Berkshire Hathaway Chairman and CEO, Warren Buffett.

When you think of world-class investors, Berkshire Hathaway (BRK.A)(BRK.B) Chairman and CEO Warren Buffett is probably the most obvious name that comes to mind. After all, the investing legend built the Omaha-based holding company into one of the most dominant conglomerates on the planet alongside his business partner, Charlie Munger.

Depending on whether your investment objectives align with Warren Buffett’s, the stocks within Berkshire Hathaway’s portfolio may be worth considering for your own. If you happen to be an investor oriented toward dividend growth as I am, Visa (NYSE:V) is arguably a must-own stock. Berkshire Hathaway’s stake in the company is valued at $2 billion, which makes it the 20th largest holding in its $352 billion investment portfolio (excluding its sizable $147 billion cash position as of June 30).

For the first time in nearly four years here on Seeking Alpha, it’s my pleasure to elaborate on why Visa is my 10th largest holding, accounting for 1.5% of my portfolio value.

Phenomenal Dividend Growth Can Continue

Make no mistake about it, Visa isn’t a stock that investors looking for immediate income should consider for their portfolio. After all, the stock’s 0.7% dividend yield is just half of the S&P 500 index’s 1.5% yield.

But for investors seeking remarkable dividend growth and capital appreciation to boot, the stock is an excellent pick. Consider this, Visa’s quarterly dividend per share has skyrocketed by 545% in the past 10 years from $0.0825 to its current rate of $0.45 – – an 18%-plus compound annual growth rate.

By virtue of its low payout ratio, the company has been able to invest in making further improvements in its payment network to support further growth. And it looks like this trend will continue: Analysts expect Visa to generate $8.67 in adjusted diluted EPS in its fiscal year ending later this month. Compared to the $1.80 in dividends per share that will have been paid this fiscal year, that equates to a 20.8% adjusted diluted EPS payout ratio. This is essentially in line with the company’s 20% adjusted diluted EPS payout ratio in the prior year ($1.50 in dividends per share paid divided by $7.50 in adjusted diluted EPS).

This manageable payout ratio paired with the ongoing adoption of credit cards and debit cards around the world should bode well for Visa’s future. That is why analysts believe that the company’s adjusted diluted EPS will grow at a respectable rate of 14.6% annually for the next five years. For these reasons, I believe Visa should have no problem delivering annual dividend growth of around 15% for the foreseeable future.

A Competitive Moat That Will Only Grow Stronger

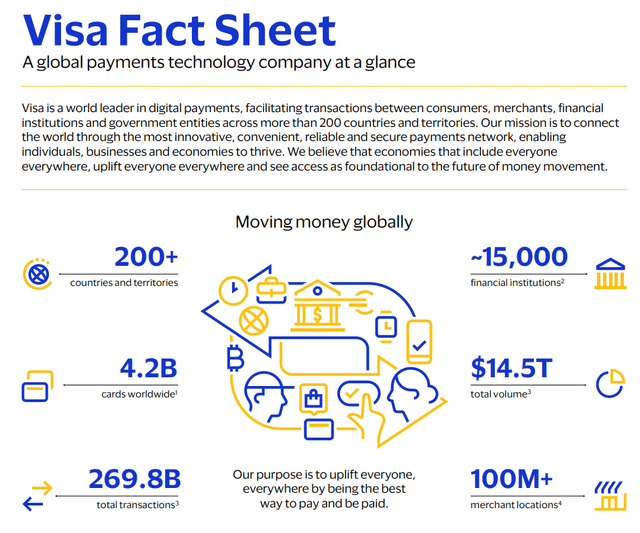

Visa Fact Sheet

On the high chance that you have a credit card or debit card, there’s just as high of a chance that you own at least one issued by your financial institution on Visa’s payment network. Via its network of more than 4 billion cards, Visa has processed a staggering $14.5 trillion in the trailing twelve months as of the fiscal third quarter ended June 30. For context, that means the company has processed nearly $500,000 in transactions on its network each second (details per Visa Fact Sheet illustrated above).

