I understand that life can get busy. And when it does, your finances might not be top of mind. But part of being a diligent investor is keeping a close eye on your investments. This doesn’t mean that we need to look at our portfolio’s performance every single day. But it does mean that we should continue to monitor the fundamental health of the companies that we buy into so as to ensure that they still make sense to own. One company that is definitely worth revisiting is Watsco (NYSE:WSO) (NYSE:WSO.B), an enterprise that specializes in HVAC and refrigeration equipment, as well as other related offerings.

Since I last wrote about the company in June of this year, revenue, profits, and cash flows have shown nice signs of improvement. Much of that improvement came in the third quarter. Considering what is happening with the economy and the markets in which it operates, the year over year growth the company has exhibited is a bit surprising. In the near term, it certainly bodes well for shareholders. But it doesn’t necessarily change my own stance on the company.

Back in June, because of how well shares had performed compared to the broader market and because the company was experiencing some weakness on its bottom line, I ended up downgrading it from a ‘buy’ to a ‘hold’. The stock has fallen about 2% since then compared to the 0.6% decline seen by the S&P 500. Despite the improved bottom line performance and the drop in share price, I still don’t believe that it is a prime time to jump in. But if subsequent quarters do show robust results, and if shares continue to lag the broader market, the company could make sense for value investors in the not-too-distant future.

Recent performance is heating up

The third quarter of the 2023 fiscal year for Watsco was rather interesting. Revenue for that time came in at $2.13 billion. That represents an increase of 4.5% compared to the $2.04 billion generated one year earlier. The company was certainly aided in this growth by the addition of new locations in operation. This time of 2022, the firm had 675 locations running. That number has now grown to 691 as of the end of the third quarter. Over 100% of this growth came from acquired locations since the number of locations closed outpaced the number opened. But this wasn’t entirely responsible for the higher sales. The company also reported an increase in same store revenue of 3.6%, or $73.9 million. HVAC equipment sales, excluding acquisitions, came in particularly strong thanks to higher demand for residential products. International markets performed particularly well, with demand shooting up 15% year over year. And commercial HVAC equipment revenue jumped 14%.

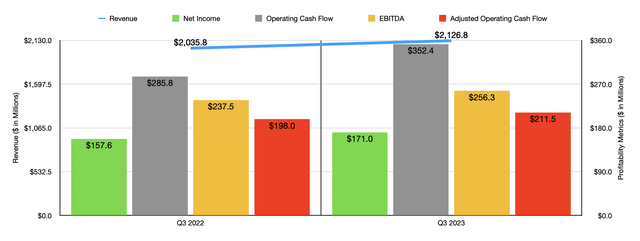

Author – SEC EDGAR Data

The increase in sales for the company brought with it higher profits as well. Net income shot up 8.5% from $157.6 million to $171 million. Although the increase in revenue certainly helped, the company also benefited from some margin improvement. In particular, selling, general, and administrative costs fell from 15.8% of revenue to 15%. Management attributed this performance improvement to improved operating efficiencies. But beyond that, they did not delve into the details all that much. Other profitability metrics followed a very similar trajectory. Operating cash flow, for instance, grew from $285.8 million to $352.4 million. If we adjust for changes in working capital, we get a more modest rise from $198 million to $211.5 million. And finally, EBITDA for the company increased from $237.5 million to $256.3 million.

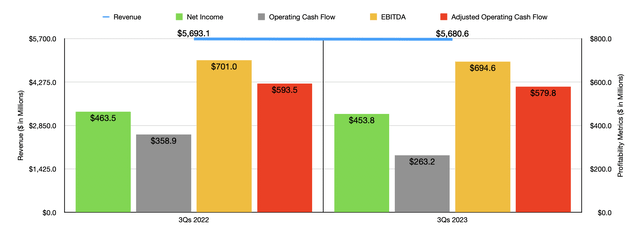

Author – SEC EDGAR Data

To investors who are more accustomed to companies that achieve rapid expansion, these improvements may not seem all that impressive. But when you look at how the company performed for the first nine months of 2023 in its entirety compared to the same time last year, you might have a better appreciation for matters. As you can see in the chart above, even with the strong performance in the third quarter of this year, revenue dropped year over year, declining from $5.69 billion to $5.68 billion. This week Ness came entirely from a decline in same store sales amounting to $36.6 million. According to management, the same areas that were a strength for the company in the third quarter were a weakness for it for the most part year to date.

