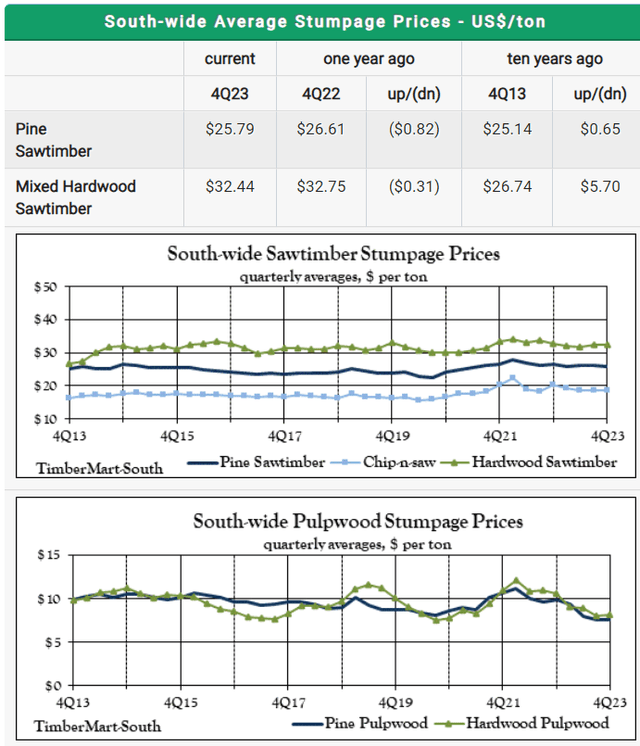

While land is an inherently limited resource, timber has largely been oversupplied in the U.S. due to government incentives put in place long ago encouraging farmers and other large landowners to plant forests, particularly in the South. The forests planted in these incentive programs have been reaching maturity in the last decade resulting in an oversupply of timber and consequently low timber pricing. Note the TimberMart-South data showing pine sawtimber pricing about the same as 10 years ago.

TimberMart-South

Mixed hardwood sawtimber is up modestly over the 10 year period and pulpwood is actually down significantly. Overall, I think it is quite clear that timber pricing has not kept up with inflation and this is largely due to the aforementioned oversupply.

Lumber, however, has been much more favorably priced. For clarity, here is the difference between timber and lumber:

Pinterest

The timber real estate investment trusts, or REITs, have seen fairly weak profitability from their timber segments, instead deriving the bulk of their EBITDA from wood products. Vertical integration allowed Weyerhaeuser Company (NYSE:WY) and Potlatch (PCH) to use much of their timber internally to make lumber and engineered wood products which have had much stronger profit margins.

Lumber prices have generally risen over the past 10 years, with extraordinary spikes in 2021 and 2022.

Tradingeconomics

The incredible pricing of those 2 years produced billions of extra EBITDA for sawmills, allowing WY to issue a massive special dividend.

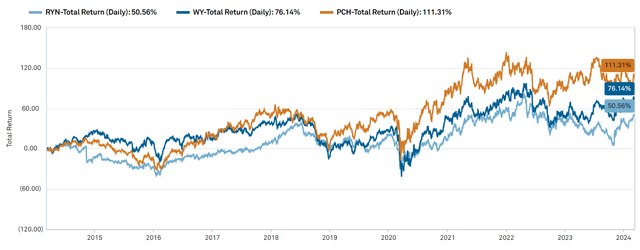

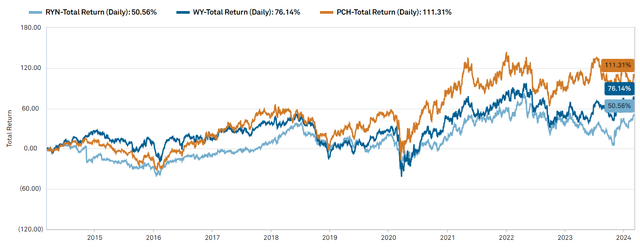

10 year returns for the timber REITs have been correlated to how exposed they are to lumber rather than timber.

