Roughly 4 months ago I started covering Whitestone REIT (NYSE:WSR), which is a U.S. based equity REIT owning and operating retail centers (convenience focused) across the Sun Belt markets.

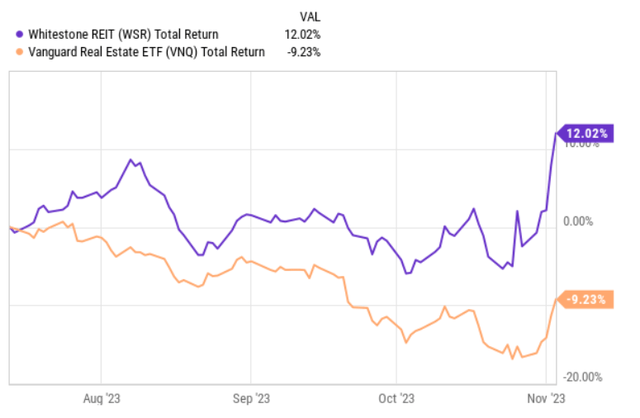

Ycharts

Since that time, WSR has outperformed the broader REIT market by ~20% on a total return basis. WSR has also delivered by ~7% better returns over the same period of time than its peers operating in the shopping center REIT segment.

When outlining my buy thesis on WSR, there were 5 elements, which supported going long:

- Improving balance sheet due to conservative FFO payout and well-balanced asset rotation strategy.

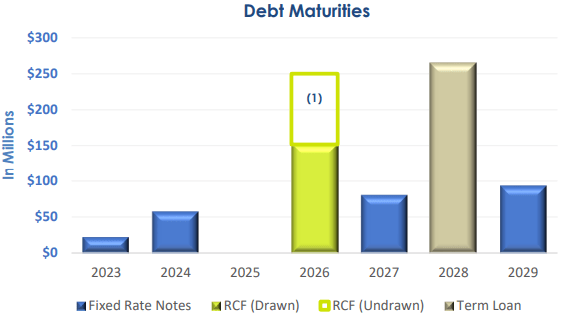

- Perfectly structured debt maturities with no major refinancings until 2026 that warrants time for the management to mitigate the refinancing risk and / or the impact of fixed rate debt repricing.

- Well-positioned portfolio in attractive Sun Belt markets, where the demand for convenience based retail properties is favourable and with positive growth prospects.

- Portfolio-wide diversification with assets being spread across different states, tenants, economic segments and having no notable single-tenant risk.

- Attractive valuation, which at the time of my first WSR article implied ~16% discount to the closest peers.

Almost all of the aforementioned points have played out nicely causing the valuation discount to narrow. Yet, the most important thing is that the underlying fundamentals have become stronger and have also clearly proved that there is an inherent value embedded in the portfolio.

Recently, WSR issued Q3, 2023 results, which one the one had have justified the recent price increase and on the other strengthen the bull thesis even further.

Q3 results in a nutshell

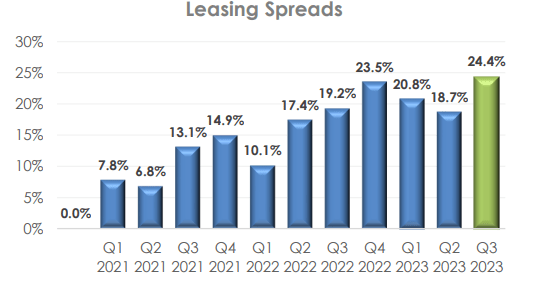

The single biggest driver of positive reaction by the market was the data on the leasing front. During Q3, 2023, WSR managed to register 24.4% in leasing spreads from which around 10.5% have directly fed into the cash generation.

WSR Investor Relations

As a result, the like-for-like NOI grew by 4.9% compared to the third quarter of last year, marking sixth consecutive quarter of a straight line leasing spread above 17%.

This is a clear sign that for WSR properties there is a strong and persistent demand despite the inflationary pressures on the consumers. We can also confirm this by looking at the occupancy ratio. WSR’s total occupancy in Q3, 2023 was 92.7%, which is by 20 basis points higher than in the third quarter of last year.

One of the key mechanisms how WSR manages to deliver consistently solid NOI growth is by having relatively short lease maturities. This was also confirmed by the Management during the most recent earnings call:

Our tenants can often fund operations out of cash and generally have very low working capital requirements as they’re service-oriented rather than being focused on hard and soft goods. We also believe that the shorter leases with less restrictive structures and are constantly reviewing the strength of our tenants allows us to stay ahead of the changes in the retail space, strengthening our position if there is a harder landing.

