.5% as investors sold tokens to capture gains from its outperformance in July. Other major index components fared slightly better, with MKR, AAVE, and LDO returning -6%, -14%, and -15%, respectively. The total value locked (TVL) across DeFi fell 8% in August, from $40.8 billion to $37.5 billion, slightly outperforming Ethereum’s 10% pullback. Decentralized exchange volume experienced a more severe decline to $52.8 billion in August, 15.5% lower than in July. While DeFi tokens had a lackluster performance in August, many of the core DeFi protocols experienced positive developments. Uniswap Labs won a class action lawsuit, and Maker and Curve saw TVL growth in their stablecoins.

August DeFi Volume Falls 15%

Source: DefiLlama as of 8/31/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Uniswap Wins Lawsuit, Sets Precedent for Decentralized Protocols

While the UNI token underperformed its peers in August, the leading decentralized exchange celebrated a major victory when the Southern District Court of New York dismissed a class action lawsuit. The lawsuit alleged that Uniswap contributors, including Uniswap Labs, Uniswap Foundation, Hayden Adams, and multiple venture investors, had violated securities laws by selling unregistered securities on the platform. The court ruled that Uniswap cannot be held liable for any damage caused by third parties misusing the protocol because Uniswap is a decentralized exchange. As such, it does not have control over how its protocol is used. Judge Katherine Failla, who is also presiding over the SEC v. Coinbase case, wrote in her decision that “this case is more like an effort to hold a developer of self-driving cars liable for a third party’s use of the car to commit a traffic violation or to rob a bank.” The ruling is a huge win for Uniswap and other decentralized protocols, as it sets a precedent that could be used to defend other open-source crypto developers and contributors from unfounded lawsuits.

MakerDAO Drives DAI Adoption by Increasing the DAI Savings Rate (DSR)

DAI Market Capitalization Reverses Trend

Source: VanEck Research as of 8/31/2023. Past performance is no guarantee of future results.

In August, the amount of DAI deposited in MakerDAO’s DAI Savings Rate (DSR) contract increased 278%, settling at ~1.3 billion DAI following the interest rate increase from 3% to 8%. Rune Christensen, the founder of MakerDAO, lauded the success of the rate increase, which grew DAI’s total market capitalization by 19% to $5.35 billion over the course of the month. However, many in the MakerDAO community were uneasy with the results of the rate change due to whales being able to borrow large amounts of DAI at an interest rate below the 8% deposit interest they received for depositing in the DSR. This effectively allowed whales to fill up the DSR by arbitraging the borrow and deposit rates, resulting in a situation where MakerDAO’s treasury was essentially paying whales the difference. To alleviate this, Rune proposed the DAO lower the DSR to 5% and raise DAI borrow rates to match the DSR to disincentivize users from depositing borrowed DAI in the DSR. To prevent capital departure upon lowering the deposit interest rate, MakerDAO implemented the SPK pre-farming airdrop, which will reward Spark protocol borrowers in an upcoming airdrop of the SPK token. The goal here is to attract as much TVL as possible to boost market trust in the product while mitigating the expense of funding the DSR, which, at the current rate and level of deposits, is costing MakerDAO $65 million annually to fund. While this expense should be covered by the revenue generated from Maker’s U.S. Treasury Bond holdings, other stablecoins, such as USDC and USDT, have developed much larger market share without providing high yield to holders, calling into question the long-term sustainability of the DSR, especially once the Spark airdrop concludes. By the end of the month, Spark’s TVL had grown to $455 million, representing a monthly increase in deposits of 712%, with wstETH constituting 78% of deposits.

