Investment Thesis

Whitecap Resources (OTCPK:SPGYF) did yesterday after the close report the Q1-23 result, and the company will have a conference call later today. These are my main takeaways from the quarterly report and my overall views on the company. I have covered the stock a few times in the past and those articles can be found here.

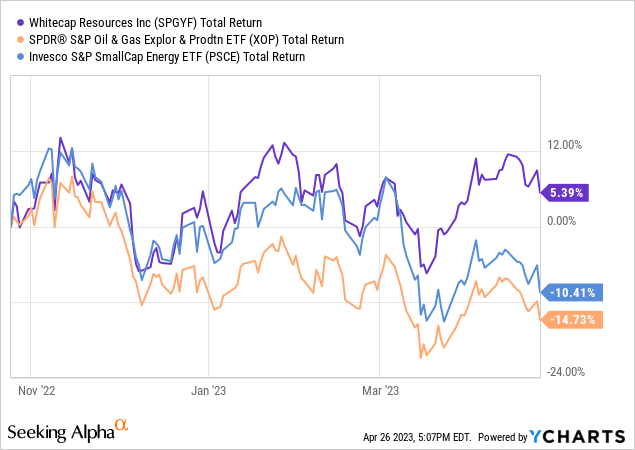

The stock price of Whitecap has had a good return over the last 6 months, where the successful integration of the assets from the XTO acquisition, an increased dividend, and divestments of some non-core assets have likely been some of the main drivers for the stock price.

Figure 1

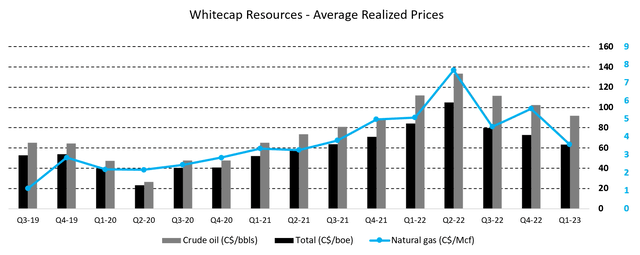

The company released a solid Q1-23 result, even though the sales price declined quarter-over-quarter and year-over-year. Natural gas prices specifically have been weak in 2023, but only 11% of Whitecap’s revenues in Q1-23 came from natural gas.

Figure 2 – Source: Whitecap Quarterly Reports

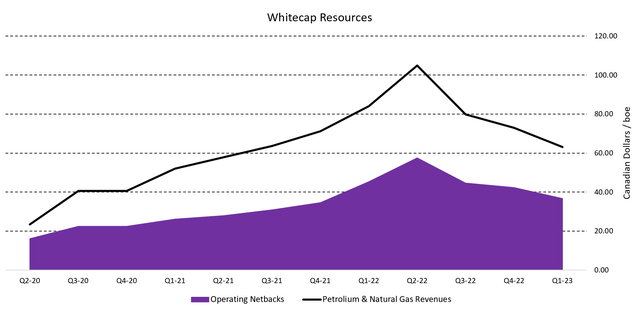

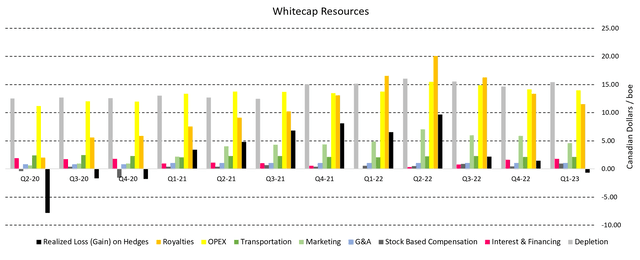

Revenues and cash flows are down from the peak quarters seen last year, but the company is still very profitable in the current energy price environment, with a netback of C$36.68 boe/d in Q1-23.

Figure 3 – Source: Whitecap Quarterly Reports

Q1-23 Result

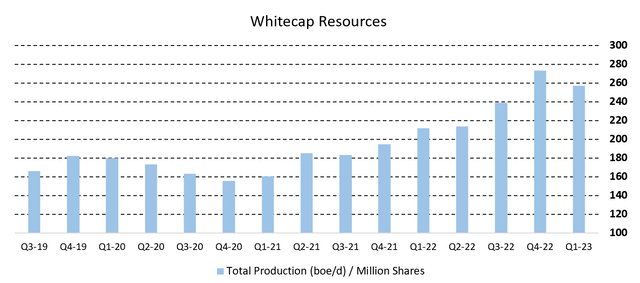

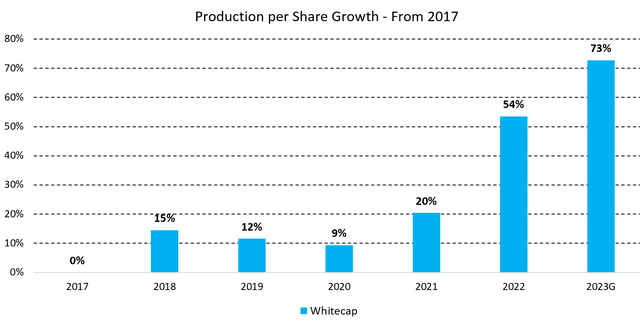

Whitecap did in Q1-23 produce 155,124 boe/d, which is slightly below guidance of 160,000-162,000 boe/d. However, the company confirmed that production will be tilted towards the end of this year, where production in Q4-23 is expected to average around 170,000 boe/d. The chart below of production per share continues to look very constructive due to a combination of the growth in production and the decrease in shares from buybacks.