S&P Global Market Intelligence

Potlatch was the top performing timber REIT of the last decade. Having acquired Deltic, which was a mill-focused company, Potlatch is the most leveraged to lumber prices and has been able to use the majority of its timberlands for internally supplying its mills and capturing the nice margins from the moderate to high lumber pricing.

With 35 sawmills valued at over $10B, Weyerhaeuser has the largest wood products segment, but the company is so huge that it is not as high of a percentage of the company as it is for PCH. PCH is approximately ½ mills by enterprise value while WY is just over 1/3. As such, WY was able to enjoy the EBITDA growth of the robust lumber pricing, but did not benefit as much in percentage terms as PCH.

Rayonier (RYN) used to have significant vertical integration of its pulp production through its fiber segment. However, they spun off the fiber into Rayonier Advanced Materials (RYAM), making RYN a pure-play timberland company. With only a 50% total return over the past decade, RYN was the worst-performing timber REIT. It makes sense as timber was materially oversupplied in the past decade, particularly in the U.S. south where RYN owns the bulk of its land.

From a positioning standpoint, the timber REITs can be thought of as follows:

- PCH EBITDA comes largely from lumber

- WY vertically integrated mixed between lumber and timber

- RYN EBITDA comes from timberland.

While the performance of the past decade was directly correlated with exposure to sawmills, investing is about looking forward and the fundamental outlook has changed. In the following sections we will discuss forward fundamentals for lumber/wood products and timber.

Lumber and wood products outlook

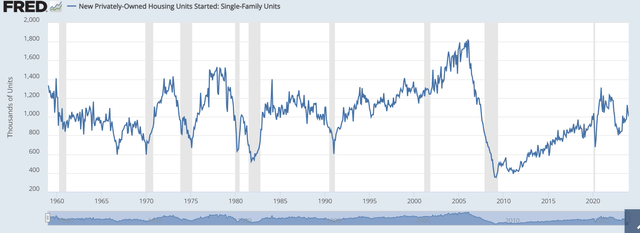

While commercial real estate uses some wood, much of the framing is done with metal. The bigger wood user is single family homes, which have been materially undersupplied in the past 19 years.

FRED

Following the financial crisis, supply of new homes has been muted, amassing what is estimated to be a 7 million home deficit. Over time, it strikes me as likely that the deficit will be made up in addition to the roughly 1 million new homes per year required to replace expiring inventory and keep up with population growth.

As such, demand for lumber for homebuilding should be slightly stronger than historical norms.

The other major contributor to demand is repair and remodel which is actually nearly as large of a driver as the construction itself. Repair and remodel demand is mostly driven by home transactions. Those moving out use repair and remodel so as to make the home more salable and those moving in customize the space to their liking.

Repair and remodel demand has been muted as of late due to the dearth of housing transactions resulting from the spike in mortgage rates. Those sitting on a 2% mortgage are hesitant to move as that would mean going to a 7% mortgage. Thus, many have chosen to remain in place.

Over time, consensus suggests mortgage rates are likely to come back down to maybe 6% and even if they do not, the mere passage of time will make higher mortgage rates more acceptable. In other words, 7% mortgage rates are not stifling home transactions because 7% is inherently high, but rather because 7% is high relative to where mortgage rates had recently been.

After being in the 5%-8% range for a few years, mortgage rates will no longer discourage transactions.

Overall, lumber and wood products demand looks healthy going forward. Homebuilding is likely to pick up to make up for the undersupply and repair and remodel demand should recover as transaction volume returns toward the mean.

On the supply side, there have been a couple of key mill closures lately, which is keeping supply in check. Supply can change rather quickly due to the ability to run multiple shifts at the same mills. For now, supply seems moderate and I anticipate it will roughly keep pace with demand. Lumber prices are stable in the mid to high $500 per thousand board feet range and are projected to slowly move up over time.

Timber and timberland outlook

The timber and timberland side is where the greatest changes are happening. We are moving from a decade of oversupply to long term undersupply. Multiple new sources of land and timber demand have popped up which are both creating new revenue streams and reducing competing supply. The biggest factors are:

- Continued real estate sales (higher-better-use or HBU)

- Solar conversions

- Carbon Capture and Storage ((CCS))

- Biofuel (pulp demand).

