Dear readers/followers,

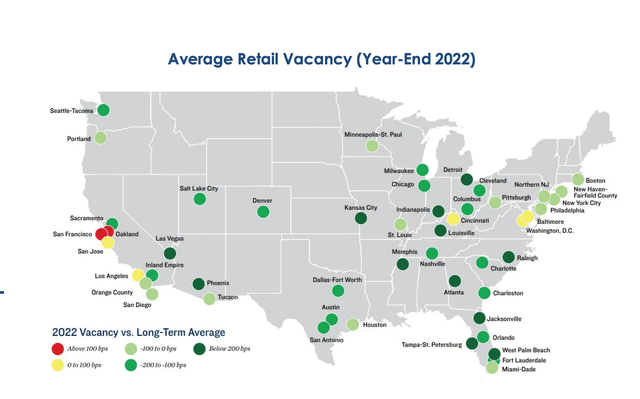

Today I want to cover a REIT which specializes on service-oriented strip malls in rapidly growing cities in the Sunbelt – Whitestone REIT (NYSE:WSR). The company owns and operates 57 properties located in Phoenix, Austin, San Antonio, Dallas, and Houston. Since location is everything in real estate, being located in areas that are experiencing both population and jobs growth is a major selling point for the company and has materialized into strong and accelerating rent growth. Whitestone also expects that their properties will continue to benefit from the work from home trend as people spend less time in offices and city centers and more time in their neighbourhoods shopping, eating and getting things done at strip malls.

Whitestone Presentation

Management’s strategy is to focus on smaller properties with service oriented tenants. Their in-house regional leasing teams focus on building a tenant mix that is both e-commerce and recession resistant. They have a very low number of big box tenants outside of grocery stores and mainly focus on restaurants, coffee shops, barbershops, nail salons, dry cleaning services, gyms etc. These are generally the types of tenants you want to have, especially in areas that are seeing rapid population growth, which makes Whitestone very well positioned.

Their tenant mix is well diversified, with no single tenant accounting for more than 2.2% of ABR and the top 10 tenants accounting for just 15% of ABR. It’s worth mentioning that one of the REITs tenants – Bed Bath and Beyond has recently filed for bankruptcy. When asked about it on the earnings call, management highlighted that (a) the company accounts for less than 0.5% of overall ABR and (b) that the impact is likely to be positive as it will allow the company to re-lease the space at a higher rent. I must say I agree with their assessment, especially on the latter point.

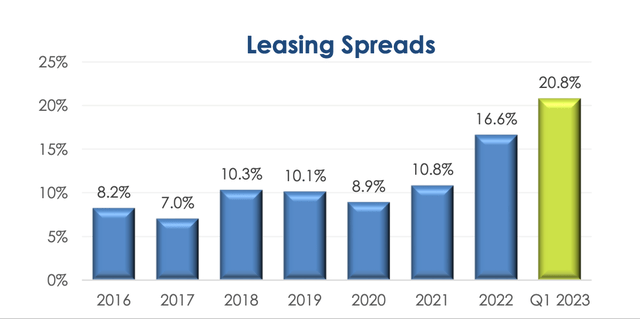

In fact raising rents on re-leasing is exactly what they have been doing very well for years. In contrast to other net lease REITs, WSR focuses on shorter-term 3-5 year leases which enables them to increase rents significantly above the average 3% build-in rent escalators and it provides great inflation protection as they’re able to capitalize on market rent increases sooner than peers with 8+ year WAULTs. Leasing spreads (aka the increase in rent on renewals and new leases) have reached 20.8% in Q1 2023 (13.3% on a cash basis). That’s about double the 10% average that we’ve been used to seeing from the company for years and is mostly attributable to inflation.

Whitestone Presentation

The flip side to the ability to raise rents faster, is that short lease terms put a lot more pressure on the leasing team to roll over leases frequently and may result in more volatile occupancy. Sure enough, occupancy dropped by 1 percentage point in Q1 to 92.7%, but is expected to end the year 94%.

Financials

Despite very good leasing spreads, during the first quarter the company saw their FFO per share drop from $0.30 to $0.24. A 20% seems scary at first sight, but it’s actually not as bad as it looks. Firstly, last year’s numbers included a benefit of $0.04 from forfeiture of restricted equity compensation stock as a result of employee terminations in Q1 2022.