Figure 4 – Source: Whitecap Quarterly Reports

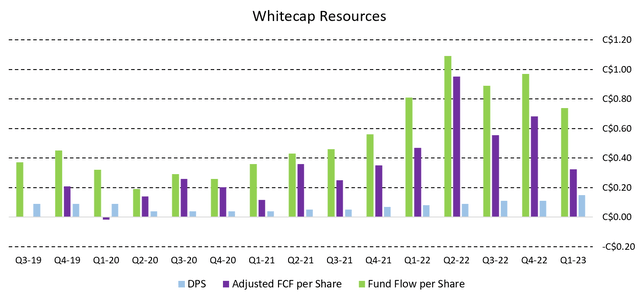

The company reported C$448M in funds flow during Q1-23 and C$194M in free cash flow, which translates to C$0.74 funds flow per share and C$0.32 in free cash flow per share. Where the added production from the XTO acquisition has to some extent offset the lower energy prices compared to last year. We can in the chart below also see that the dividend is well covered by cash flows.

Figure 5 – Source: Whitecap Quarterly Reports

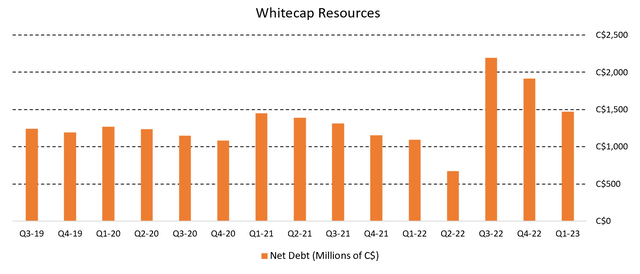

The net debt has in Q1-23 come down to C$1,471M. At these energy prices, we are roughly looking at C$200M in free cash flow per quarter. So, if the company uses all the free cash flow minus around C$87M in dividends per quarter, the company should reach the C$1.3B net debt target in Q3, provided nothing unexpected happens. The reason the net debt isn’t even lower is because Whitecap did also do C$33M worth of buybacks in the first quarter of 2023.

Figure 6 – Source: Whitecap Quarterly Reports

Once the net debt target is reached, it will lead to an increase in the base dividend. We are then looking at a dividend per share of C$0.73 per year, which comes to a 7.0% dividend yield using the latest share price. The company has at that point also committed to distribute 75% of free cash flow to shareholders in the form of buybacks and/or additional dividends. Buybacks would definitely be my preference and I expect that would be true for the company as well, at least in 2023.

When it comes to costs in boe/d, the floating scale royalties have naturally decreased YoY due to lower energy prices. Finance or interest expenses have increased due to a high debt load in the quarter, which the company is working hard to decrease, and higher interest rates. We did also see some minor hedging gains in the quarter, compared to more material hedging losses in Q1 last year. The remaining costs have otherwise been roughly in-line with what we saw in Q1-22.

Figure 7 – Source: Whitecap Quarterly Reports

Valuation & Conclusion

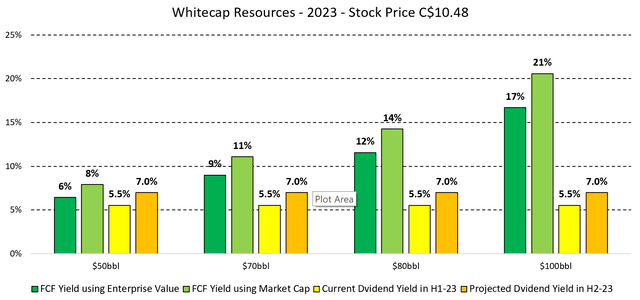

The below chart relies on the company’s latest estimates for free cash flow. Where Whitecap is presently trading with a FCF yield around 10-13% using today’s energy prices, somewhat dependent on whether we look at the market cap or enterprise value. Keep in mind that the difference between market cap and enterprise value will decrease during the year as Whitecap continues to deleverage.

Figure 8 – Source: Company’s FCF Estimates

This is in my view an attractive valuation for a quality oil producer, that offers high shareholder distributions, and has a proven track record of delivering profitable production growth over the long term.

Figure 9 – Source: Annual Reports & 2023 Guidance

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you like this article and is interested in more frequent analysis of my holding companies, real-time notifications on portfolio changes, together with macro and industry analysis. I would encourage you to have a look at my marketplace service, Off The Beaten Path.

I primarily invest in turnarounds in natural resource industries, where I have a typical holding period of 1-3 years. Focusing on value offers good downside protection and can still provide great upside participation. My portfolio generated a return of 81% during 2020, 39% in 2021, -8% in 2022, and is up 2% in March of 2023.

Sign up!

Read the full article here