The net result of these factors is going to be less timberland supply and more demand for timberland. It will take time, but I believe the sector is heading for secular undersupply.

There is one directional movement in the use of land away from timber.

- Timberlands get converted into real estate development, but it would be quite anomalous for developed land to be converted back into timber.

- Timberland is increasingly being used for solar energy generation, but nobody tears down solar panels and restores the land to timber.

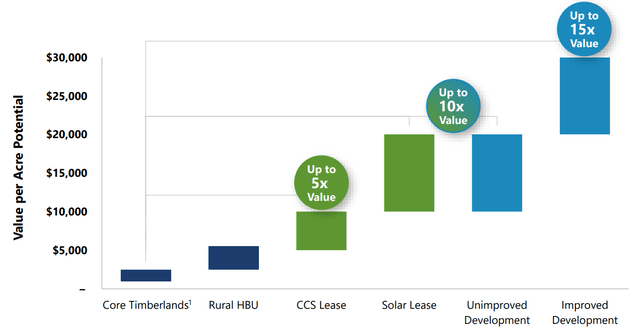

Economics are the key driver. Land is simply more valuable when used for a different purpose and less valuable on a per acre basis when used for timber. Rayonier quantified the valuation delta below:

RYN

Timberland is only worth about $2K per acre (varies by location) while land can be worth vastly more than that when used for other purposes.

Each year, as cities expand, formerly remote timberlands become proximal to population centers, which makes the land valuable for real estate development. Most of the timber REITs sell off approximately 1% of their land for HBU each year. At the timber REIT level, that land is replaced as they routinely acquire timberlands from other owners. However, the acquired land was already being used for timber so overall it represents a net reduction in timberland.

The loss in timberland per year is not all that huge, but since it is only moving in one direction, the cumulative negative supply over time is quite substantial.

To get a sense of the scale of this turnover, let’s look at RYN’s HBU sales in the last 10 years.

RYN sold an aggregate of 588K acres at an average price of $3231 per acre. Beyond the gain on sale, this is a seemingly permanent removal of 588K acres of supply. Similar proportional sale volumes could be found at the other timber REITs.

HBU has been a source of negative supply for a long time and will continue to be. Alone, it would take quite a while to create an overall undersupply of timber, but an inflection point appears to be near as new sources of negative supply are ramping up quickly: carbon capture and solar land use.

I understand that carbon and solar are politically charged subjects. I ask that you set aside biases either for or against these things as this article will be focused exclusively on the financial impact for the timber REITs. Our thesis does not require that you care about carbon in any way, nor does it require a particular political party to be in power for the financial benefits to accrue to the timber REITs.

Solar – negative supply of timberland

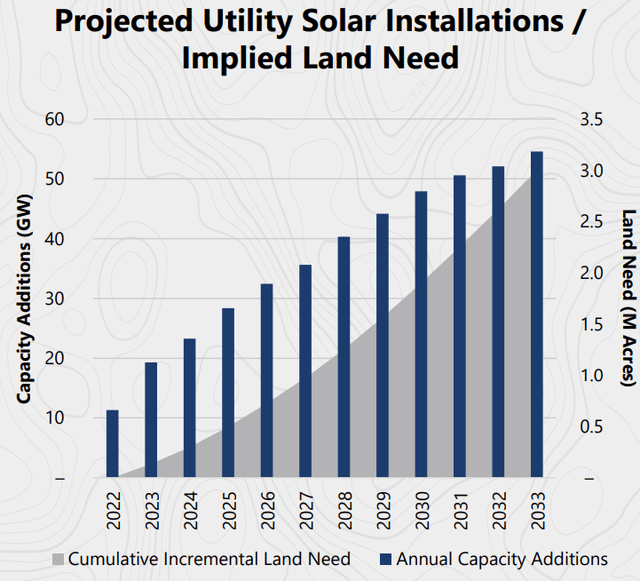

All forms of energy generation have advantages and disadvantages relative to other forms. Solar has recently become economically efficient in terms of MW per dollar. It is, however, very land greedy. Each MW of solar power generation requires about 7 acres of land. As demand for power continues to increase, an estimated just over 3 million incremental acres of land will be needed in the U.S. for solar use.