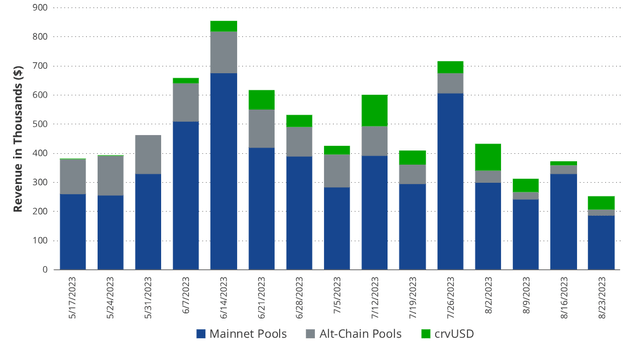

Curve Update: Recovering from July’s Exploit

Curve Revenue by Source

Source: VanEck Research, Curvemonitor as of 8/30/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Curve (CRV-USD) has begun to show signs of recovery from the Vyper compiler exploit last month that caused Curve’s TVL to fall 48% to $1.68 billion. In the first week of August, about $750 million of TVL returned as Frax redeposited its base pool liquidity, and other investors regained confidence in the platform’s security. Additionally, crvUSD saw significant growth this month and achieved a new all-time high of $114 million borrowed. The growth of crvUSD has allowed it to become a significant contributor of revenue for the platform, with crvUSD fees exceeding fees collected from all non-mainnet liquidity pools in 3 of the 4 last weeks. Curve’s governance token, however, has not seen promising signs of recovery, with its price falling 24% in August to $0.45. Due to the price decline, investors who bought CRV OTC from Michael Egorov last month are now only 12.5% above the water on their investment, with 5 months left until they can sell. If crvUSD can continue to grow to the point that it offsets the drop in exchange revenue caused by decreasing DeFi volume, CRV price may see some relief. Still, until then, declining DeFi volume remains a solid headwind for CRV appreciation.

High-Interest Rates: A Strong Headwind to Stablecoin Market Growth

Stablecoin Market Capitalization

Source: Artemis as of 8/31/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

Despite Maker and Curve’s success in expanding the supply of their respective stablecoins, the aggregate market capitalization of stablecoins continued to trend down, falling 2% in August to $119.5 billion, according to data from Artemis. This is mainly a result of elevated interest rates in traditional finance, which have incentivized investors to dump their stablecoins and move into money market funds where they can receive ~5% risk-free yield. With U.S. Federal Reserve (Fed) chair Jerome Powell noting that further interest rate increases in 2023 may be necessary, we think it is unlikely the stablecoin trend will reverse in the near term. Until interest rates begin to recede or a stablecoin provider finds a seamless way to bring this yield on-chain, as MakerDAO attempts to do, the risk and opportunity cost of holding stablecoins will continue to drive out capital. PayPal’s (PYPL) launch of their first stablecoin, PYUSD, could also bolster stablecoin adoption. While PYUSD doesn’t offer yield to holders, it could garner broader adoption if it introduces additional utility not offered by other stablecoins, such as the ability to conduct e-commerce payments.

Lack of Metaverse Development & Usership Stifle Performance

In August, the MarketVector Media and Entertainment Leaders Index fell 23.4% as metaverse tokens continued to underperform ETH. APE (APE-USD) fell 23%, while MANA (MANA-USD) and SAND (SAND-USD) fell 22.5% and 27%, respectively. The selling pressure results from continued token unlock, causing inflation and increasing investor doubt that metaverse platforms can deliver on the vision they promised. Throughout the bear market, data analytics platforms DCL-Metrics and DappRadar have reported declining usership metrics in both The Sandbox and Decentraland, which have 3,600 and 4,500 monthly active users, respectively. Meanwhile, APE’s feature product, the Otherside metaverse, is still developing while token staking rewards continue to inflate supply and drive sell pressure. However, Yuga Labs announced that its Legends of the Mara strategy game will be released in open beta in September, presenting a potential tailwind for APE. We believe these tokens will continue to underperform ETH until there is a strong reversal in the usership trend brought about by significant product enhancements or new releases.

Zynga Enters Crypto Gaming as Usership Stagnates

Zynga, a notorious Web2 casual game developer, announced the launch of their first Web3 gaming platform, Sugartown. Not much information was released about Sugartown as an attempt to bolster interest by maintaining a veil of mystery and slowly releasing information to the public. However, we know there will be an upcoming free mint for “Ora” NFTs, potentially having governance powers within the Sugartown platform. Additionally, Zynga made clear that Sugartown will not be a standalone game. Zynga described the nature of Sugartown as a transmedia IP and a gaming and community-building platform. Since other Web3 products have struggled to create compelling IP to attract gamers, Zynga has leveraged its existing IP by featuring 3 of its Farmville characters in Sugartown. The announcement of Sugartown comes as crypto gaming continues to struggle to bring in new users. In August, the user count amongst the top crypto games increased by 1.6% but is down about 35% compared to the same period a year ago. As a well-established game developer with a strong track record of success, we believe Zynga has the expertise to develop and market Web3 IP that could bring Web3 gaming to the masses.

NFT Volume Hits 2.5-Year Low as SEC Files Enforcement Action & Recur Shuts Down

Monthly NFT Volume Hits 2.5-Year Low

Source: Cryptoslam! as of 8/31/2023. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein.

August was a brutal month for NFT enthusiasts, as negative news for the market continued to outpace positive developments. NFT volume fell again in August, marking 6 months straight of declining volume. Cryptoslam! reported that NFT secondary sales in August generated only $390 million of volume, marking the lowest monthly volume for NFTs since January 2021. The 23% drop in monthly volume highlights the growing apathy in NFT markets, where little product improvement has occurred, and a lack of new entrants has inhibited the sector’s ability to drive speculation. Blur continued facilitating most Ethereum NFT volume in August, commanding a 65% market share of total volume and 37% of trades. Meanwhile, OpenSea retained its majority share of NFT trades, conducting 61% of trades and driving 21% of Ethereum NFT volume. Despite Blur’s success in dethroning OpenSea as the leading NFT marketplace by volume, the continued lack of investor interest in the NFT market creates major headwinds for BLUR, which fell 30% in August.

