Anyone familiar with my investment style knows that I am a big believer in railroads. I was almost married to them, but recently sold all of my railroad stock. My largest holding was Union Pacific (NYSE:UNP), representing 7% of my entire portfolio.

I have been worried about Union Pacific for some time now. Last March I reported on the company’s escalating debt and minimal growth in its volumes over the last seven years under former CEO Lance Fritz.

I wrote, “Long-term debt at Union Pacific has grown from $15.6 billion in September 2016 to $33.3 billion on Dec. 31, 2022, essentially doubling the debt during that time. But — and this is huge — total carloads/intermodal traffic actually declined from 9 million in 2015 to 8 million in 2022.”

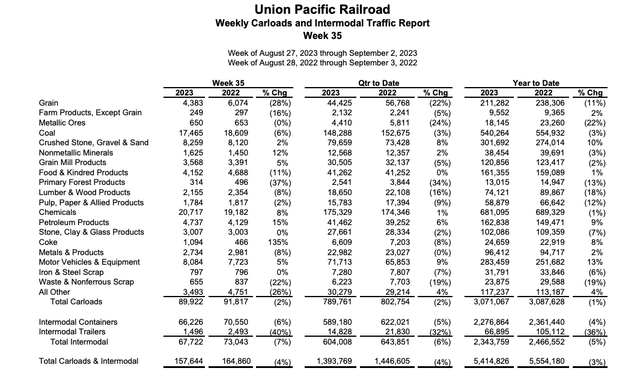

Traffic at UNP in 2023 is expected to be lower than in 2022; the company’s weekly carload report shows total carloads and intermodal traffic was down 3% year to date through Sept. 2.

Executives did not use additional debt for acquisitions of major companies, but instead to buy back stock. This strategy worked for awhile as it increased earnings per share by reducing the number of shares outstanding. But now the strategy is coming back to haunt them because the company bought stock at premium prices, while the debt is costing more money to service due to rising interest rates. I was just researching UNP debt and found a bond paying a 6.25% coupon through 2034, and another bond paying 6.625% through 2029, both are callable. However, most of the UNP bonds listed at Charles Schwab were paying 3% to 5% coupons. A few could be found paying 2.75% coupon. The average yield to maturity was around 5.2%. This is a lot higher than a few years ago.

Union Pacific also used debt to fund some infrastructure improvements on track, bridges and equipment.

In July 2023, Union Pacific hired a new chief executive officer, Jim Vena, who is well known for creating efficiencies at Canadian National Railway. The stock jumped 10% at the announcement.

While at CN, Vena was involved with the development of its precision scheduled railroading. The idea for PSR is to have no idle assets, train schedules are expected to be customer friendly and trains will run seven days a week with precise regularity.

I believe Union Pacific is already as efficient as it possibly can be. Indeed, managers laid off too many workers. They kept cutting and cutting and found themselves without enough staff when the economy picked up again post Covid in 2021-2022.

There have been times in the past few years that Union Pacific has turned away business because it did not have the employees or equipment in order to serve these customers. In April 2022, Pilot Flying J CEO Shameek Konar said Union Pacific informed Flying J to reduce diesel rail shipments by 26%, then in subsequent conversations with the railroad, Union Pacific asked them to reduce rail shipments by another 50% or face embargoes. Essentially Union Pacific was turning away business because it could not handle it.

Let me go back in time and let you know how I fell in love with the railroads. As a reporter for The Grand Island independent (1989-1998), and The Topeka Capital-Journal (1999-2009), I covered railroads in Nebraska and Kansas. At the time I did not own any railroad stock because I felt it was a conflict of interest (Seeking Alpha has a proper disclosure policy that I am comfortable with). I admired how much of an impact railroads had on communities in the Midwest.

I saw firsthand how railroads transformed small towns in America. If the railroad came through your town, your community was likely to prosper. But without the railroad you were lucky to survive. I wrote about several communities that became ghost towns without a railroad, including Belfast, Nebraska, in Greeley County, where the town died after the Chicago, Burlington & Quincy Railroad pulled out. When I visited Belfast in 1992, I saw an abandoned school house, a rusted out Chevy, and a foundation for a dancehall. By 1950, old-timers said there wasn’t much left at Belfast.