RYN

To put that into perspective, Rayonier has 2.7 million acres.

That is quite a bit of potential negative supply of timberland. Additionally, the unit economics are quite compelling for the timber REITs.

Why utilities rent from timber REITs

Timberland along with ranchland, is the lowest cost source of land. Utility scale solar is most efficient when the land is contiguous, so it requires vast plots of land.

Buying or renting from small landowners can be tricky as it would require cooperation among dozens of parties, so it is usually more efficient to buy/rent from land owners that own vast plots of contiguous land. That makes timber REITs ideal counterparties for the utilities.

Unit economics of timberland rented for solar

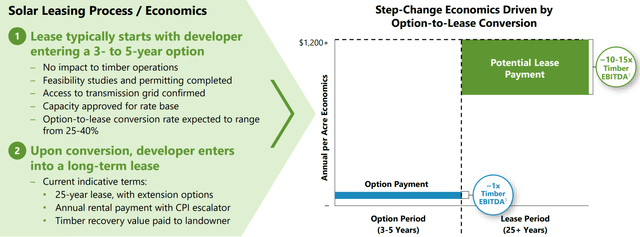

Here is how solar leases typically work:

RYN

Timberland operated as timberland generates about $80 of EBITDA per acre per year. In renting land on which to install solar, utility companies will pay about $80 per acre to hold that land as an option for development. During this time, the timber REIT can still grow and harvest trees so that is effectively doubling the EBITDA per acre.

Once the utility gets approval for the project and decides to go through with it (RYN says 25%-40% of options commence) the standing timber is fully cleared and the land can no longer be used for timber. Instead, the REIT receives annual rent per acre of $800 to $1200, usually on long term contracts.

For land that is currently valued at less than $2K per acre, that is remarkable EBITDA generation. Since the timber REIT is merely leasing the land and the utility does the operations, the rent is almost 100% margin.

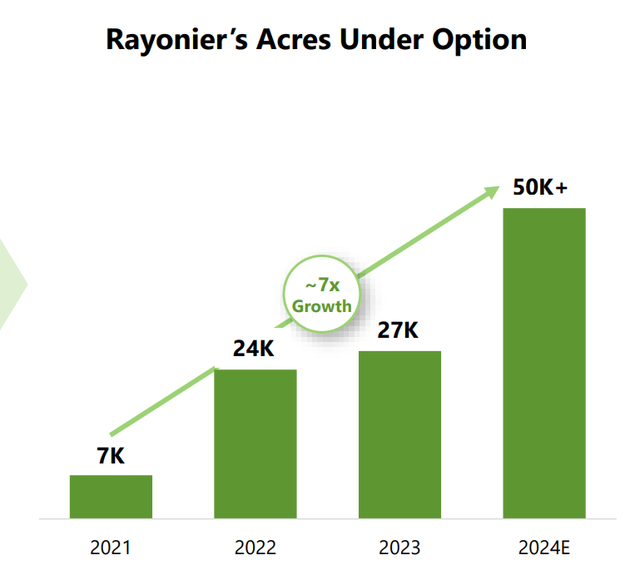

By the end of 2024, RYN expects to have 50K acres under solar option.

RYN

Carbon offsets and carbon capture in timberland

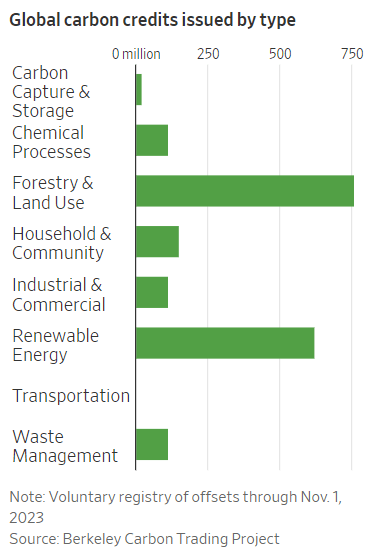

Timberland is already the largest provider of carbon credits globally with over 750 million credits issued. It is even outperforming renewable energy for carbon credits.