Through the first nine months of its current fiscal year, Visa’s net revenue has surged 11.7% higher year over year to $24 billion. Thanks to more individuals getting credit and debit cards and more merchants accepting Visa’s payment methods at their places of business each day, the company is growing in every aspect, creating a virtuous cycle of growth. That explains how Visa’s payment volume in constant currency dollars grew by 9% in the third quarter. The company’s cross-border volumes where the issuing country was different from the merchant country also rose by 17% during the quarter. And the number of processed transactions increased by 10% for the quarter.

Visa’s adjusted diluted EPS vaulted 15.6% higher over the year-ago period to $6.44 for the nine months ended June 30. And as has been the case for a long time, the company’s profitability stood out: For every dollar of net revenue to date, Visa converted a staggering $0.56 into adjusted net income. As the payment processor continues to grow in size and scale while expenses grow at a lesser rate than net revenue, profitability should remain just as strong in the future (all details and calculations in prior two paragraphs made from data sourced from Visa Q3 2023 earnings press release).

Risks To Consider

Of course, even the best businesses like Visa have their share of risks. In the near term, the company could be adversely impacted by a recession. Reduced consumer spending could pressure payment volumes, processed transactions, and international travel, which would lead to a deceleration in revenue and earnings growth for a while.

The only downside to Visa’s immense profitability is that it has garnered its share of scrutiny from regulatory authorities in the past. That’s why the possibility remains for potential regulatory action against the company, which could damage profitability.

Visa Is Undervalued For Its Fundamentals

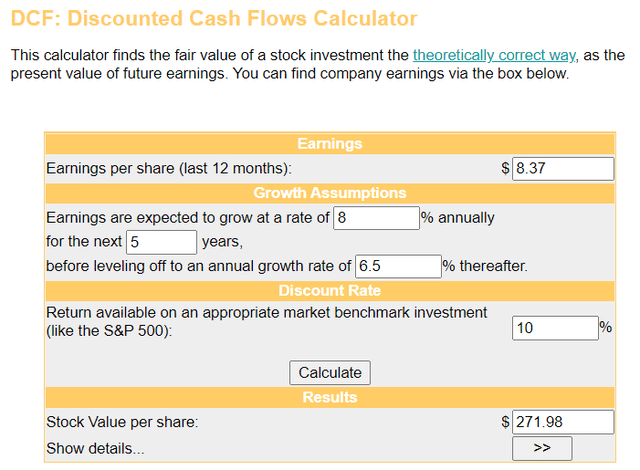

Even near its 52-week-high, shares of Visa look to offer value at the current share price of $246.31 (as of September 7, 2023). Based on my assumptions in the discounted cash flows model shown below, I reached this conclusion.

Money Chimp

The first input for the DCF model is trailing 12 months adjusted diluted EPS. This figure is $8.37 for Visa.

The second input into the DCF model is growth. For the sake of conservatism, I will assume 8% annual adjusted diluted EPS growth over the next five years – – about half of what analysts expect. I’ll then factor in deceleration to 6.5% annually in the years that follow.

The third input for the DCF model is the discount rate. This is simply the annual total return rate that an investor requires from their investments. Since I target 10% annual total returns, that is what I will use for this input.

Factoring these inputs into the DCF model, I get a fair value output of $271.98. This suggests that shares of Visa are trading at a 9.1% discount to fair value and could offer a 10.4% upside from the current share price.

And keep in mind that I intended to build an adequate margin of safety for dividend growth investors with a slant toward value. Visa could likely outperform these assumptions in the years to come. But at a minimum, I don’t see the company doing any worse than these expectations.

Summary: Sleep Well At Night Owning A World-Beating Stock

Visa has 14 years of dividend growth under its belt. The company’s payout growth is going to slow down a bit from its 10-year annual average 18%+ rate. But Visa can extend its dividend growth streak while still handing out strong raises.

And despite relatively cautious growth assumptions, the stock’s shares look to be priced near a double-digit percentage discount to my estimated fair value. Put Visa’s 0.7% dividend yield and low-teens annual earnings growth potential together, and you have the necessary components for healthy annual total returns moving forward. That is why I view the stock as one of the most compelling picks for dividend growth investors over the long haul.

Read the full article here