This weakness on the top line also resulted in weakness on the bottom line. Net income fell from $463.5 million to $453.8 million. Operating cash flow fared worse, dropping from $358.9 million to $263.2 million, while the adjusted figure for this fell from $593.5 million to $579.8 million. And finally, EBITDA for the firm managed to fall from $701 million to $694.6 million. To be honest with you, weakness is not particularly shocking to see at this point in time. I say this because between 10% and 15% of the revenue the company generates in any given year comes from new residential properties being built. At the same time, it might be surprising to see the strength experienced during the third quarter. But as I wrote in prior articles like this one and this one, the home building market has started to see a recovery even though interest rates are at the highest point that they have been in well over 20 years now. So this likely is in reaction to that.

As for what the future holds, my guess is that the final quarter of this year will be stronger than the final quarter of last year. But even if we assume that financial performance will match with what the company saw in the first nine months of this year relative to the same nine months of last year, we would expect net profits for 2023 of $588.6 million. Adjusted operating cash flow would be $751 million, while EBITDA would come in at $854.9 million.

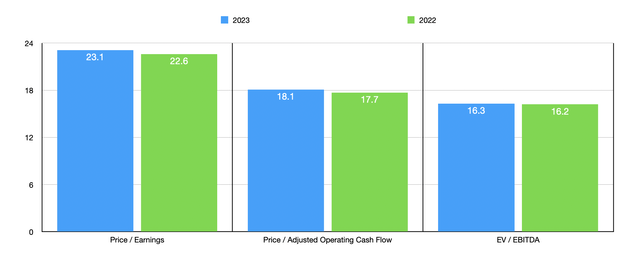

Author – SEC EDGAR Data

Using these figures, I was able to value the company as shown in the chart above. As you can see, the stock does look a bit more expensive on a forward basis than if we were to use data from last year. But the divide here is not terribly significant. I also compared the company to five similar firms. These can be seen in the table below. On a price to earnings basis, two of the five companies were cheaper than Watsco. This number increases to three of the five on a price to operating cash flow basis. And when it comes to the EV to EBITDA approach, I found that three of the companies were cheaper than it, while another was tied with it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Watsco | 23.1 | 18.1 | 16.3 |

| Comfort Systems USA (FIX) | 23.4 | 11.2 | 15.0 |

| SPX Technologies (SPXC) | 72.8 | 143.3 | 30.1 |

| EMCOR Group (EME) | 18.4 | 13.7 | 10.7 |

| CSW Industrials (CSWI) | 27.3 | 17.2 | 16.3 |

| Carlisle Companies (CSL) | 18.7 | 11.2 | 11.8 |

While understanding relative pricing is important, I also wanted to see if there is any sort of relationship between the companies when it comes to quality. The management team at Watsco pegs the company as the largest seller of HVAC systems in the country. In fact, it claims that, as measured by revenue, it’s more than twice as large as the next largest player. But size does not always equate to quality.

| Company | Net Profit Margin | Operating Cash Flow Margin | ROE | ROA |

| Watsco | 8.1% | 6.6% | 27.8% | 14.6% |

| Comfort Systems USA | 5.8% | 12.0% | 26.6% | 9.2% |

| SPX Technologies | 1.8% | 3.3% | 7.9% | 1.3% |

| EMCOR Group | 4.5% | 6.1% | 26.6% | 8.8% |

| CSW Industrials | 13.4% | 21.9% | 18.8% | 10.2% |

| Carlisle Companies | 12.8% | 21.0% | 25.1% | 10.8% |

In the table above, for instance, you can see four key profitability metrics for not only Watsco but also the similar firms that I compared it to. The net profit margin of Watsco ended up being higher than three of the five companies that I compared it to. However, this number drops to two of the five when using the operating cash flow margin. Five of the six companies have very similar return on equity measures. And on that basis, our prospect came out in the lead. The same can also be said of the return on asset approach. What this suggests to me is that, at least relative to assets and net assets, Watsco has demonstrated itself to be a higher quality prospect than its peers. But that picture does look different, placing it in the middle of the road, when it comes to profitability margins.

Takeaway

All things considered, I still do believe that Watsco is an interesting company with attractive potential in the long run. In some respects, it is superior to other similar companies. But I wouldn’t say that it’s superiority is great enough to justify such lofty multiples when it is trading at levels that place it in the middle of the pack from a valuation perspective. The valuation of the company is also a bit lofty on an absolute basis, even for such a quality operator that has cash in excess of debt that totals $56.8 million. Given all of these considerations and in spite of the fact that the company continues to grow by means of acquisition, namely its most recent purchase for an undisclosed sum that will bring in $180 million of additional revenue per year, I do think that there are better places to allocate money at this time.

Read the full article here