WSJ

There are 3 main ways in which forests are used for carbon mitigation:

- Offsets via agreements not to cut

- Carbon removal via growth of forest from clear cut start

- Carbon sequestration.

The economics of each is quite enticing for timberland.

Offsets are the weakest form and not as broadly recognized in the U.S. because there is some chance the trees were not going to be cut anyway and thus it is questionable whether anything was offset. So while offsets are massive globally, I do not anticipate a significant future for offsets in the U.S.

Removal is cleaner to measure and thus supported more broadly. Freshly cleared timberland has essentially 0 carbon stored in above ground tree mass, so as trees are grown on the land, the current mass lends itself to precise calculation of how much CO2 was removed from the atmosphere. Precise calculations facilitate precise negotiations as to how much the forest owner gets paid as compensation for the removal. Generally, the payer will be some larger company seeking carbon credits for ESG purposes or to meet regulations as to how much they are allowed to emit.

Going forward, the magnitude of timberland used for carbon removal via fresh tree growth will depend on how the price of carbon compares to the value of timber. At current U.S. carbon prices, the EBITDA per acre is approximately the same as using the land for regular timber use. If carbon prices rise, I anticipate a substantial chunk of timberland will be used in this way, functionally removing supply from the timber markets.

Outlook for carbon prices

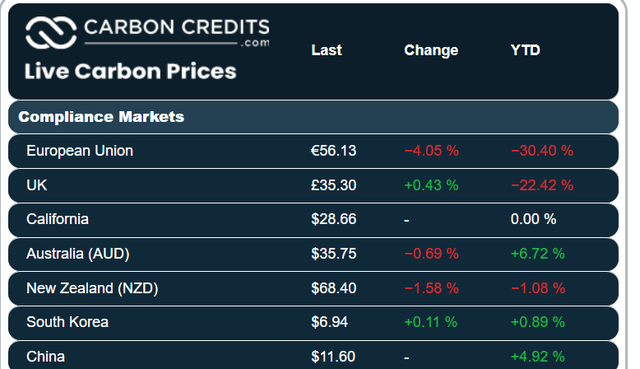

Carbon prices vary significantly by location. California has fairly low pricing at $28.66 per ton while Europe is just over double that figure.

Carboncredits

Consensus views on where carbon prices are headed unfortunately seem highly correlated to the political leanings of the source. As such, it is quite difficult to get a clean read on where carbon prices will be in 5 to 10 years.

Ultimately, it will come down to some mix of future scientific environmental consensus and weighted average political will. I’m not even going to attempt to predict that. There are just too many moving parts to have any reasonable precision.

From factual observation, carbon prices are volatile and I assume have the potential to be quite volatile going forward.

With regard to the financial impact on timber REITs, I view ownership of timberland as a call option on carbon pricing. If carbon prices drop to near $0 it has little impact on timber REITs because nearly all of their revenues are currently from the regular timber/lumber business.

However, if carbon prices rise closer to where they are in more established carbon markets like Europe, it dramatically increases the EBITDA per acre potential of U.S. timberland. Timberland has clearly become the most efficient way to mitigate CO2 on a mass scale and to the extent that there is demand it will become a major use case of timberland.

In fact, even with where U.S. prices are today, use of timberland to mitigate carbon is already showing up in a fairly large way through what is now termed CCS or carbon capture and storage.

- Rayonier has a large contract with Exxon Mobil (XOM)

- Weyerhaeuser has a large contract with Occidental Petroleum (OXY)

How do CCS contracts work?