Not only has there been a lack of new entrants to the NFT scene, but existing franchises expected to drive development and adoption are running out of cash. Notably, Recur announced they would close shop over the coming months due to the NFT winter. Recur raised $50 million in Sept. 2021 at a $333 million valuation and garnered market-wide attention after announcing NFT collections for several big brands, including Hello Kitty and Nickelodeon. As part of the winddown process, Recur will migrate all media and attributes for the >380k NFTs minted by the platform to IPFS by November 22, with NFT deposits and other platform actions being disabled in the weeks preceding the IPFS migration. The closure of Recur shows that even well-funded companies are struggling to survive in the current environment.

Furthermore, the SEC launched their first enforcement action against NFTs in August, alleging that L.A.-based Impact Theory sold unregistered securities in their $30 million sale of Founder’s Key NFTs. The SEC alleged that Impact Theory marketed the NFTs as assets that would appreciate with the success project, constituting an investment contract. In a dissent on the Commission’s decision, Commissioner Peirce and Uyeda emphasized that while they worry about people buying NFTs without knowing how their funds will be used, the statements made by Impact Theory were not indicative of an investment contract just as an artist’s commitment to build their brand doesn’t justify labeling their paintings as investment contracts. Impact Theory agreed to settle with the SEC, requiring the team to destroy any NFTs they possess, set up a fund to reimburse investors, and pay more than $6.1 million in penalties.

One NFT-based game that recently found a clear product-market fit is DraftKings’ (DKNG) Reignmakers, which merges card collecting with fantasy sports using NFTs on the Polygon blockchain. Over the next four quarters, we estimate the Reignmakers franchise (an NFT-based fantasy sports game on Polygon) will generate $70M+ in high-margin revenues, accounting for 3% of DraftKing’s top line and 5% of 2022 full-year profits. Please check out our recent deep dive on the platform here.

Links to third-party websites are provided as a convenience and the inclusion of such links does not imply any endorsement, approval, investigation, verification, or monitoring by us of any content or information contained within or accessible from the linked sites. By clicking on the link to a non-VanEck webpage, you acknowledge that you are entering a third-party website subject to its own terms and conditions. VanEck disclaims responsibility for content, legality of access, or suitability of the third-party websites.

DISCLOSURES

Index Definitions

S&P 500 Index: is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Nasdaq 100 Index: is comprised of 100 of the largest and most innovative non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

MarketVector Decentralized Finance Leaders Index: is designed to track the performance of the largest and most liquid decentralized financial assets, and is an investable subset of MarketVector Decentralized Finance Index.

MarketVector Media & Entertainment Leaders Index: is designed to track the performance of the largest and most liquid media & entertainment assets, and is an investable subset of MarketVector Media & Entertainment Index.

MarketVector Smart Contract Leaders Index: designed to track the performance of the largest and most liquid smart contract assets, and is an investable subset of MarketVector Smart Contract Index.

MarketVector Infrastructure Application Leaders Index: is designed to track the performance of the largest and most liquid infrastructure application assets, and is an investable subset of MarketVector Infrastructure Application Index.

Coin Definitions

- Bitcoin (BTC-USD) is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.

- Ethereum (ETH-USD) is a decentralized, open-source blockchain with smart contract functionality. Ether is the native cryptocurrency of the platform. Amongst cryptocurrencies, Ether is second only to Bitcoin in market capitalization.

- Arbitrum (ARB-USD) is a rollup chain designed to improve the scalability of Ethereum. It achieves this by bundling multiple transactions into a single transaction, thereby reducing the load on the Ethereum network.

- Optimism (OP-USD) is a layer-two blockchain on top of Ethereum. Optimism benefits from the security of the Ethereum mainnet and helps scale the Ethereum ecosystem by using optimistic rollups.

- Polygon (MATIC-USD) is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development. Its core component is Polygon SDK, a modular, flexible framework that supports building multiple types of applications.

- Solana (SOL-USD) is a public blockchain platform. It is open-source and decentralized, with consensus achieved using proof of stake and proof of history. Its internal cryptocurrency is SOL.

- Uniswap (UNI-USD) is a popular decentralized trading protocol, known for its role in facilitating automated trading of decentralized finance (DeFi) tokens.

- Curve (CRV-USD) is a decentralized exchange optimized for low slippage swaps between stablecoins or similar assets that peg to the same value.

- Lido DAO (LDO-USD) is a liquid staking solution for Ethereum and other proof of stake chains.

