Introduction

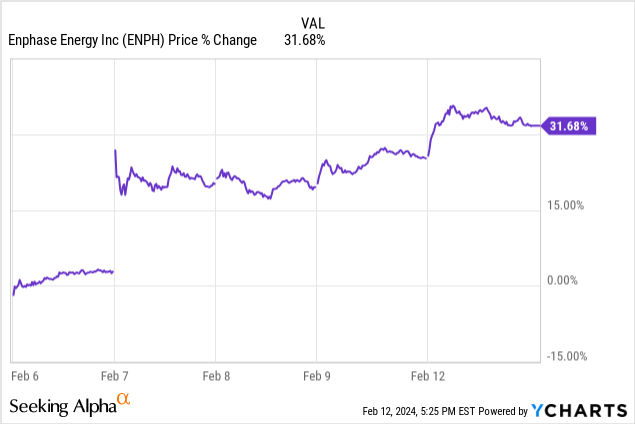

Last Wednesday, Enphase’s (NASDAQ:ENPH) results came out. To say they were ugly would be an understatement. Bad earnings, bad guidance, and still the stock jumped. The stock is now up 32% compared to last week.

The question is why, and that’s what we explore in this article. Let’s start with the results.

The Numbers

Revenue came in at $302.6 million, down 58% compared to the same quarter last year and a whopping 45% decline from Q3, which was also already a weaker quarter, with revenue down 13% YoY. And that was a quarter that underperformed the consensus as well, even though Enphase had already slashed its guidance after the second quarter.

In the US, revenue was down 35% quarter-over-quarter, while in Europe, it was down a jaw-dropping 70%.

The company missed its own guidance by 6.8% and the revenue consensus by 7.6% in Q4. Again, I should probably add.

Non-GAAP EPS came in at $0.54, missing the consensus by $0.01. Actually, the miss was less than a cent, so here you could say the company met expectations.

Guidance was also lower than the consensus. Again, I should probably add “again”. It stood at $316 million, and the company guided for $260 million to $300 million. At the midpoint, that’s 13% lower than the consensus and looking at the string of disappointments Enphase is making, we have to wonder if the company will meet its guidance in the current quarter.

The main reasons for the bad results and the lower guidance were the same as in the previous quarters:

…reduced shipments to manage high inventory at our distribution partners along with a further softening in demand.

Management also put a number out. CEO & President Badri Kothandaraman on the earnings call:

On our last earnings call, we said we would reduce channel inventory by approximately $150 million. We achieved a reduction of $147 million in Q4.

And the damage is not over yet. As you can see, the company guides for another 45% drop in the next quarter in the number of microinverters shipped.

We shipped approximately 913,000 microinverters to customers in Q4 from our contract manufacturing facilities in the U.S. (….)

We expect to ship approximately 500,000 microinverters to customers from our U.S. manufacturing facilities in Q1. We expect that our shipments from U.S. facilities will be lower in the first half of the year as we reduce both factory as well as channel inventory.

And the company will continue to push for efficiency:

We implemented a restructuring plan in December 2023 to reduce our operating costs and align our workforce and cost structure with current market conditions.

As part of the plan, we are reducing our global workforce by approximately 10% and expect to reduce our non-GAAP operating expenses to be in the range of $75 million to $80 million a quarter in 2024 when these restructuring actions are substantially complete within the first half of this year.

This shows two things: management’s determination to navigate this as well as possible, but also that the problems are real and have an impact.

Why is the stock up so much?

How can the stock of a company with such an awful quarter and even worse guidance for Q1 be up so much?

Well, let’s list some of the management quotes here.

We anticipate a higher level of shipments in the second half of the year.

(…)

Let me conclude, we have been managing through a period of slowdown in demand. We think Q1 could be the bottom quarter.

(…)

We expect sell-in numbers or our revenue numbers to go higher sequentially in Q2.

The word “bottom” was mentioned 10 times on the conference call, by management and analysts.

On top of that, there’s another reason and the main reason why I made Enphase my top addition (not position, mind you!) the day before the earnings. As I wrote to my Potential Multibaggers subscribers:

The Fed has said it will not cut rates in March, but I don’t think anyone doubts that there will be several cuts this year. And interest rates and residential solar power suppliers are reversely connected. The higher the interest rates, the lower the solar power demand and vice versa.

Couple that with the inventory pipes that are still very full at Enphase’s distribution partners and you get a perfect storm Enphase is going through.

With management repeating that Q1 could be the bottom, the market turned positive, especially when coupled with inevitable rate cuts. Hence, the big surge. For once, the market appears to be looking beyond the next quarter.

Other Interesting Points

I want to emphasize a few other items as well.

Let’s start with something important: the balance sheet.

Despite the big drop in revenue, Enphase remained free cash flow positive and generated $35.5 million in cash from operations in Q4. That brought the company’s total cash, equivalents and short-term securities to $1.7 billion. On top of that, the company has net receivables of $330 million, adding up to about $2 billion. There’s $1.3 billion in long-term debt. So, that shows that Enphase doesn’t have too much leverage, which is often a problem in the energy market.