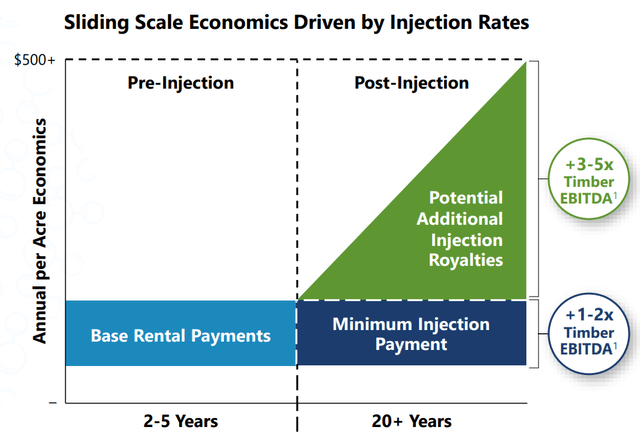

The actual terms of the contracts have not been publicly revealed, but Rayonier’s investor day presentation gave some good color as to how they work.

Similar to solar land rental, there is an initial setup phase in which the timber REIT gets $80-$160 per acre per year and then this ramps up once the energy company starts actually injecting CO2 into the ground.

RYN

One of the really nice aspects of this for the timber REIT is that the above ground footprint is minuscule so they can continue operating the land. Thus, it is once again additive margin increasing EBITDA generation of the contracted acres to 200% to 600% of its regular timberland EBITDA.

Douglas Long (EVP and Chief Resource Officer) of Rayonier anticipates 70,000 acres to be under contract by the end of 2024.

“With ExxonMobil, we now have over 59,000 acres under lease and current negotiations with our customers. We expect to have over 70,000 acres under lease by year-end with more in the pipeline.”

The economics of such deals are obviously beneficial to the timber REITs, so why do the energy companies agree to these deals?

Government regulations force energy producers to care about their net carbon emissions and the Inflation Reduction Act (IRA) economically incentivizes certain forms of mitigation. Exxon, Occidental and other large energy producers use a variety of methods, with CCS being one of the newer additions to their arsenals. CCS is efficient in situations where the right geological formations are proximal to existing CO2 pipelines.

Timber REITs are the ideal partners for this as they own large chunks of contiguous land in similar locations to energy production. Timber REITs also already have well mapped out subterranean configurations as they did the scans long ago for mineral rights.

Over time, CCS has the potential to be a massive revenue driver for the timber REITs and I think it is being entirely overlooked.

Market has not priced in CCS, solar or forward undersupply of timber

Reposting the same returns chart from above, I think it is obvious that there has not been an inflection point in the timber REIT market pricing.

S&P Global Market Intelligence

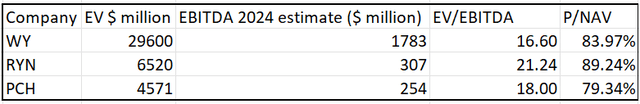

The market is pricing these REITs in a business-as-usual fashion. Multiples are slightly on the low end for the sector with EV/EBITDA ranging from 16.6X to 21.2X.

Data from company filings compiled by author

All 3 are trading at steep discounts to asset value.

Given the material changes to supply/demand outlook and the new opportunity in solar and CCS, I believe one of the following must be the case.

Either:

- The market is not aware of the fundamental and growth changes.

Or

2. The market does not believe it is real.

In other words, the market might think the industry chatter around CCS is all hype and not much will come of it.

Weyerhaeuser has been discussing opportunities such as their contract with OXY for a few years now but I think has struck the market as small in scale simply because of how massive WY is.

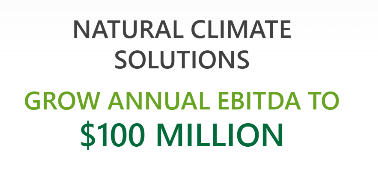

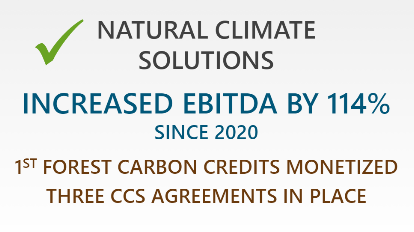

Based on contracts in place, WY has high visibility into near-term CCS earnings and put out a 2025 target of $100 million EBITDA annually.

WY

While that is a lot considering it is almost entirely additive to their normal earnings, as a $30B company it is only modest to the overall company.

It works out to be about $0.14 per share which would be about 10% growth to AFFO/share.