- Aave (AAVE-USD) is an open-source and non-custodial protocol to earn interest on deposits and borrow assets with a variable or stable interest rate.

- Blur (BLUR) is the native governance token of Blur, a non-fungible token (NFT) marketplace and aggregator platform that offers features such as real-time price feeds, portfolio management and multi-marketplace NFT comparisons.

- ApeCoin (APE-USD) is a governance and utility token that grants its holders access to the ApeCoin DAO, a decentralized community of Web3 builders.

- Decentraland (MANA-USD) is building a decentralized, blockchain-based virtual world for users to create, experience and monetize content and applications.

- The Sandbox (SAND-USD) is a virtual world where players can build, own, and monetize their gaming experiences using non-fungible tokens (NFTs) and $SAND, the platform’s utility token.

- Binance Coin (BNB-USD) is digital asset native to the Binance blockchain and launched by the Binance online exchange.

- Fantom (FTM-USD) is a directed acyclic graph (DAG) smart contract platform providing decentralized finance (DeFi) services to developers using its own bespoke consensus algorithm.

- Ripple (XRP-USD) Ripple is a real-time gross settlement system, currency exchange, and remittance network that is open to financial institutions worldwide and was created by Ripple Labs Inc.

- Stacks (STX-USD) provides software for internet ownership, which includes infrastructure and developer tools to power a computing network and ecosystem for decentralized applications (dApps).

- Tron (TRX-USD) is a multi-purpose smart contract platform that enables the creation and deployment of decentralized applications.

- Cosmos (ATOM-USD) is a cryptocurrency that powers an ecosystem of blockchains designed to scale and interoperate with each other. The team aims to “create an Internet of Blockchains, a network of blockchains able to communicate with each other in a decentralized way.” Cosmos is a proof-of-stake chain. ATOM holders can stake their tokens in order to maintain the network and receive more ATOM as a reward.

- Avalanche (AVAX-USD) is an open-source platform for launching decentralized finance applications and enterprise blockchain deployments in one interoperable, scalable ecosystem.

- Maker (MKR-USD) is the governance token of the MakerDAO and Maker Protocol — respectively a decentralized organization and a software platform, both based on the Ethereum blockchain — that allows users to issue and manage the DAI stablecoin.

- Osmosis (OSMO-USD) is an automated market-making protocol (AMM) that specializes in the Interchain DeFi movement and is built on its own blockchain, utilizing the Cosmos SDK and IBC technologies. Osmosis is an advanced protocol focused on customizable AMMs, where users can create, construct, design, and deploy individual and highly customized AMMs with various modules and the on-chain governance system.

- Kava (KAVA-USD) is a layer-1 blockchain that combines the speed and interoperability of Cosmos with the developer power of Ethereum.

- Strike (STRK) is a DeFi lending protocol that allows users to earn interest on their digital assets by depositing them into one of several markets supported by the platform.

- Linea is a network that scales the experience of Ethereum with out-of-the-box compatibility with the Ethereum Virtual Machine which enables the deployment of already existing applications.

Risk Considerations

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments, or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned is unknown. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third-party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

Index performance is not representative of fund performance. It is not possible to invest directly in an index.

Investments in digital assets and Web3 companies are highly speculative and involve a high degree of risk. These risks include, but are not limited to: the technology is new and many of its uses may be untested; intense competition; slow adoption rates and the potential for product obsolescence; volatility and limited liquidity, including but not limited to, inability to liquidate a position; loss or destruction of key(s) to access accounts or the blockchain; reliance on digital wallets; reliance on unregulated markets and exchanges; reliance on the internet; cybersecurity risks; and the lack of regulation and the potential for new laws and regulation that may be difficult to predict. Moreover, the extent to which Web3 companies or digital assets utilize blockchain technology may vary, and it is possible that even widespread adoption of blockchain technology may not result in a material increase in the value of such companies or digital assets.

Digital asset prices are highly volatile, and the value of digital assets, and Web3 companies, can rise or fall dramatically and quickly. If their value goes down, there’s no guarantee that it will rise again. As a result, there is a significant risk of loss of your entire principal investment.

Digital assets are not generally backed or supported by any government or central bank and are not covered by FDIC or SIPC insurance. Accounts at digital asset custodians and exchanges are not protected by SPIC and are not FDIC insured. Furthermore, markets and exchanges for digital assets are not regulated with the same controls or customer protections available in traditional equity, option, futures, or foreign exchange investing.

Digital assets include, but are not limited to, cryptocurrencies, tokens, NFTs, assets stored or created using blockchain technology, and other Web3 products.

Web3 companies include but are not limited to, companies that involve the development, innovation, and/or utilization of blockchain, digital assets, or crypto technologies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here