Ghost town of Belfast, Neb. (by Eric Gregory, used with permission)

These ghost towns are scattered all over Kansas, Nebraska, Wyoming, Colorado and Utah. Look at the towns that kept their railroads, like Grand Island, Neb., and Salina, Kan. Wow these communities really prospered over the years. Of course, they also had ample water supplies, good highways and diverse economies.

I like railroads because they haul heavy freight more efficiently than trucks.

Controversial history

Looking at the history of Union Pacific, you see all kinds of controversy, from the beginning with the Boston and New York board members creating Crédit Mobilier of America, the company that built the railroad and got funding from Congress, 1864-1867, while funneling dividends to UP board members, who owned stock in UP and Crédit Mobilier. Although the railroad cost $50 million to build, Crédit Mobilier billed $94 million and Crédit Mobilier shareholders pocketed the excess $44 million.

There were some bright moments with strong progressive leadership in 1884 under former UP president Charles Francis Adams Jr, a reformer who built hospitals to care for Union Pacific employees and libraries for their education.

Yet Adams witnessed some of the worst moments in UP history in 1885 when the company was building through Wyoming; the Irish got angry with the Chinese and killed 28 Chinese coworkers and burned down their houses in Rock Springs, Wyoming, according to Union Pacific Volume 1, 1862-1893, by Maury Klein.

Nevertheless Union Pacific contributed mightily to the development of the American West.

American railroads peaked with their employment in the 1950s and have declined in the number of employees ever since as shipping on trucks took off and passenger railways declined in favor of automobile and interstate travel. By the 1970s a lot of railroads went into bankruptcy. The 1980 bankruptcy of the Rock Island Railroad was a major blow to many communities. The Staggers Act of 1980 allowed railroads to offer more lucrative pricing that covered the cost of their services.

The Union Pacific somehow survived, although it struggled as it added on the Southern Pacific in the 1990s under then-CEO Dick Davidson. I remember when Dick Davidson told me that the merger was a nightmare at first. But they worked through the problems; eventually the merger became a great boon to the Union Pacific.

Union Pacific and BNSF Railway both wanted to expand to the East Coast, but American regulators have continuously opposed a transcontinental railway, while Canada promoted it with Canadian National Railway and Canadian Pacific.

I left the newspaper business in 2009 and followed Warren Buffett into the railroads. I bought every one of the publicly-traded Class 1 railroads, concentrating on Union Pacific, and Burlington Northern & Santa Fe Railway, which was later acquired in 2010 by Berkshire Hathaway, another stock I own. These investments became lucrative because the railroads were trading quite cheaply after the financial crisis of 2008-2009 and then rebounded in value when the economy picked up again.

I continued buying Union Pacific until I had many shares and then sold most of them in 2015 when I saw things slowing down. Eventually I started buying more shares again around 2017-2018, I never went in as deep as I was before but I was quite happy to hold the shares because their returns were solid.

In conference calls it seemed like UP leadership were sucking up to Wall Street analysts; I thought why are you buying shares back with borrowed money? Anyway, I continued to hold the stock, even promoted it, but in the back of my mind I was a little worried.

Well last spring, I put it all together in an article about this disturbing trend of borrowing money to buy back shares, and, then several Seeking Alpha writers followed up and did deeper stories like this story by DJTF Investments. UNP at $221.03 would earn only a CAGR of 1% over the next five years, DJTF Investments wrote.

Reuters reported that labor unions called on railroad operators to halt all stock buybacks until they improve safety and abandon their lean operating model, which regulators and shippers say has led to deterioration in the quality of service.

Fourteen railroad unions have blamed Precision Scheduled Railroading (PSR) for worsening working conditions for employees, while shoring up profit for railroads, Reuters reported.

Union Pacific said in its second quarter report that it plans no further stock buybacks in 2023. Without the aid of stock buybacks, shares of Union Pacific may trend lower. I don’t think this stock is going to fall 50%; UNP is a solid company with a wide moat, and its credit is still rated A- by ratings agencies.