And because of that cash and free cash flow, it also buys back shares opportunistically. CFO Mandy Yang on the conference call:

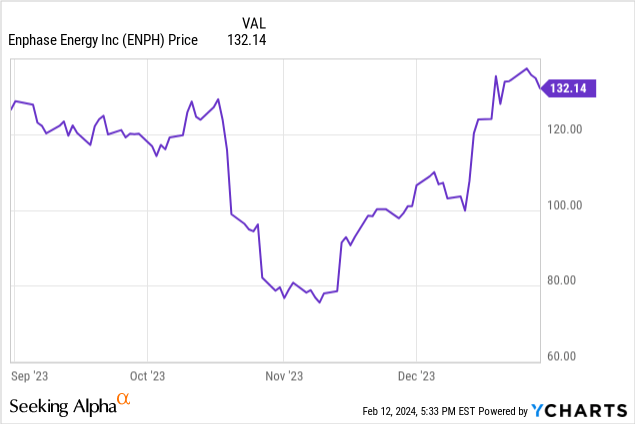

In the fourth quarter of 2023, we repurchased 1,183,246 shares of our common stock at an average price of $84.51 per share for a total of approximately $100.0 million.

That’s an impressive timing of Enphase’s management if you look at the chart of the fourth quarter.

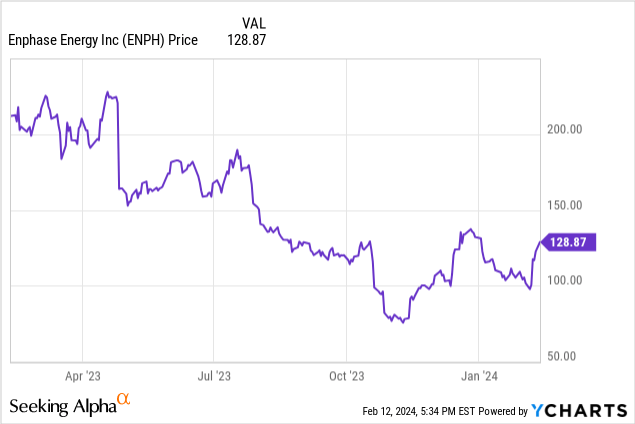

In the whole year 2023, Enphase bought back 3.3 million shares of our common stock for approximately $410 million.

That’s an average of $124, also not bad at all if you look at the stock price evolution over the year.

And CFO Mandy Yang said on the conference call:

In Q1, we plan to do similar magnitude of share buyback. As long as we believe our share price is below the intrinsic value, right? We are very disciplined in doing share buyback. Every quarter, we look at the current share price and then we propose for the Board to approve and we execute.

I really like that approach and it shows good management.

Management also talked about NEM 3.0 in California, a very important market for the company. Net metering – or NEM – programs allow you to earn credits for excess solar electricity you send to the grid when your solar panel system generates more than you need. California switched from NEM 2.0 to 3.0, which is much less generous.

But that also means that people buy much more batteries. And that has interesting consequences for Enphase.

Third-party data shows that the battery attach rate for NEM 3.0 systems is over 80%. Based on our system activations in January last month, approximately half of our solar installations in California were NEM 3.0. Of our NEM 3.0 solar installations, about half of them use Enphase batteries. Our revenue per NEM 3.0 system is approximately 1.5x our average NEM 2.0 system.

Management admitted that the transition to NEM 3.0 was slower than anticipated. On top of that:

The ones who started are finding the sales process a little more difficult given the complexity of the tariff structure, the added cost of batteries upfront and high interest rates.

(…)

In addition, installers are still coming up the learning curve on installing batteries. We are addressing this by making a lot of products improvement for ease of installation commissioning, serviceability and continue to offer in-person training and webinars on Solargraf software.

This makes a lot of sense, and Enphase does what it should do.

A few more points to round this off. The company had an NPS (net promotor score) of 77, which is very good, considering that NPS ranges from -100 to +100. I found it also refreshing that the company shared this:

Our average call wait time was one minute compared to 1.3 minutes in Q3.

By mentioning this on the conference call, management shows it finds this important.

Conclusion

Management has often demonstrated great capability in the past, which gives credibility to the company’s belief that Q1 2024 can be the bottom of the cycle. Of course, the stock may remain volatile.

I would not be afraid to add a bit here too. If the growth returns, as management projects, this price still looks cheap or at least fair. To be clear, I’m not a market-timer, so I see this as a long-term investment. The volatility is inherent for many great investments.

In short, I would summarize the results like this.

RESULTS

Made by the author

MARKET REACTION

Made by the author

The market looks forward to the Q2 earnings and beyond and that is why it’s optimistic about Enphase’s future.

In the meantime, keep growing!

Read the full article here