Overview

This is now the second weekly update on insider trades we have posted and we plan to continue posting weekly going forward. Last week we discussed three companies. Energy Transfer LP (ET) which has been widely discussed on Seeking Alpha now for a number of months and has been mentioned several times in other insider related articles we’ve written per Chairman Kelcy Warren’s relentless buying spree. Cassava Sciences (SAVA), which has risen as much as 23% since last Friday and continues to be a regularly discussed stock on r/Wallstreetbets. The ticker has been mentioned 101 times on the forum since Monday the 28th. Lastly was PENN Entertainment Inc., which was bought by one of its own directors shortly after agreeing to license its Barstool Sportsbook rights to ESPN for $2 billion.

Sirius XM Holdings Inc (SIRI)

This week on Monday we tracked the first insider purchase, outside of its ownership group Liberty SiriusXM Group (LSXMA), at SIRI since 2008. The CEO, Jennifer Witz, of the massive broadcasting corporation bought 250,000 shares for just more than $1 million. The filing states she paid around $4.10 a share. The purchase becomes all the more notable when we recall back in July shares were halted for volatility several times as the result of a short squeeze; more than 200 million shares were sold short. This likely stemmed from the potential arbitrage opportunity on Liberty Media’s tracking stocks. They own significant stakes in Formula One Group (FWONA) (FWONK), SIRI, and the Atlanta Braves which they recently spun off into the ticker (BATRA). In short, traders were hedging their LSXMA positions by shorting SIRI and it caught up to them in July. Now that the dust has settled, shares trade at prices nearly identical to those from early July, around $4.50 to be precise. Short squeeze aside, the company’s financials are strong and investors have been without an earnings shocker for quite some time. The last quarterly report that revealed double digit YoY revenue change was Q2 2021. That being said following their most recent earnings on August 1st, shares slipped as much as 18% until the CEO made her purchase, which has since given shares a near 10% boost. SIRI’s Q2 report this year did show investors the first YoY decline in revenue since 2020.

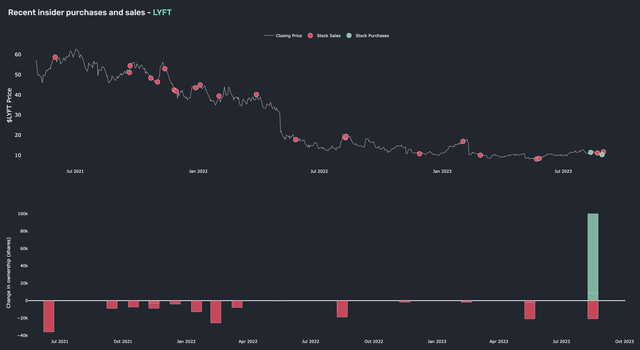

Lyft, Inc. (LYFT)

Since introducing their new CEO David Risher in April, shares have risen close to 20% thanks in part to his own purchase of 100,000 shares back on August 11th. This week it was a director that bought shares of the ride share company, 96,900 to be exact for around $1 million as well. Since the company IPO’d in March of 2019 the stock price has fallen 82% and if the chart below is any indication, insiders have shared the same sentiment as the market. The numbers make it even a bit more alarming. To the $3,852,049 that insiders have bought since the IPO they have sold just about a million shy of half a billion dollars’ worth of their own stock. At today’s valuations that’s more than a tenth of the entire firms worth. On the flip side, since LYFT closed at an all-time low of $7.99 a share in late May, shares are up more than 50%, revenue is on pace to grow by a slight margin of about 6% YoY reliant on no surprises in Q3 and Q4 earnings reports, and aside from a lingering cash burn problem the company’s balance sheet is actually quite strong. They have around $1.7 billion in total cash and investments to around $1 billion in total debt. In an unrelated note the firm is on pace to spend a near record $1.7 million on corporate lobbying expenditures this year. Spending has been across a number of issues but here is look at one of their largest more recent expenditures.

