Oh no, the “C” word. Why is everyone so intimidated by corrections? It’s like the sky is falling when the market gives up several percent. Well, regardless of my feelings or yours on the matter, pullbacks and corrections are a necessary and healthy phenomena. We need these resets to eliminate overheated technical conditions and bring valuations back in line. The market has gone a long time without a reset, and a hotter-than-expected CPI read may provide the catalyst or the “excuse” for stocks to sell off.

We discussed the upcoming payroll report last week, and we essentially got a “goldilocks” number. The economy added just 136K private sector jobs, relative to the 160K estimate. Despite the higher number of government jobs created, the unemployment rate ticked up to 4.1%. Therefore, the labor market continues to slow while not illustrating signs of deterioration. This dynamic is positive, as it brings us closer to a rate cut in September. In fact, there is now about a 77% chance that we will see the Fed cutting rates at the upcoming September FOMC meeting. The next domino that must fall in place is the CPI number this Thursday, and earnings season is about to kick off.

Continued progress on inflation, better-than-anticipated earnings, a likely rate cut in September, and other positive elements provide a constructive backdrop for high-quality stocks and other risk assets. Still, we must remain mindful of a possible near-term pullback due to overheated technical conditions and elevated valuations. Despite the plausibility of near-term turbulence, I remain positive on markets in the intermediate and longer term. Due to bullish developments and solid market performance, I am raising my year-end S&P 500 “SPX” (SP500) target range to 6,000-6,200 (previous 6,000 target).

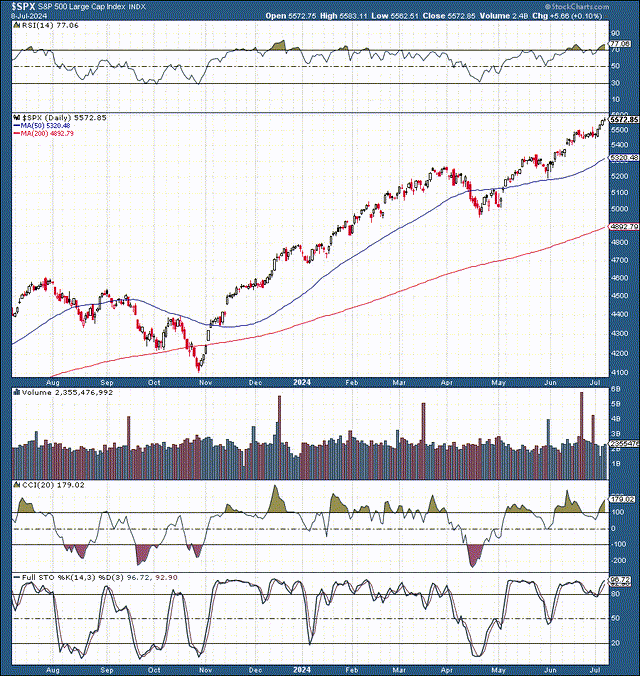

The Technical Image – Concerning In The Near Term

SPX (StockCharts.com | Advanced Financial Charts & Technical Analysis Tools)

The SPX has been overbought for a while and is becoming more overbought now. This means we will need a correction at some point, likely soon. The RSI is approaching 80. The CCI is also elevated. The full stochastic has not dipped below 80 in over a month. The SPX is about 15% above its 200-day MA. In other words, the technical indicators are screaming that the stocks are overbought.

The market could have a 5% (base-case) or a 10% (worse-case) pullback at any time. All the market needs is a catalyst, an excuse to correct. The catalyst could be a higher-than-expected inflation reading, decreased probability for a September rate cut, worse-than-expected earnings, guidance, or something else.

Therefore, while I remain mindful of a potential correction, I maintain a constructive intermediate and longer-term view of the markets. A base-case, mild pullback would reset the SPX to about the 5,300 support level, creating solid buying opportunities in many high-quality stocks.

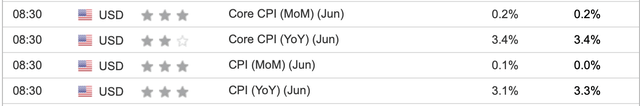

The Crucial CPI Data

CPI data (Investing.com – Stock Market Quotes & Financial News)

The market expects the CPI to drop from 3.3% in May to 3.1% in June. However, the core CPI is expected to remain at 3.4%. While the CPI may not be the best inflation gauge (in my view), the market pays close attention to it. Therefore, we need a 3.4% or lower core number and a 3.1% or lower CPI. A 3.1% or a 3.0% CPI read would be constructive for markets, and the rally could continue with such progress on inflation.

However, oil prices ticked up recently, and there is a chance we could see a 3.2% CPI number. A 3.2% CPI would disappoint markets, but in a worst-case scenario, a 3.3% print could trigger the correction/pullback many have been looking for in recent months. Therefore, the CPI mustn’t disappoint on Thursday.