Currently, the weighted average remaining life of WSR’s leases is a bit under 4 years, which helps avoid locking in leases during the inflationary environment. It also helps WSR to consistently review its tenant profile to keep the overall tenant mix in line with the structural dynamics (e.g., align with the demand patterns, decrease dependency on specific sectors or tenants in a tactical and pre-emptive fashion).

An additional factor, which has made the market glad over WSR is the results on the balance sheet end.

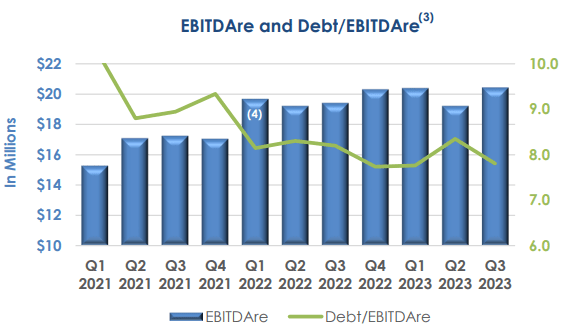

WSR Investor Relations

WSR ended the quarter with an improved leverage profile brining the debt to EBTIDA down below 8x. Considering the FFO payout level of ~50%, it is only obvious that the Company is able to gradually de-risk its balance sheet.

All in all, this is a great pattern and should help soften the potential consequences of first major refinancing in 2026 and then in 2028 (term loan).

WSR Investor Relations

As of now 86% of WSR’s debt is fixed providing stability on the FFO levels on a go forward basis. While the remaining debt maturities in 2023 and 2024 are relatively small and could be to a large extent handled by the internal cash generation, in year 2026 we could theoretically experience an unfavourable adjustment to the FFO due to freshly repriced / rolled over debt.

However, there are several mitigants for this that the investors should take into account:

- By retaining 50% of the annual FFO throughout 2024 and 2025, WSR should be able to partially delever, thus achieving smaller base of debt from which the new interest rates will be recalibrated.

- Given the recent dynamics and structural tailwinds for WSR’s Sun Belt convenience based properties, WSR should be able to generate incremental like-for-like FFO that should impact the leverage and coverage ratios positively.

- Until 2026 there is a plenty of time for the SOFR to go down or revert back to a more acceptable levels at around 2 – 3%.

- WSR carries an optionality to win a lawsuit against its former CEO that according to the Management has a great probability of going through successfully. If that happens, WSR would be able to access $51.2 million plus interest in damages, thereby finally monetizing its frozen JV stake. These proceeds would come in extremely handy in further deleveraging the balance sheet.

Lastly, despite the positive share price performance, WSR still remains undervalued. Currently, the Stock trades at P/FFO of 11.2x, which is ~12% below its sector average.

The dividend yield has reduced a bit landing at 4.4%, but in the context of 50% FFO payout ratio it could be safely deemed attractive.

Key risks

One of the key reasons why WSR is priced below the sector average is the exposure to potentially negative outcome from the lawsuit with the ex-CEO. According to the management, we should expect an outcome by the end of this year. In case of the loss, WSR would not only be able to monetize its ~$50 million stake and receive back legal costs, but also be subject to additional payments to the ex-CEO to cover the relevant damages. Here, it is difficult to estimate a concrete figure, but considering the accumulated costs of WSR that are linked to this trial, we could be speaking about a loss of one year’s FFO.

Obviously, if such scenario takes place, WSR’s share price would nosedive and the aforementioned path towards de-leveraging would take the opposite direction.

Then there is always a risk of the Fed Fund’s rate becoming more restrictive or remaining this high for a long period of time, stretching beyond the dates of first major debt refinancings. If WSR had to reprice the entire amount of debt that comes due in 2026 and 2028, interest costs would increase causing the share price to drop in a material fashion.

All in all, I think that these two risks are mitigated quite nicely. By looking at the lawsuit’s details it is rather obvious how WSR was hurt by the embedded poison pill. Plus, the commentary by the Management on the likely outcome has been rather optimistic over the past couple of earnings calls. The interest rate risk (higher SOFR for longer) is also well-managed due to WSR’s ability to accumulate cash (from 50% FFO payout) to retire some part of maturities and the potential to access additional funding from the monetization of its currently frozen joint venture.

The bottom line

Recently, WSR’s share price performance has exceeded the broader REIT market due to very solid dynamics in the underlying fundamentals. Double digit leasing spreads, consistently growing like-for-like NOI and gradual de-risking of the balance sheet have clearly justified the recent gains the WSR’s market cap levels.

Going forward, WSR remains a solid buy due to still existing discount to the peers and a portfolio that enjoys secular tailwinds and that at the same time is protected from the interest rate risk until at least 2026.

Read the full article here