Lyft Insider Trades (Quiver Quantitative)

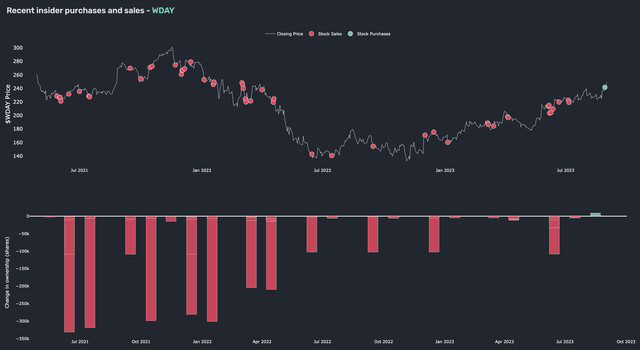

Workday, Inc. (WDAY)

Workday has been an absolute winner of a stock pretty much all year and some; YTD returns equate to 46% and 1Y returns to 54%. The CEO seems to think there’s more to come seeing he bought 8,767 shares for just more than $2 million on Tuesday the 29th. It’s the first insider purchase at the company since 2019 and just the fourth since 2013. Similarly to LYFT, the ratio of insider sales to purchases is alarming to say the least. The company is a cash cow with YoY revenue growing at double digit rates for a decade now but profitability still has not been an attainable goal for the software and cloud applications firm. They did just report their first positive GAAP EPS (0.30) since Q3 of 2021 however and while still negative, the TTM EPS has been steadily rising for the entirety of the year. Forward looking EPS comes in at 5.57, which if true this time next year these insider purchases could be extremely well timed. 2023 GAAP EPS for WDAY are -1.44 so that would indicate quite the turnaround.

Workday Insider Trades (Quiver Quantitative)

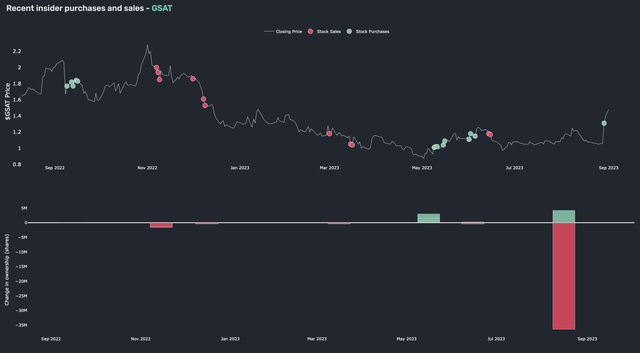

Globalstar, Inc. (GSAT)

The mobile satellite services provider that has been associated with and backed by Apple (AAPL) just finished a $64 million deal to use SpaceX launch technology to send their own satellites into orbit. Just prior, on the 29th, the Chairman of the Board of Directors, James Monroe, bought $4.7 million worth of stock. His filing shoes he bought just shy of 4.2 million shares at $1.13 a share. He actually made his trade on the day GSAT gapped up more than 30% on news the firm would be appointing former QUALCOMM (QCOM) CEO, Paul Jacobs, would be taking the helm at GSAT. This certainly adds an extra dose of conviction. To add to that conviction we would note that Mr. Monroe has now spent more than $10 million this year buying GSAT stock although he is the only insider to have bought in that span. Both Seeking Alpha analysts and Wall Street analysts are found of the stock rating it 4 and a 4.5 despite not posting a positive annual EPS since 2019 although revenue has grown 40% YoY. The revenue increase is largely in thanks to proceeds from services rendered to AAPL who use their satellites to give iPhones the ability to make emergency texts and calls. Thanks to the number of recent catalysts GSAT is now up about 13% YTD and close to 40% in the last month and today can be bought around $1.48 a share. For Monroe that’s already a 30% gain on his $4.7 million investment.

Globalstar Insider Trades (Quiver Quantitative)

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here