At 9:45 central time on Sept. 12, the stock in Union Pacific dropped from $211 per share to $206.86 during rapid selling. The stock rebounded to $211 and then continued climbing to $214.91 per share before closing at $213.85. This type of selling and buying shows extreme volatility, making this a great stock for day trading. Here’s a link to my SA article about day trading UNP.

Optimists think this new CEO is going to create greater efficiencies in the railroad but it’s already cut to the bone. You cut too deeply and you’re going to end up with a crisis like Norfolk Southern suffered with its chemical-spill derailment in Ohio, in February 2023. I expect regulators to increase their scrutiny of the railroads over the coming years and there won’t be much room for cutting employees.

I know safety is talked about as the most important thing at all these railroads but sometimes it’s just phony talk. You suck up to Wall Street analysts and play their game of doing anything and everything you can to improve EPS, you’re going to lose eventually. Wall Streeters will just sell the stock and move on. But retail shareholders who are married to these stocks will suffer. And the public and employees will suffer too.

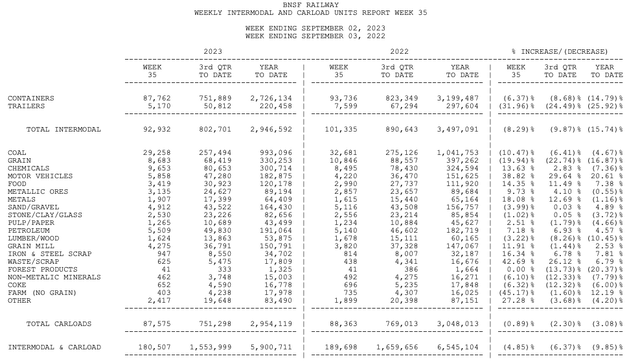

I just checked the most recent volumes at Union Pacific and BNSF Railway, and they are both declining. Both BNSF and Union Pacific have suffered big declines in container/trailer traffic from Asia. China is struggling to get its economy going.

UNP Weekly Volume Report through Sept. 2, 2023 (Union Pacific) BNSF Railway Weekly Volume Report (BNSF Railway)

I know Goldman Sachs recently reduced the chances of a U.S. recession from 20% to 15%, which is about normal with a recession once every six years, but I think a recession is imminent. The volume reports from the railroads are a good indicator of what’s happening in the economy. BNSF Railway’s volumes were down 9.85% YTD through Sept. 2 and UNP’s were down 3% YTD.

A headwind for UNP is an additional $50 million expense implementing new sick leave agreements with labor unions. Fuel prices also have come up a bit, Jennifer Hamann, UP chief financial officer, said at the Morgan Stanley’s 11th Annual Laguna Conference on Sept. 12, according to an SA transcript. She said new work-rest agreements also will cost the company more money.

Another concern is the drought in the Midwest. The summer’s 100-degree days, day after day, week after week, from Texas to the Dakotas, left burned up fields, dying cattle and diminished water supplies. I predict food prices will remain high, while the amount of commodities shipped on these railroads will decline. At UNP, grain shipments were down 11% YTD through Sept 2. At BNSF, grain shipments were down 16.87% YTD through Sept. 2. Another big decliner is the shipment of lumber and wood products, down 18% YTD at UNP, and down 10.45% at BNSF. Shipment of motor vehicles is a bright spot at both railroads, up 13% at UNP and up 20% at BNSF.

Another disturbing trend is American credit card debt ballooning to $1 trillion for the first time in the second quarter while car loan debts have increased as well. Interest on student loans began accruing again on Sept. 1 with first payments due in October. All of this debt is going to stress the American consumer, especially young people.

I had bought a few more shares of Union Pacific at $188.00 per share in the spring. After the announcement of the new CEO, the stock ran to $240 in July. Although my cost basis was low, having purchased most of my shares before the Covid crisis, I decided to lock in my profits by selling UNP at $216.52 per share. I can see Union Pacific going down to $200 again. So I’m out. I rate the stock a hold at $210 per share.

I may consider getting back into the stock of Union Pacific at around $200 per share, but for now I’m going sit on the sidelines and see how this plays out.

Read the full article here