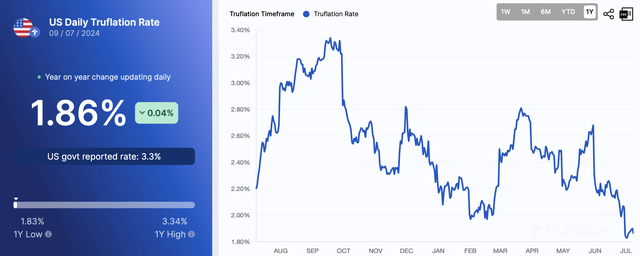

Despite The CPI – Inflation May Be Below 2%

I’ve discussed why the CPI may not be the optimal inflation gauge. The CPI puts too much emphasis on transitory services-related inflation, housing (rental prices), tobacco, alcohol, and other elements that may not be the best representations of inflation. On the other hand, Truflation is an independent, non-government, real-time inflation gauge that may illustrate the current state of inflation more accurately than the outdated, lagging CPI and PCE inflation gauges.

Truflation Inflation

Truflation inflation (Truflation.com)

Despite the CPI floating around 3.3%, Truflation is around its lowest level for the year, below 2%. Also, Truflation is not a gauge known for suppressing inflation readings, as it was around 10% during the peak inflation period in recent years. Therefore, inflation may be around or below 2%, which is an appropriate rate for the Fed to consider cutting, as the trend for inflation is still lower, and the last thing the Fed wants to see is deflation.

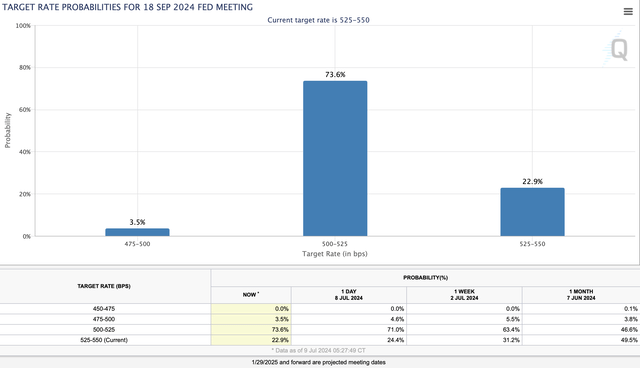

September Rate Cut Probabilities Continue Increasing

Rate probabilities (CMEGroup.com)

The likelihood of a September rate cut is around 77% now, substantially higher than the 50% probability roughly one month ago. This dynamic implies that a September rate cut is very likely, and the likelihood should increase if the CPI inflation number comes in lower than anticipated. On the other hand, we want to avoid a resurgence in the CPI and other inflation data, as hotter-than-anticipated inflation would decrease the odds of a September rate cut.

Earnings – Another Positive Catalyst

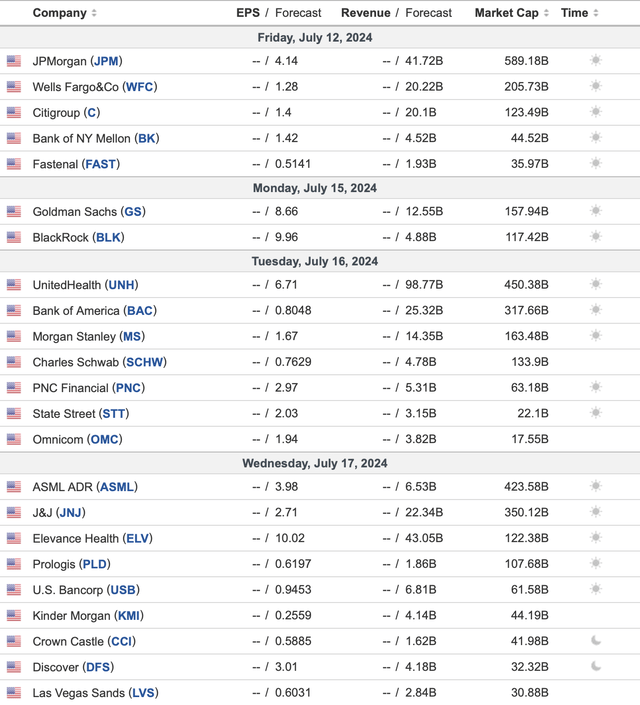

Earnings (Investing.com)

Earnings season kicks off this Friday with JPMorgan Chase & Co. (JPM), Wells Fargo & Company (WFC), and Citigroup Inc. (C). Next week, The Goldman Sachs Group, Inc. (GS), UnitedHealth Group Incorporated (UNH), Bank of America Corporation (BAC), Morgan Stanley (MS), and others will report. These earnings should set the tone, and the mega-cap tech names will begin reporting the following week (starting on July 23rd).

The trend of solid earnings and robust guidance from many bellwether companies could continue, creating a bullish dynamic for many high-quality stocks. While the bullish scenario is the base case outcome, in my view, disappointing results and, more importantly, poor guidance from some of Wall Street’s darlings could temporarily derail the rally, possibly enabling a considerable correction to ensue.

The Bottom Line

While the market is overbought and there are transitory risks to the rally, the intermediate and long-term bullish thesis remains intact. Despite challenging areas, the economy is resilient, and there are solid growth segments, especially in technology and AI. Moreover, we’re around the top of an interest rate cycle, and there is a high probability that the Fed will begin cutting rates soon.

Corporations are highly profitable, and valuations could continue expanding as profitability and efficiency increase. The Fed will also likely introduce a more accessible monetary environment, sparing growth and increasing the appetite for risk assets. Despite the likelihood of near-term turbulence, I remain bullish on stocks in the intermediate and long term. Due to this bullish dynamic, I am elevating my year-end target for the S&P 500 to the 6,000-6,200 range.

Read the full article here