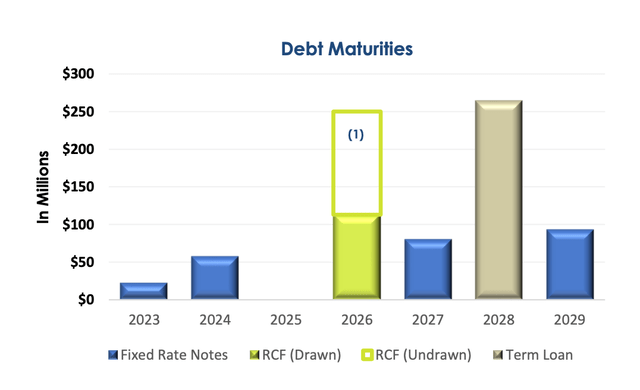

Secondly, abstracting from this one-off, FFO per share declined by just $0.02 YoY of which $0.04 were attributable to increased interest expense due to an increase of the variable rate on their credit line. The credit line accrues interest at SOFR+160bps and for the next few quarters it’s expected that it will continue to drive interest expense higher. For 2023 management expects to deliver FFO per share roughly in line with last year as NOI growth gets offset by higher interest.

Whitestone Presentation

To reduce interest rate uncertainty, on the last day of the first quarter, the company entered into an interest rate swap on $50 million of variable rate debt, reducing the portion of variable rate debt to 10% (i.e. the $63 Million drawn on the credit line). Part of the reason management entered into this swap is that they expect to refinance the roughly $20 Million debt maturity due in 2023 via their line of credit. Beyond that, there’s another $63 Million in maturities in 2024 that they’ll have to deal with. In total, leverage stands at 7.3x EBITDA which is definitely on the higher side when compared to peers, but has come down over the years and could go as low as 6.9x by the end of the year if management delivers on their guidance.

Whitestone Presentation

To sum up, before diving into the valuation, Whitestone has really good properties that will likely do well and will be resistant to headwinds that are currently hurting other REITs, namely e-commerce, work from home and a potential economic slowdown. The short duration leases enable the company to increase rents quickly in a high interest rate environment, but pose a risk of rising vacancy if leasing doesn’t deliver. The largest risk lies in the balance sheet as the REIT is quite heavily leveraged and its floating rate exposure, though small, has been negatively impacting their FFO per share, performance and will likely continue to do so for at the least a couple of quarter. Still I like the company a lot, especially at the right price.

Valuation

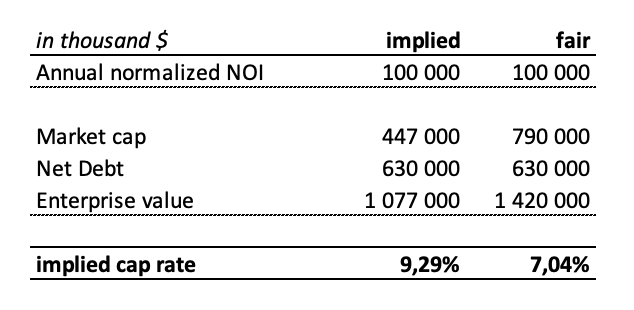

At $9 per share and assuming a normalized annual NOI of $100 Million (below annualized Q1 numbers and in line with management’s plan), the stock trades at an implied cap rate of 9.3%. Despite high leverage and a relatively high interest rate that the REIT pays on its debt of 4.87%, I consider this to be way too high given the quality of assets that WSR owns.

In Q4 of last year, the company managed to sell six of their properties for about $40 Million at a 5.6% cap rate. And notably, those properties were below average, in terms of both occupancy and rent per sft. Since then, cap rates have definitely widened (perhaps by 30-40 bps on average) and although there have been very few transactions during the first quarter, I’m confident in the fact that a 7% cap rate would still be a bargain for this portfolio.

Author’s calculations

Valuing Whitestone at a 7% cap rate implies a stock price of $15.80 per share, that’s 75% above the price today, and that’s using assumptions that frankly are still very conservative. Of course, the price won’t get to those levels without a catalyst. Beyond the obvious ones such as a rate cut, the small size of this REIT ($0.5 Billion market cap) could make it an interesting target for a buyout by one the bigger players. While we wait for the catalyst, we get to collect a $0.04 monthly dividend, which yields 5.3%.

The company is clearly trading at a massive discount to NAV and I really like its portfolio which enables it to grow internally at a rate that peers can only dream off, without the need to push for new acquisitions to fuel external growth. All things considered, I rate WSR a BUY here at $9 with a PT of at least $15 per share and will initiate a position in the stock soon after writing the article. Whitestone is also a part of our portfolio at High Yield Landlord, which I’m now happy to be part of.

Read the full article here