Longer term, I think 2025 is just the tip of the iceberg. It is a new business and growing at a startup style pace.

WY

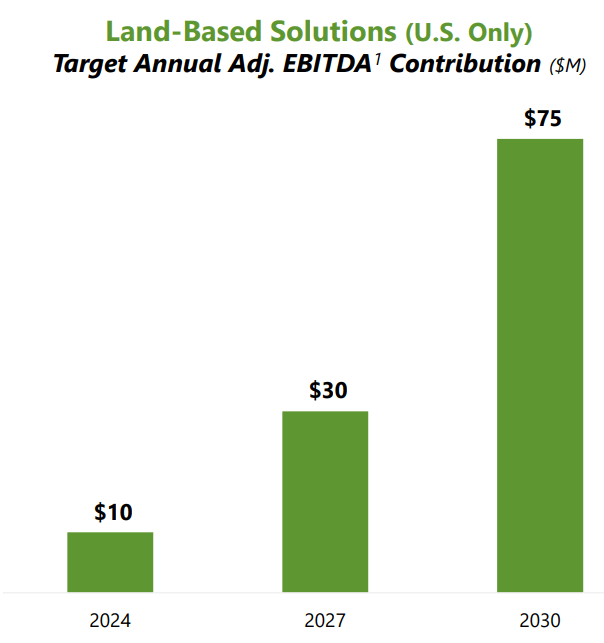

Rayonier put out a longer term target calling for $75 million annual EBITDA by 2030.

RYN

As RYN is a significantly smaller company, $75 million of incremental earnings from CCS and solar would be AFFO/share growth of about 40%.

All of this is additional growth on top of the regular timber/lumber businesses of the companies.

So far, the market is valuing these new segments at basically $0. I think that is a mistake and represents opportunity. They are already producing legitimate incremental earnings with revenues from strong counterparties like XOM and OXY. Depending on how CCS plays out over time, it could be a massive growth driver and purchase of timber REITs today functionally comes with a free call option on this potential.

Best timber REIT today

In my opinion, Weyerhaeuser presents the best overall opportunity. In addition to having the cheapest valuation on EV/EBITDA it has consistently been the best operated. Superior timberland and sawmill operations have resulted in the highest EBITDA margins.

Rayonier gets the most bang for the buck with regard to CCS as it is a pure-play timber company and its lands are mostly located in energy producing geographies. However, since its EBITDA production is otherwise less impressive, investors are not getting paid as much to wait for that opportunity to manifest. In contrast, with WY one gets a similar CCS upside option but is already today collecting sizable cashflows.

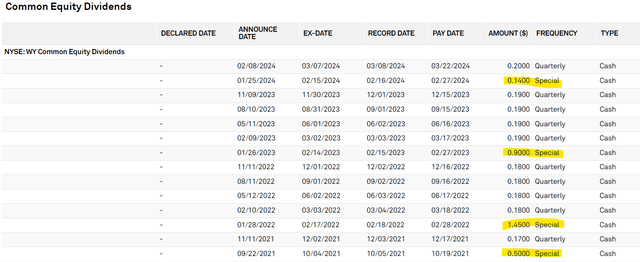

WY’s nominal dividend yield looks somewhat low at 2.3%, but their dividend is structured differently, providing much of its yield in the form of special dividends proportional to EBITDA generation of the particular year.

S&P Global Market Intelligence

Inclusive of special dividends and assuming flattish lumber pricing, I anticipate overall dividend yield for WY closer to 4%-5%.

Potlatch can be a good investment depending on one’s outlook for lumber prices. At stable lumber pricing using today’s level I find PCH significantly weaker than the other 2 REITs. It is very far behind on CCS opportunities and based on conference calls seem to have little interest in pursuing that angle.

The bottom line

Land is an increasingly scarce asset. Raw land ownership is problematic because of taxation and the lack of revenues to offset it, but through a well-run company like Weyerhaeuser Company one can invest in the upside appreciation of land ownership while also generating current cashflows through timber, lumber and leasing. I find Weyerhaeuser Company stock to be underpriced and compelling for long-term total returns.

Read the full article here